Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO PS plc is evaluating a seven - year project in the renewable energy sector. The initial outlay is K 5 . 8 million

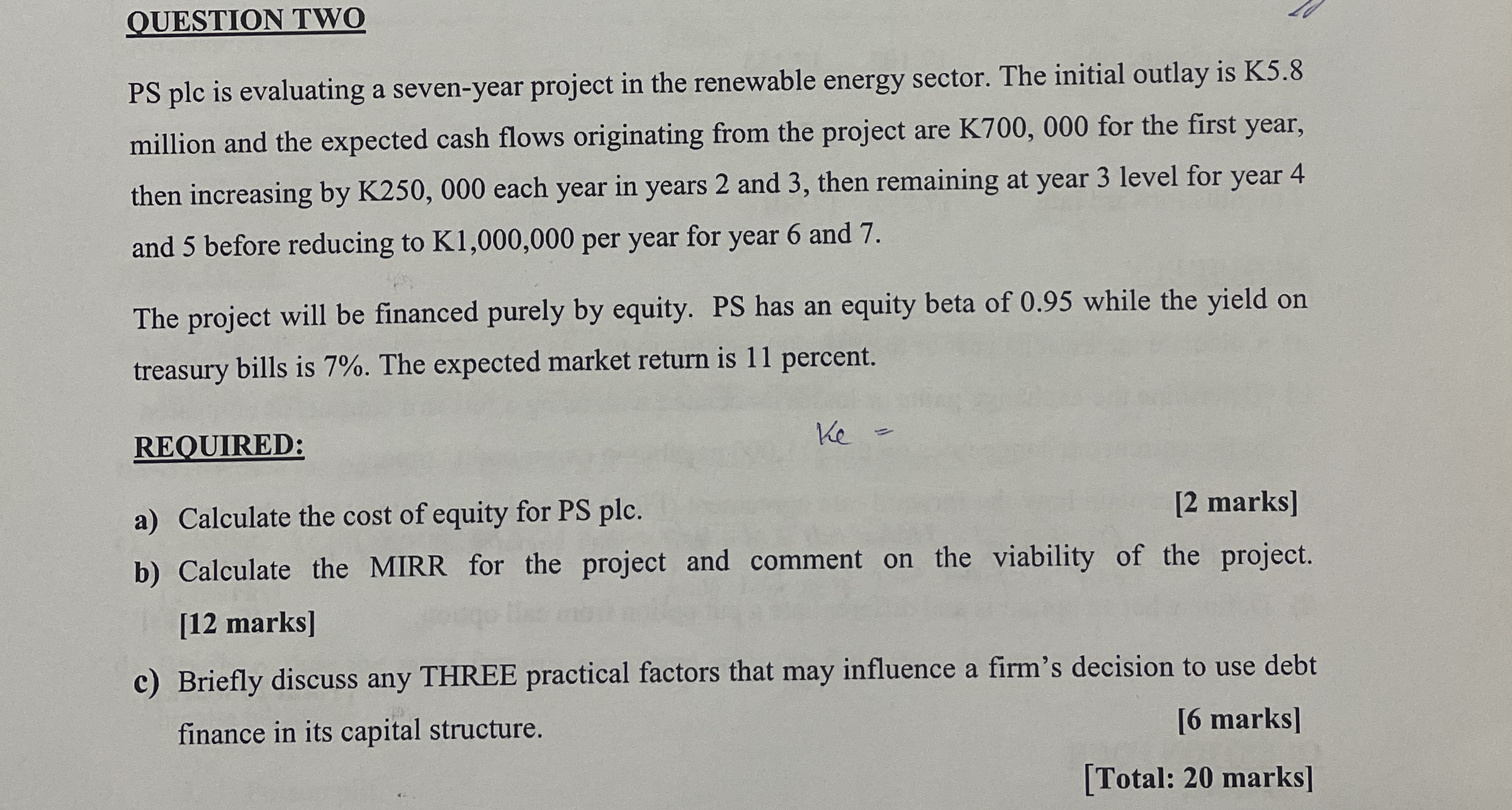

QUESTION TWO

PS plc is evaluating a sevenyear project in the renewable energy sector. The initial outlay is K million and the expected cash flows originating from the project are K for the first year, then increasing by K each year in years and then remaining at year level for year and before reducing to K per year for year and

The project will be financed purely by equity. PS has an equity beta of while the yield on treasury bills is The expected market return is percent.

REQUIRED:

a Calculate the cost of equity for PS plc

marks

b Calculate the MIRR for the project and comment on the viability of the project. marks

c Briefly discuss any THREE practical factors that may influence a firm's decision to use debt finance in its capital structure.

marks

Total: marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started