Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO Becca, a fast food company is considering replacing its existing equipment, which is near the end of its useful life Details in relation

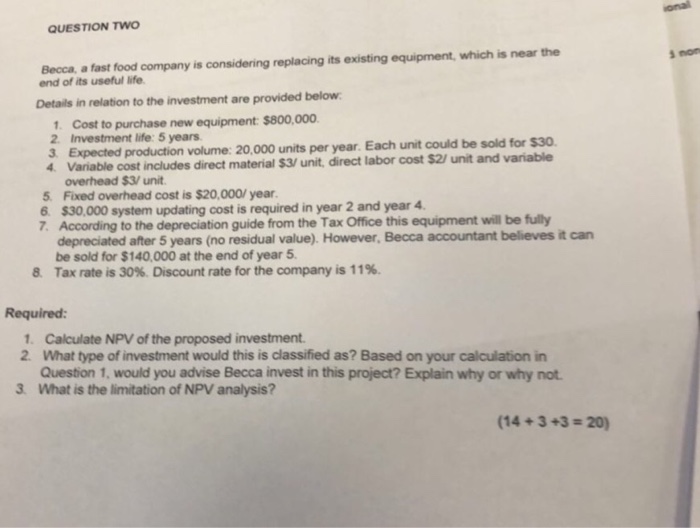

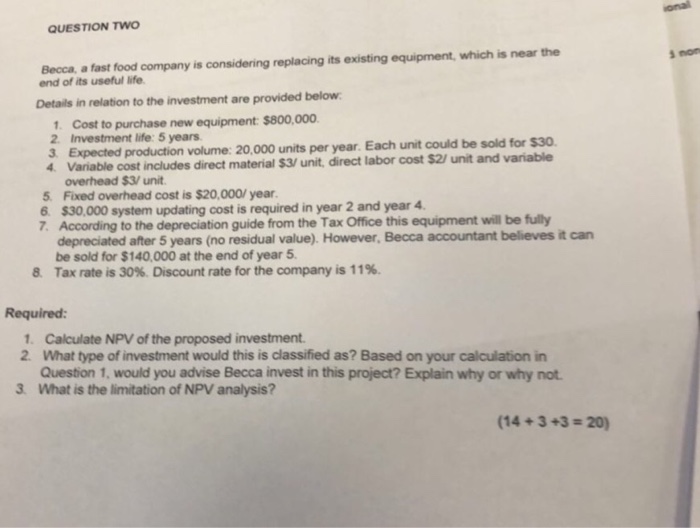

QUESTION TWO Becca, a fast food company is considering replacing its existing equipment, which is near the end of its useful life Details in relation to the investment are provided below 1 Cost to purchase new equipment: $800,000 2. Investment life: 5 years 3 Expected production 4 Variable cost includes direct material $3/ unit, direct labor cost $2/ unit and variable volume: 20,000 units per year. Each unit could be sold for $30 overhead $3/ unit 5. Fixed overhead cost is $20,000/ year 6$30,000 system updating cost is required in year 2 and year 4 7. According to the depreciation guide from the Tax Office this equipment will be fully depreciated after 5 years (no residual value). However, Becca accountant believes it can be sold for $140,000 at the end of year 5 Tax rate is 30%. Discount rate for the company is 11%. 8. Required 1. Calculate NPV of the proposed investment 2. What type of investment would this is classified as? Based on your calculation in Question 1, would you advise Becca invest in this project? Explain why or why not 3 What is the limitation of NPV analysis? (14 + 3+31: 20)

QUESTION TWO Becca, a fast food company is considering replacing its existing equipment, which is near the end of its useful life Details in relation to the investment are provided below 1 Cost to purchase new equipment: $800,000 2. Investment life: 5 years 3 Expected production 4 Variable cost includes direct material $3/ unit, direct labor cost $2/ unit and variable volume: 20,000 units per year. Each unit could be sold for $30 overhead $3/ unit 5. Fixed overhead cost is $20,000/ year 6$30,000 system updating cost is required in year 2 and year 4 7. According to the depreciation guide from the Tax Office this equipment will be fully depreciated after 5 years (no residual value). However, Becca accountant believes it can be sold for $140,000 at the end of year 5 Tax rate is 30%. Discount rate for the company is 11%. 8. Required 1. Calculate NPV of the proposed investment 2. What type of investment would this is classified as? Based on your calculation in Question 1, would you advise Becca invest in this project? Explain why or why not 3 What is the limitation of NPV analysis? (14 + 3+31: 20)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started