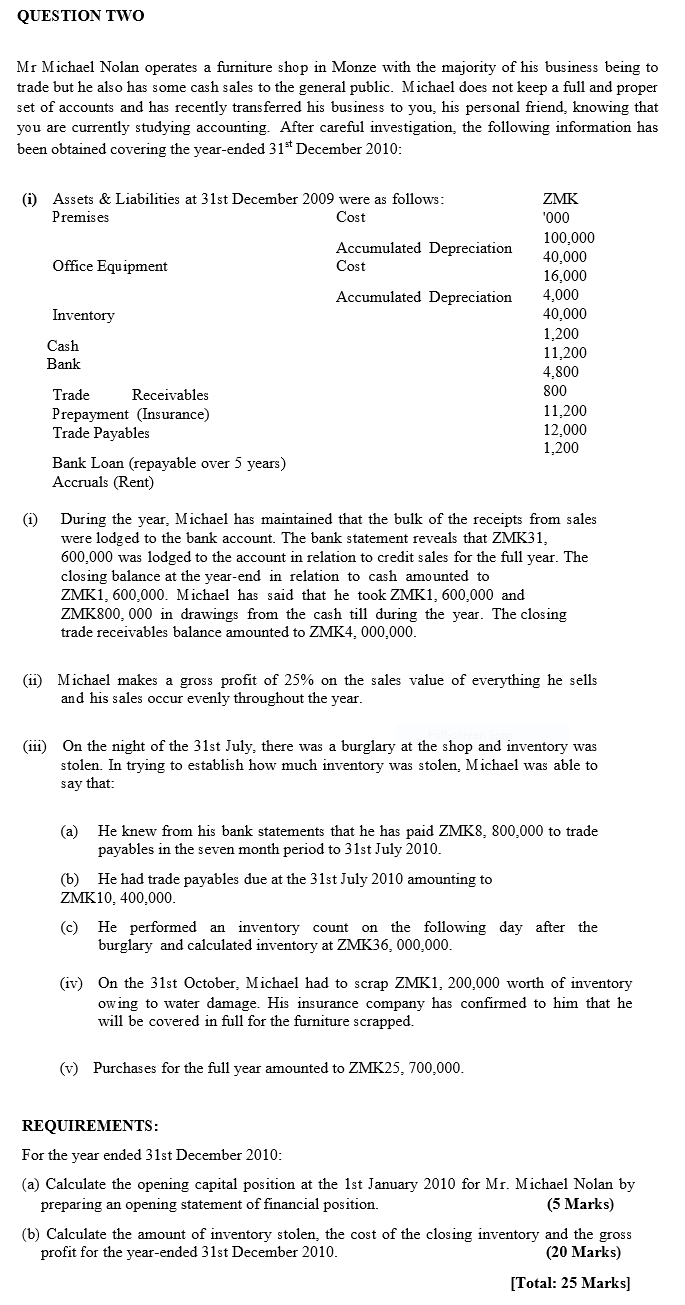

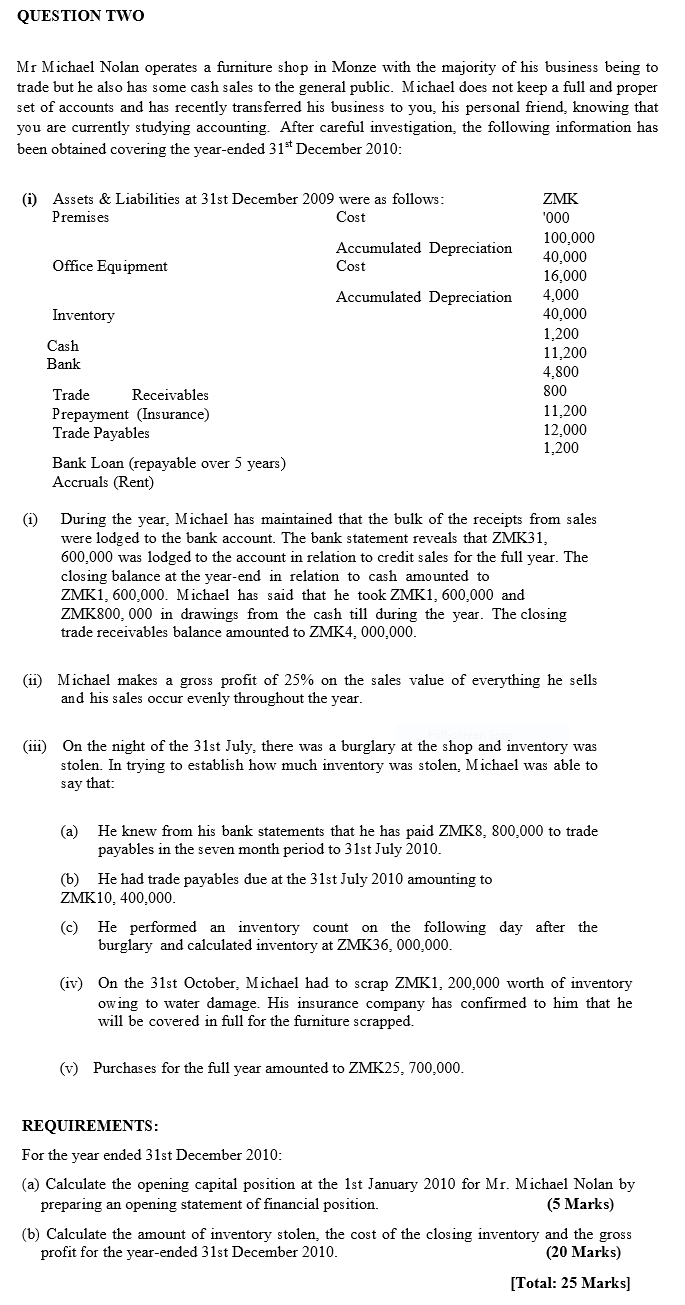

QUESTION TWO Mr Michael Nolan operates a furniture shop in Monze with the majority of his business being to trade but he also has some cash sales to the general public. M ichael does not keep a full and proper set of accounts and has recently transferred his business to you, his personal friend, knowing that you are currently studying accounting. After careful investigation, the following information has been obtained covering the year-ended 31st December 2010 : (i) During the year, Michael has maintained that the bulk of the receipts from sales were lodged to the bank account. The bank statement reveals that ZMK31, 600,000 was lodged to the account in relation to credit sales for the full year. The closing balance at the year-end in relation to cash amounted to ZMK1, 600,000. Michael has said that he took ZMK1, 600,000 and ZMK800, 000 in drawings from the cash till during the year. The closing trade receivables balance amounted to ZMK4,000,000. (ii) Michael makes a gross profit of 25% on the sales value of everything he sells and his sales occur evenly throughout the year. (iii) On the night of the 31st July, there was a burglary at the shop and inventory was stolen. In trying to establish how much inventory was stolen, Michael was able to say that: (a) He knew from his bank statements that he has paid ZMK8, 800,000 to trade payables in the seven month period to 31 st July 2010 . (b) He had trade payables due at the 31 st July 2010 amounting to ZMK10, 400,000. (c) He performed an inventory count on the following day after the burglary and calculated inventory at ZMK36, 000,000. (iv) On the 31st October, Michael had to scrap ZMK1, 200,000 worth of inventory owing to water damage. His insurance company has confirmed to him that he will be covered in full for the furniture scrapped. (v) Purchases for the full year amounted to ZMK25, 700,000. REQUIREMENTS: For the year ended 31st December 2010: (a) Calculate the opening capital position at the 1st January 2010 for Mr. Michael Nolan by preparing an opening statement of financial position. (5 Marks) (b) Calculate the amount of inventory stolen, the cost of the closing inventory and the gross profit for the year-ended 31 st December 2010 . (20 Marks)