Answered step by step

Verified Expert Solution

Question

1 Approved Answer

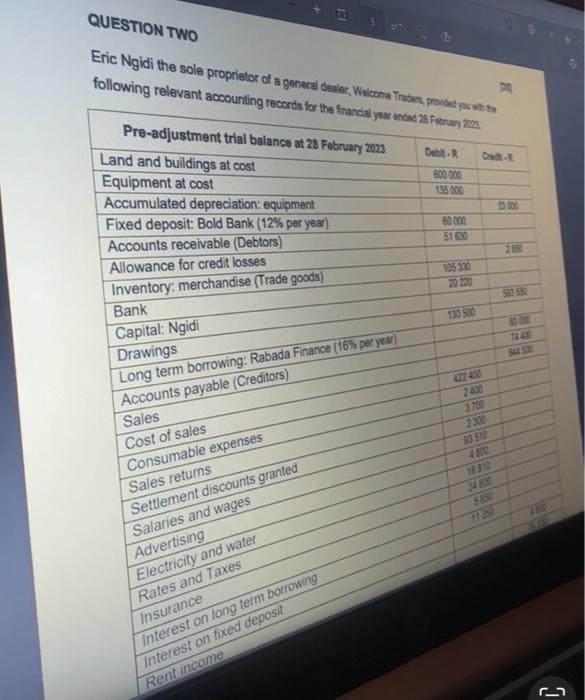

QUESTION TWO Eric Ngidi the sole proprietor of a general dealer, Welcome Traders, provided you with the following relevant accounting records for the financial year

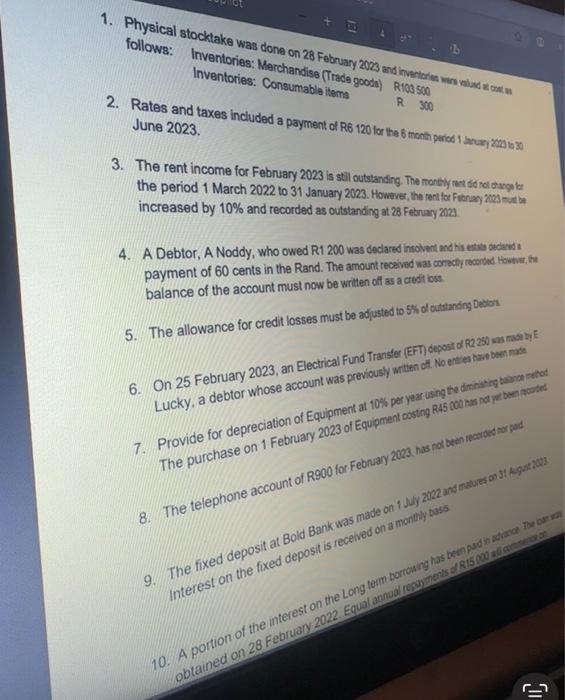

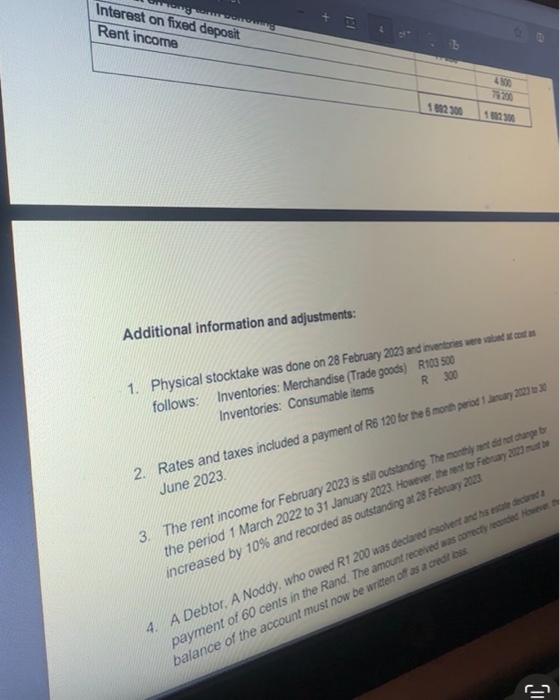

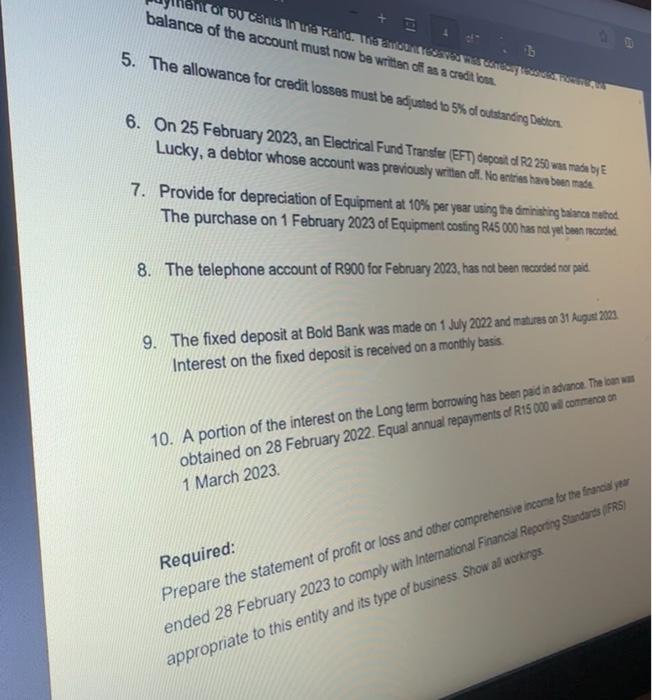

QUESTION TWO Eric Ngidi the sole proprietor of a general dealer, Welcome Traders, provided you with the following relevant accounting records for the financial year ended 28 February 2023 Pre-adjustment trial balance at 28 February 2023 Land and buildings at cost Equipment at cost Accumulated depreciation: equipment Fixed deposit: Bold Bank (12% per year) Accounts receivable (Debtors) Allowance for credit losses Inventory: merchandise (Trade goods) Bank Capital: Ngidi Drawings 3 Long term borrowing: Rabada Finance (16% per year) Accounts payable (Creditors) Sales Cost of sales Consumable expenses Sales returns Settlement discounts granted Salaries and wages Advertising Electricity and water Rates and Taxes Insurance Interest on long term borrowing Interest on fixed deposit Rent income Debit-R 600 000 135 000 60 000 51 630 105 330 20 220 130 500 Credit-R 422 400 2400 3700 2300 93 510 4 800 18 810 33 000 24 600 5850 11250 2850 593 550 60 000 74 400 844 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started