Answered step by step

Verified Expert Solution

Question

1 Approved Answer

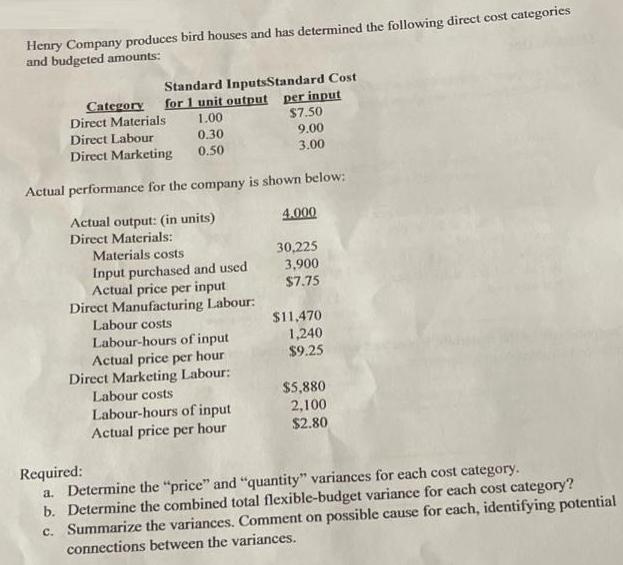

Henry Company produces bird houses and has determined the following direct cost categories and budgeted amounts: Standard InputsStandard Cost per input $7.50 9.00 3.00

Henry Company produces bird houses and has determined the following direct cost categories and budgeted amounts: Standard InputsStandard Cost per input $7.50 9.00 3.00 Category Direct Materials for 1 unit output 1.00 Direct Labour 0.30 Direct Marketing 0.50 Actual performance for the company is shown below: Actual output: (in units) Direct Materials: Materials costs 4.000 30,225 3,900 Input purchased and used Actual price per input Direct Manufacturing Labour: Labour costs $7.75 S11,470 1,240 $9.25 Labour-hours of input Actual price per hour Direct Marketing Labour: Labour costs Labour-hours of input Actual price per hour $5,880 2,100 $2.80 Required: a. Determine the "price" and "quantity" variances for each cost category. b. Determine the combined total flexible-budget variance for each cost category? c. Summarize the variances. Comment on possible cause for each, identifying potential connections between the variances.

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

For understanding of Variances Material Variances sa SP AQ SP AQ AP Material Quantity Variance Mater...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started