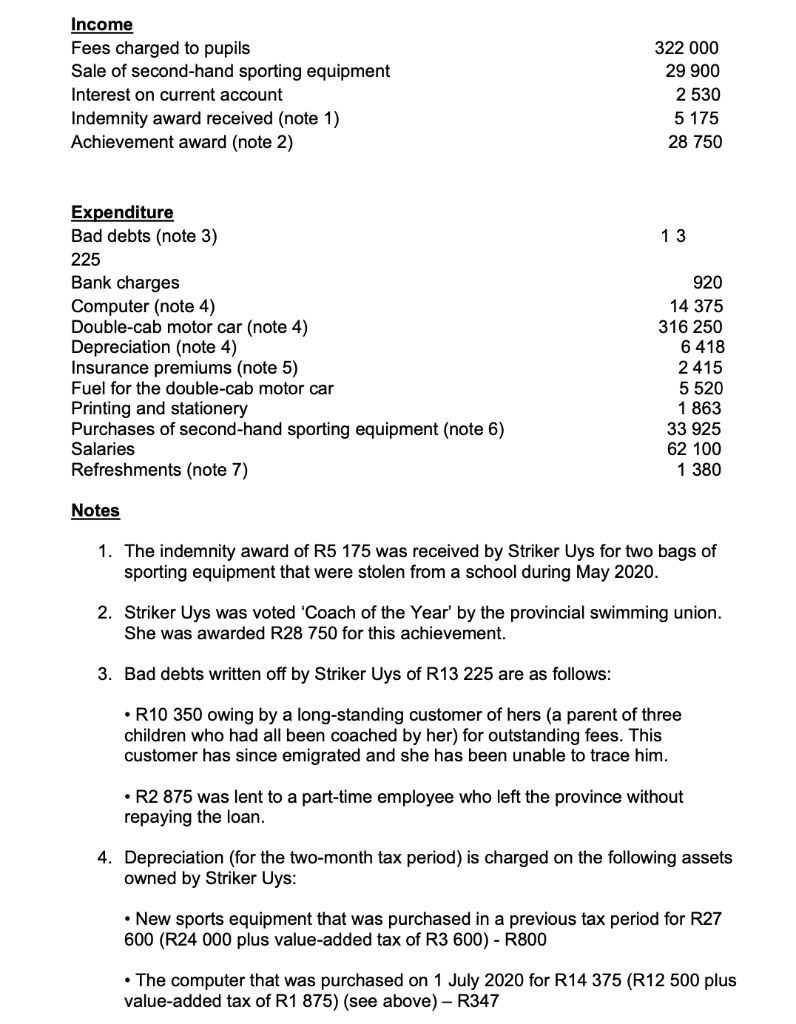

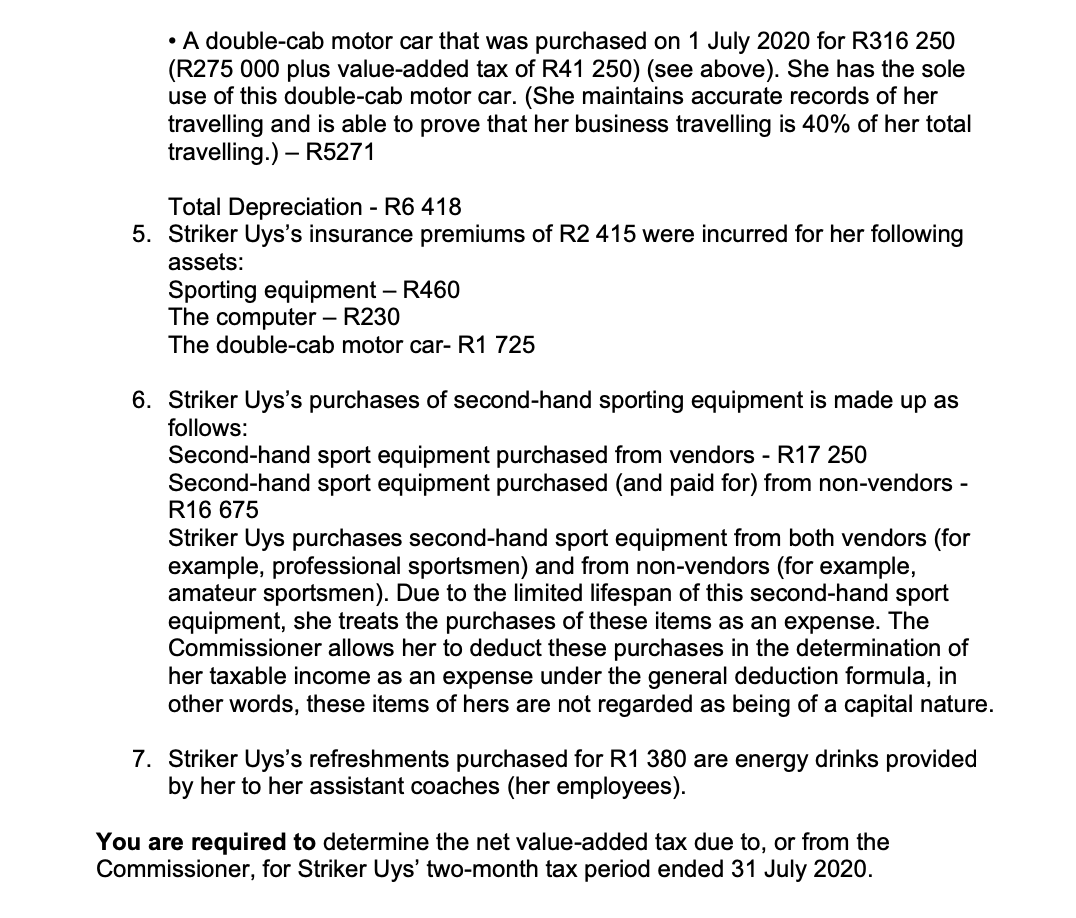

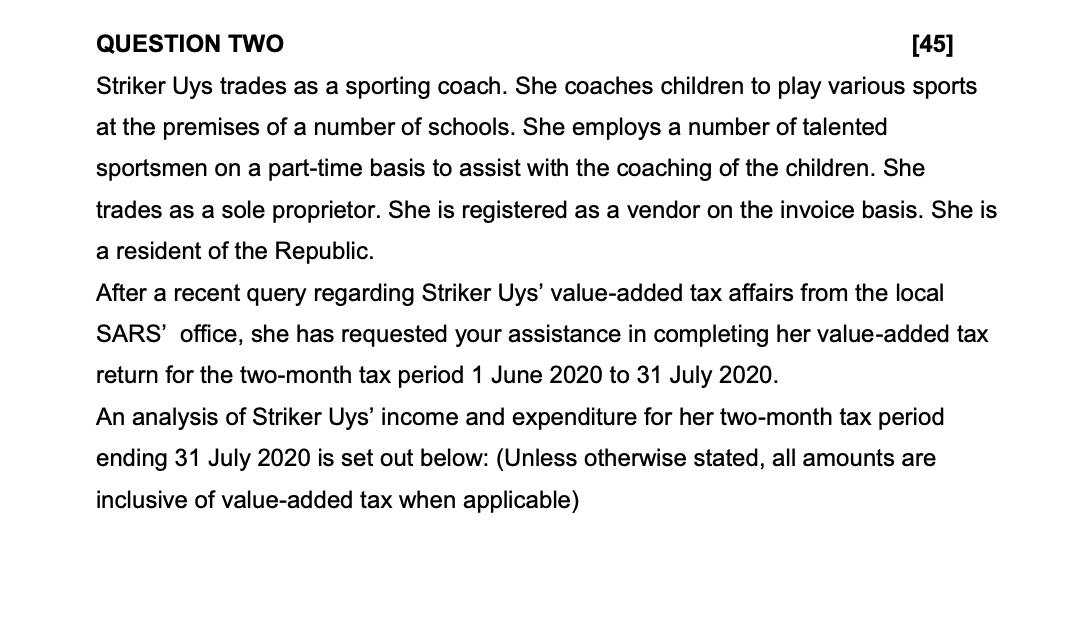

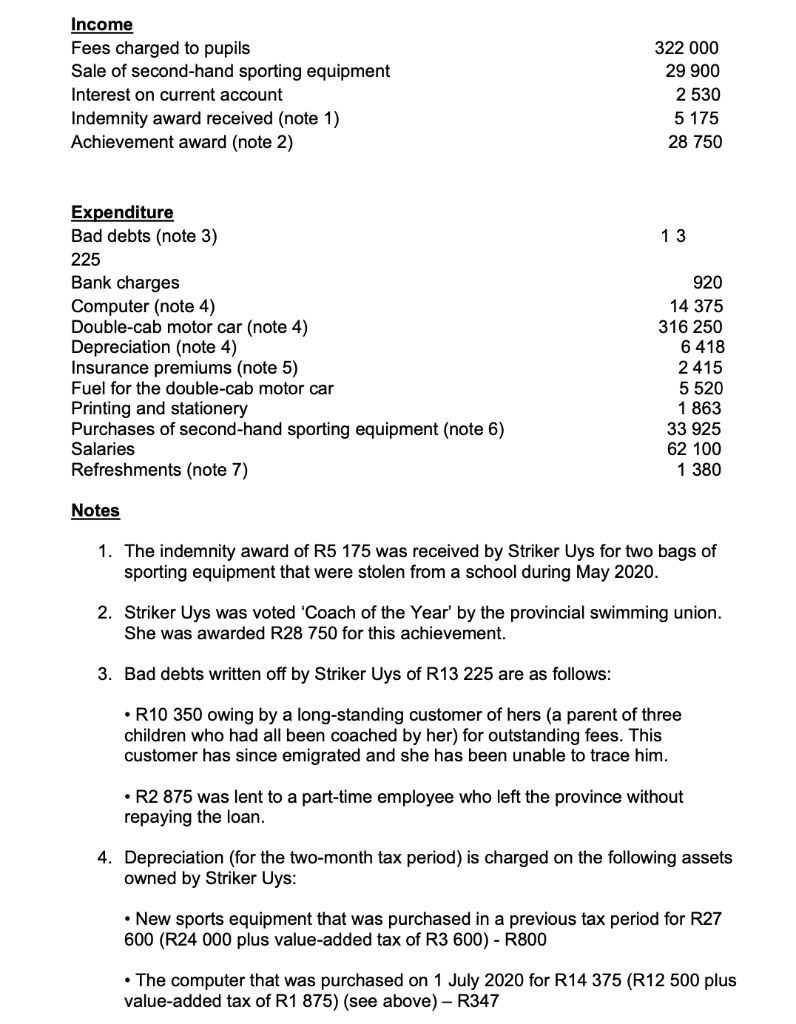

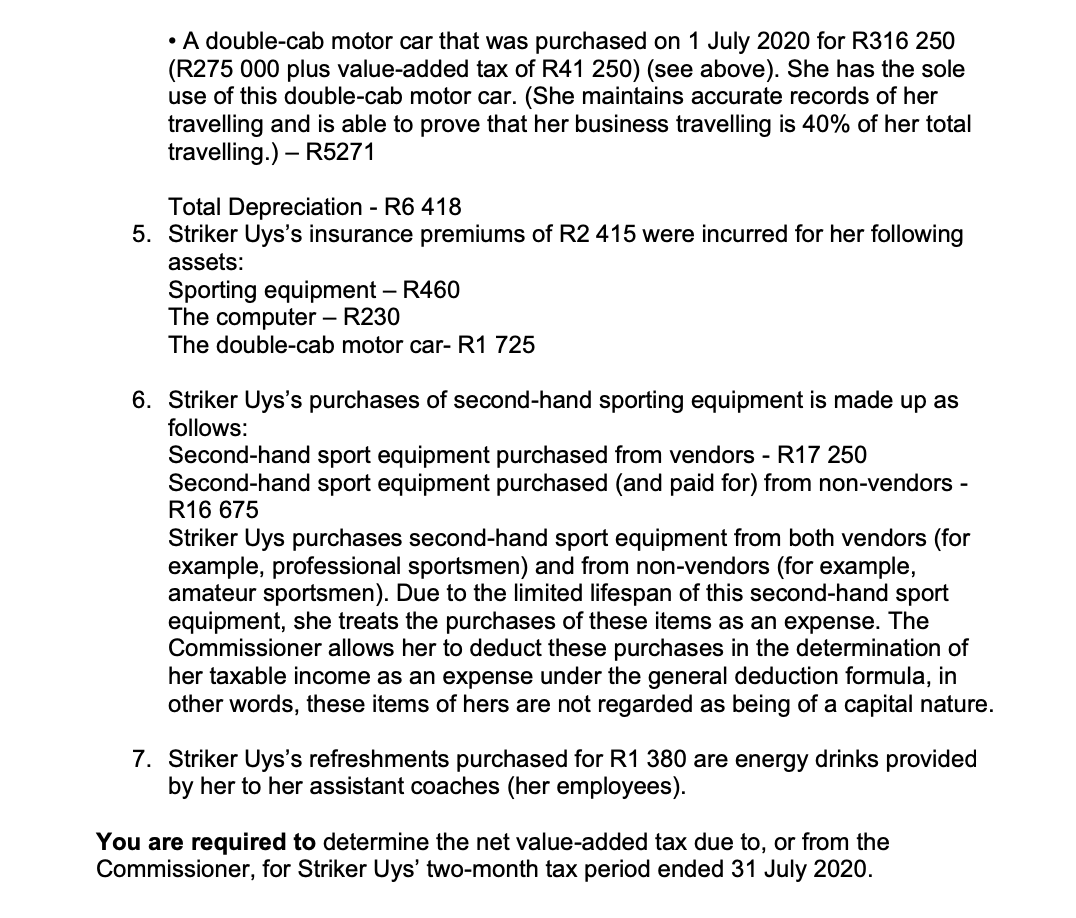

QUESTION TWO [45] Striker Uys trades as a sporting coach. She coaches children to play various sports at the premises of a number of schools. She employs a number of talented sportsmen on a part-time basis to assist with the coaching of the children. She trades as a sole proprietor. She is registered as a vendor on the invoice basis. She is a resident of the Republic. After a recent query regarding Striker Uys' value-added tax affairs from the local SARS' office, she has requested your assistance in completing her value-added tax return for the two-month tax period 1 June 2020 to 31 July 2020. An analysis of Striker Uys' income and expenditure for her two-month tax period ending 31 July 2020 is set out below: (Unless otherwise stated, all amounts are inclusive of value-added tax when applicable) 4. Depreciation (for the two-month tax period) is charged on the following assets owned by Striker Uys: - New sports equipment that was purchased in a previous tax period for R27 600 (R24 000 plus value-added tax of R3600 ) - R800 - The computer that was purchased on 1 July 2020 for R14375 (R12 500 plus value-added tax of R1875 ) (see above) - R347 - A double-cab motor car that was purchased on 1 July 2020 for R316 250 (R275 000 plus value-added tax of R41 250) (see above). She has the sole use of this double-cab motor car. (She maintains accurate records of her travelling and is able to prove that her business travelling is 40% of her total travelling.) - R5271 Total Depreciation - R6 418 5. Striker Uys's insurance premiums of R2 415 were incurred for her following assets: Sporting equipment R460 The computer - R230 The double-cab motor car- R1725 6. Striker Uys's purchases of second-hand sporting equipment is made up as follows: Second-hand sport equipment purchased from vendors - R17 250 Second-hand sport equipment purchased (and paid for) from non-vendors - R16 675 Striker Uys purchases second-hand sport equipment from both vendors (for example, professional sportsmen) and from non-vendors (for example, amateur sportsmen). Due to the limited lifespan of this second-hand sport equipment, she treats the purchases of these items as an expense. The Commissioner allows her to deduct these purchases in the determination of her taxable income as an expense under the general deduction formula, in other words, these items of hers are not regarded as being of a capital nature. 7. Striker Uys's refreshments purchased for R1380 are energy drinks provided by her to her assistant coaches (her employees). You are required to determine the net value-added tax due to, or from the Commissioner, for Striker Uys' two-month tax period ended 31 July 2020. QUESTION TWO [45] Striker Uys trades as a sporting coach. She coaches children to play various sports at the premises of a number of schools. She employs a number of talented sportsmen on a part-time basis to assist with the coaching of the children. She trades as a sole proprietor. She is registered as a vendor on the invoice basis. She is a resident of the Republic. After a recent query regarding Striker Uys' value-added tax affairs from the local SARS' office, she has requested your assistance in completing her value-added tax return for the two-month tax period 1 June 2020 to 31 July 2020. An analysis of Striker Uys' income and expenditure for her two-month tax period ending 31 July 2020 is set out below: (Unless otherwise stated, all amounts are inclusive of value-added tax when applicable) 4. Depreciation (for the two-month tax period) is charged on the following assets owned by Striker Uys: - New sports equipment that was purchased in a previous tax period for R27 600 (R24 000 plus value-added tax of R3600 ) - R800 - The computer that was purchased on 1 July 2020 for R14375 (R12 500 plus value-added tax of R1875 ) (see above) - R347 - A double-cab motor car that was purchased on 1 July 2020 for R316 250 (R275 000 plus value-added tax of R41 250) (see above). She has the sole use of this double-cab motor car. (She maintains accurate records of her travelling and is able to prove that her business travelling is 40% of her total travelling.) - R5271 Total Depreciation - R6 418 5. Striker Uys's insurance premiums of R2 415 were incurred for her following assets: Sporting equipment R460 The computer - R230 The double-cab motor car- R1725 6. Striker Uys's purchases of second-hand sporting equipment is made up as follows: Second-hand sport equipment purchased from vendors - R17 250 Second-hand sport equipment purchased (and paid for) from non-vendors - R16 675 Striker Uys purchases second-hand sport equipment from both vendors (for example, professional sportsmen) and from non-vendors (for example, amateur sportsmen). Due to the limited lifespan of this second-hand sport equipment, she treats the purchases of these items as an expense. The Commissioner allows her to deduct these purchases in the determination of her taxable income as an expense under the general deduction formula, in other words, these items of hers are not regarded as being of a capital nature. 7. Striker Uys's refreshments purchased for R1380 are energy drinks provided by her to her assistant coaches (her employees). You are required to determine the net value-added tax due to, or from the Commissioner, for Striker Uys' two-month tax period ended 31 July 2020