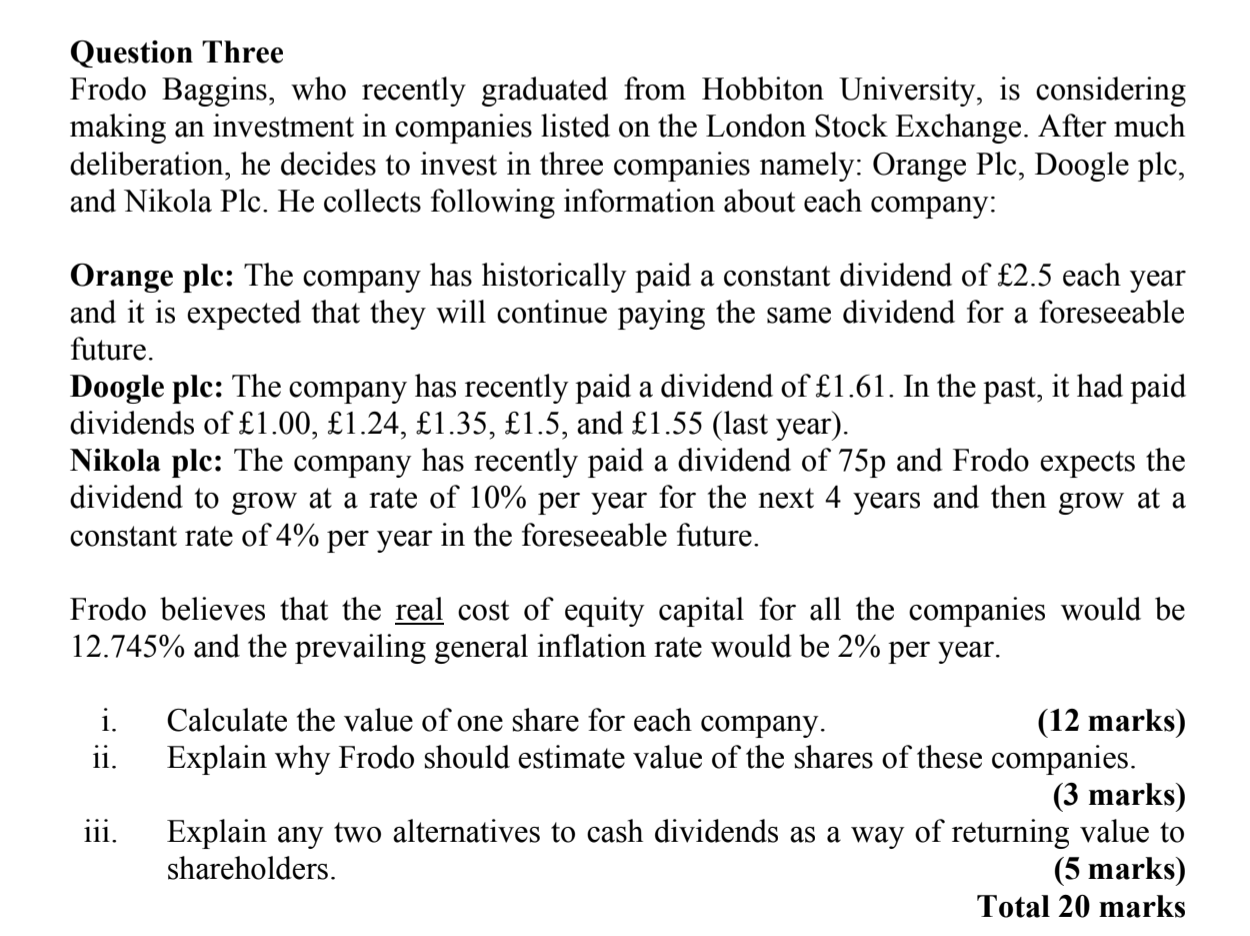

Question Two Jesse Pharma Plc is a large manufacturer of Active Pharmaceutical Ingredients (API) currently operating in the UK. It has 10 million ordinary shares and it currently trades at 20 per share. Jesse wants to expand its manufacturing facility in a South Asian country and needs 50 million to finance the expansion. Given its existing high gearing ratio, the company has decided to raise the capital requirement through a rights issue. The company has identified two potential share issue methods: Option A: A rights issue at a 25% discount to the current market price. Option B: A rights issue at a 50% deep discount to the current market price. Required: Calculate the theoretical ex-rights price and the value of rights under option A. (6 marks) ii. Calculate the theoretical ex-rights price and the value of rights under option B. (6 marks) iii. Hank Schrader, who currently holds 6,000 shares of Jesse Pharma Plc, is considering not to invest in the right issue of Jesse Pharma Plc but rather diversify to another investment. Considering Option B (deep discount), calculate the value of Hank's investment if he (a) exercises the rights, (b) sells all the rights, or (c) does nothing. (8 marks) Total 20 marks Question Three Frodo Baggins, who recently graduated from Hobbiton University, is considering making an investment in companies listed on the London Stock Exchange. After much deliberation, he decides to invest in three companies namely: Orange Plc, Doogle plc, and Nikola Plc. He collects following information about each company: Orange ple: The company has historically paid a constant dividend of 2.5 each year and it is expected that they will continue paying the same dividend for a foreseeable future. Doogle plc: The company has recently paid a dividend of 1.61. In the past, it had paid dividends of 1.00, 1.24, 1.35, 1.5, and 1.55 (last year). Nikola plc: The company has recently paid a dividend of 75p and Frodo expects the dividend to grow at a rate of 10% per year for the next 4 years and then grow at a constant rate of 4% per year in the foreseeable future. Frodo believes that the real cost of equity capital for all the companies would be 12.745% and the prevailing general inflation rate would be 2% per year. i. ii. Calculate the value of one share for each company. (12 marks) Explain why Frodo should estimate value of the shares of these companies. (3 marks) Explain any two alternatives to cash dividends as a way of returning value to shareholders. (5 marks) Total 20 marks 111