Answered step by step

Verified Expert Solution

Question

1 Approved Answer

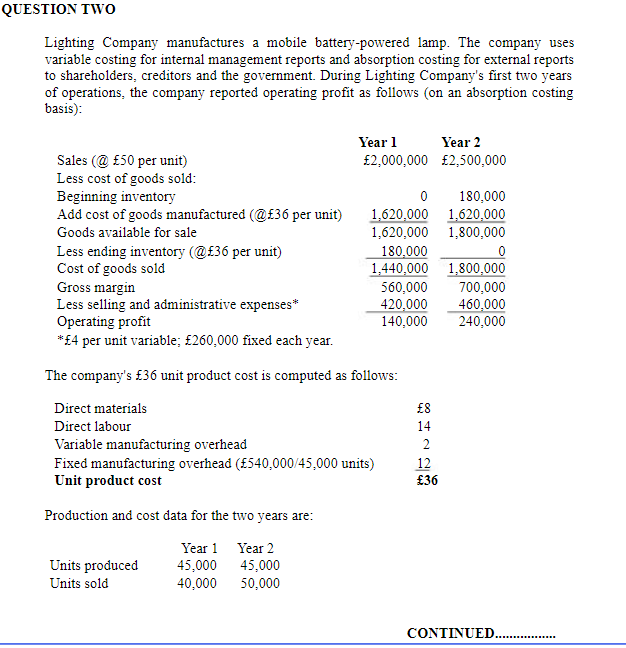

QUESTION TWO Lighting Company manufactures a mobile battery-powered lamp. The company uses variable costing for internal management reports and absorption costing for external reports

QUESTION TWO Lighting Company manufactures a mobile battery-powered lamp. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors and the government. During Lighting Company's first two years of operations, the company reported operating profit as follows (on an absorption costing basis): Sales (@ 50 per unit) Year 1 2,000,000 Year 2 2,500,000 Less cost of goods sold: Beginning inventory 0 180,000 Add cost of goods manufactured (@36 per unit) 1,620,000 1,620,000 Goods available for sale 1,620,000 1,800,000 Less ending inventory (@36 per unit) 180,000 Cost of goods sold 1,440,000 1,800,000 Gross margin 560,000 700,000 Less selling and administrative expenses* 420,000 460,000 Operating profit 140,000 240,000 *4 per unit variable; 260,000 fixed each year. The company's 36 unit product cost is computed as follows: Direct materials 8 Direct labour 14 Variable manufacturing overhead 2 Fixed manufacturing overhead (540,000/45,000 units) Unit product cost 12 36 Production and cost data for the two years are: Year 1 Year 2 Units produced 45,000 45,000 Units sold 40,000 50,000 CONTINUED.. Required: 1) Prepare a statement of profit and loss for each year in the contribution format using variable costing. (40 Marks) 2) Reconcile the absorption costing and the variable costing profit figures for each year. (20 Marks) [TOTAL: 60 MARKS] END OF QUESTION TWO END OF SECTION A

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the information provided and answer the question we need to calculate the variable and fixed manufacturing overhead costs per unit as well ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started