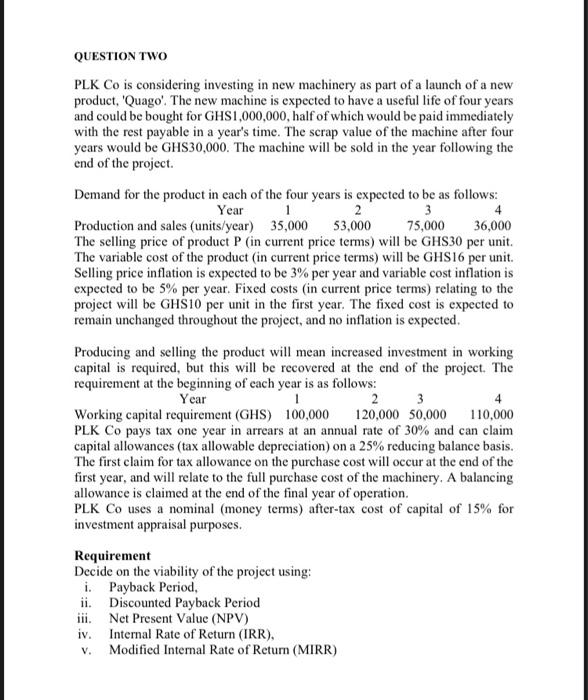

QUESTION TWO PLK Co is considering investing in new machinery as part of a launch of a new product, 'Quago'. The new machine is expected to have a useful life of four years and could be bought for GHS1,000,000, half of which would be paid immediately with the rest payable in a year's time. The scrap value of the machine after four years would be GHS30,000. The machine will be sold in the year following the end of the project. Demand for the product in each of the four years is expected to be as follows: Year 2 4 Production and sales (units/year) 35,000 53,000 75,000 36,000 The selling price of product P (in current price terms) will be GHS30 per unit. The variable cost of the product (in current price terms) will be GHS16 per unit. Selling price inflation is expected to be 3% per year and variable cost inflation is expected to be 5% per year. Fixed costs (in current price terms) relating to the project will be GHS10 per unit in the first year. The fixed cost is expected to remain unchanged throughout the project, and no inflation is expected. Producing and selling the product will mean increased investment in working capital is required, but this will be recovered at the end of the project. The requirement at the beginning of each year is as follows: Year 1 2 3 4 Working capital requirement (GHS) 100,000 120,000 50,000 110,000 PLK Co pays tax one year in arrears at an annual rate of 30% and can claim capital allowances (tax allowable depreciation) on a 25% reducing balance basis. The first claim for tax allowance on the purchase cost will occur at the end of the first year, and will relate to the full purchase cost of the machinery, A balancing allowance is claimed at the end of the final year of operation. PLK Co uses a nominal (money terms) after-tax cost of capital of 15% for investment appraisal purposes. Requirement Decide on the viability of the project using: i. Payback Period, ii. Discounted Payback Period iii. Net Present Value (NPV) iv. Internal Rate of Return (IRR), Modified Internal Rate of Return (MIRR) V. QUESTION TWO PLK Co is considering investing in new machinery as part of a launch of a new product, 'Quago'. The new machine is expected to have a useful life of four years and could be bought for GHS1,000,000, half of which would be paid immediately with the rest payable in a year's time. The scrap value of the machine after four years would be GHS30,000. The machine will be sold in the year following the end of the project. Demand for the product in each of the four years is expected to be as follows: Year 2 4 Production and sales (units/year) 35,000 53,000 75,000 36,000 The selling price of product P (in current price terms) will be GHS30 per unit. The variable cost of the product (in current price terms) will be GHS16 per unit. Selling price inflation is expected to be 3% per year and variable cost inflation is expected to be 5% per year. Fixed costs (in current price terms) relating to the project will be GHS10 per unit in the first year. The fixed cost is expected to remain unchanged throughout the project, and no inflation is expected. Producing and selling the product will mean increased investment in working capital is required, but this will be recovered at the end of the project. The requirement at the beginning of each year is as follows: Year 1 2 3 4 Working capital requirement (GHS) 100,000 120,000 50,000 110,000 PLK Co pays tax one year in arrears at an annual rate of 30% and can claim capital allowances (tax allowable depreciation) on a 25% reducing balance basis. The first claim for tax allowance on the purchase cost will occur at the end of the first year, and will relate to the full purchase cost of the machinery, A balancing allowance is claimed at the end of the final year of operation. PLK Co uses a nominal (money terms) after-tax cost of capital of 15% for investment appraisal purposes. Requirement Decide on the viability of the project using: i. Payback Period, ii. Discounted Payback Period iii. Net Present Value (NPV) iv. Internal Rate of Return (IRR), Modified Internal Rate of Return (MIRR) V