Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO Falcon Manufacturing Ltd . ( Falcon ) is negotiating a contract with JetWare Ltd . ( JetWare ) , a company that provides

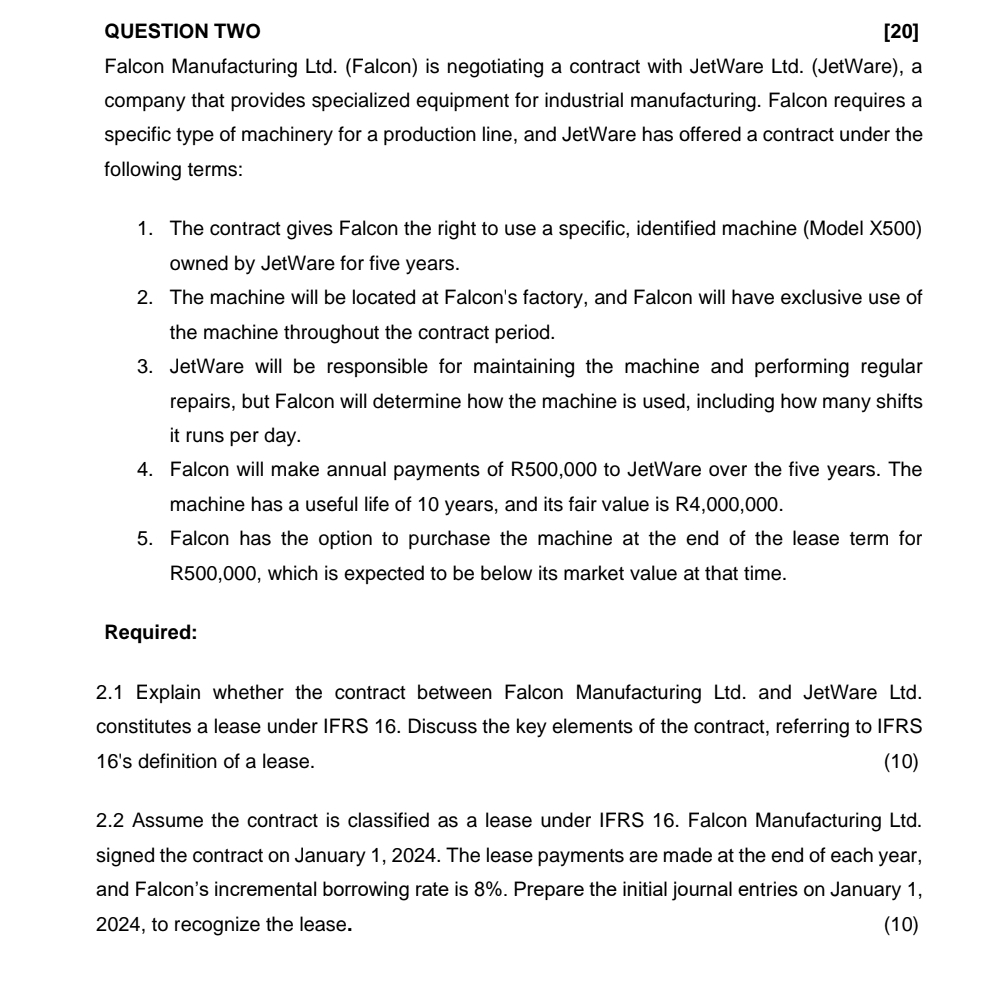

QUESTION TWO

Falcon Manufacturing LtdFalcon is negotiating a contract with JetWare LtdJetWare a

company that provides specialized equipment for industrial manufacturing. Falcon requires a

specific type of machinery for a production line, and JetWare has offered a contract under the

following terms:

The contract gives Falcon the right to use a specific, identified machine Model X

owned by JetWare for five years.

The machine will be located at Falcon's factory, and Falcon will have exclusive use of

the machine throughout the contract period.

JetWare will be responsible for maintaining the machine and performing regular

repairs, but Falcon will determine how the machine is used, including how many shifts

it runs per day.

Falcon will make annual payments of R to JetWare over the five years. The

machine has a useful life of years, and its fair value is R

Falcon has the option to purchase the machine at the end of the lease term for

R which is expected to be below its market value at that time.

Required:

Explain whether the contract between Falcon Manufacturing Ltd and JetWare Ltd

constitutes a lease under IFRS Discuss the key elements of the contract, referring to IFRS

s definition of a lease.

Assume the contract is classified as a lease under IFRS Falcon Manufacturing Ltd

signed the contract on January The lease payments are made at the end of each year,

and Falcon's incremental borrowing rate is Prepare the initial journal entries on January

to recognize the lease.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started