Answered step by step

Verified Expert Solution

Question

1 Approved Answer

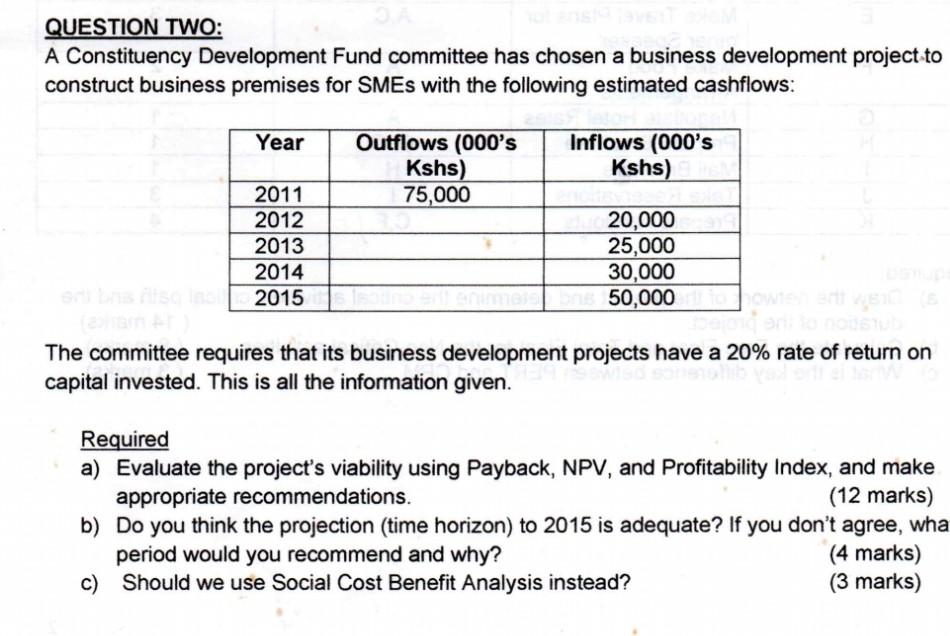

QUESTION TWO: A Constituency Development Fund committee has chosen a business development project to construct business premises for SMEs with the following estimated cashflows: Year

QUESTION TWO: A Constituency Development Fund committee has chosen a business development project to construct business premises for SMEs with the following estimated cashflows: Year Outflows (000's Kshs) 75,000 Inflows (000's Kshs) 2011 2012 2013 2014 2015 20,000 25,000 30,000 50,000 The committee requires that its business development projects have a 20% rate of return on capital invested. This is all the information given. Required a) Evaluate the project's viability using Payback, NPV, and Profitability Index, and make appropriate recommendations. (12 marks) b) Do you think the projection (time horizon) to 2015 is adequate? If you don't agree, wha period would you recommend and why? (4 marks) c) Should we use Social Cost Benefit Analysis instead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started