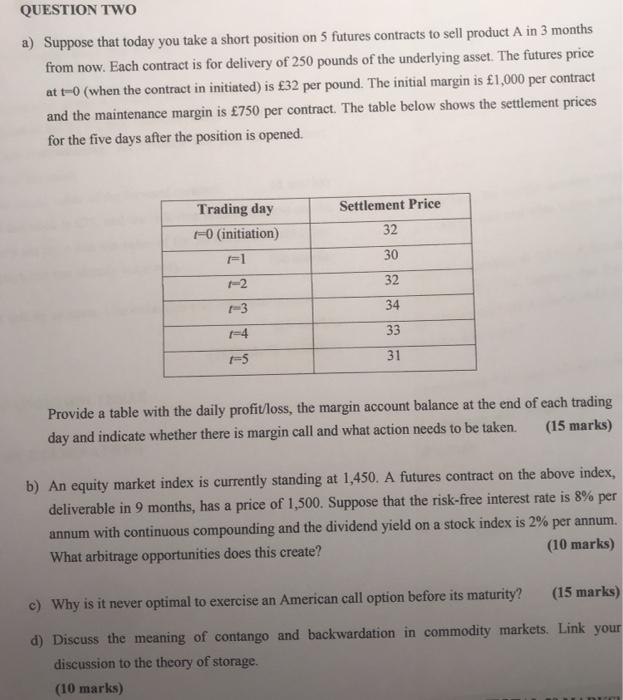

QUESTION TWO a) Suppose that today you take a short position on 5 futures contracts to sell product A in 3 months from now. Each contract is for delivery of 250 pounds of the underlying asset. The futures price at t-0 (when the contract in initiated) is 32 per pound. The initial margin is 1,000 per contract and the maintenance margin is 750 per contract. The table below shows the settlement prices for the five days after the position is opened. Trading day 0 (initiation) Settlement Price 32 30 32 -3 34 -4 33 -5 31 Provide a table with the daily profit/loss, the margin account balance at the end of each trading day and indicate whether there is margin call and what action needs to be taken. (15 marks) b) An equity market index is currently standing at 1,450. A futures contract on the above index, deliverable in 9 months, has a price of 1,500. Suppose that the risk-free interest rate is 8% per annum with continuous compounding and the dividend yield on a stock index is 2% per annum. What arbitrage opportunities does this create? (10 marks) (15 marks) c) Why is it never optimal to exercise an American call option before its maturity? d) Discuss the meaning of contango and backwardation in commodity markets. Link your discussion to the theory of storage. (10 marks) QUESTION TWO a) Suppose that today you take a short position on 5 futures contracts to sell product A in 3 months from now. Each contract is for delivery of 250 pounds of the underlying asset. The futures price at t-0 (when the contract in initiated) is 32 per pound. The initial margin is 1,000 per contract and the maintenance margin is 750 per contract. The table below shows the settlement prices for the five days after the position is opened. Trading day 0 (initiation) Settlement Price 32 30 32 -3 34 -4 33 -5 31 Provide a table with the daily profit/loss, the margin account balance at the end of each trading day and indicate whether there is margin call and what action needs to be taken. (15 marks) b) An equity market index is currently standing at 1,450. A futures contract on the above index, deliverable in 9 months, has a price of 1,500. Suppose that the risk-free interest rate is 8% per annum with continuous compounding and the dividend yield on a stock index is 2% per annum. What arbitrage opportunities does this create? (10 marks) (15 marks) c) Why is it never optimal to exercise an American call option before its maturity? d) Discuss the meaning of contango and backwardation in commodity markets. Link your discussion to the theory of storage. (10 marks)