Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO The management of Aaltic Incorporated is considering two investment opportunities: The first alternative involves the purchase of new machinery for R500 000

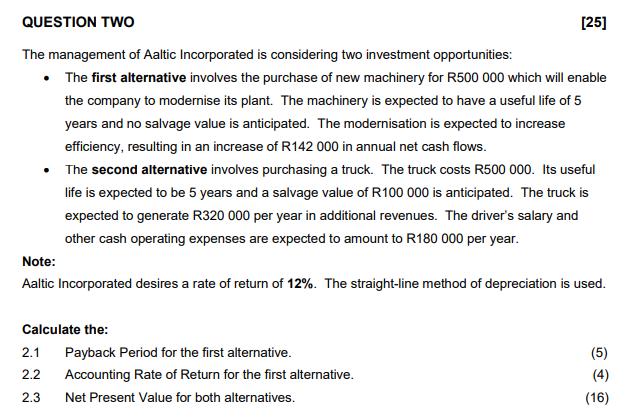

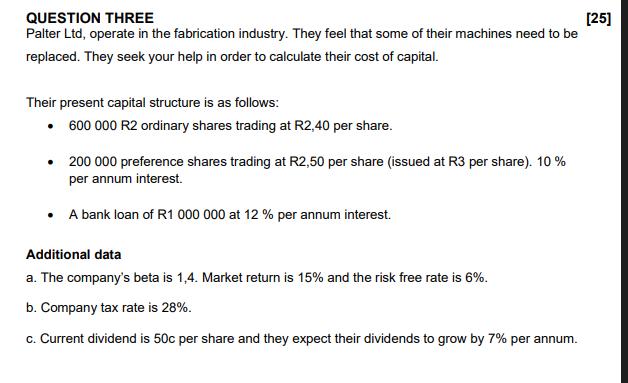

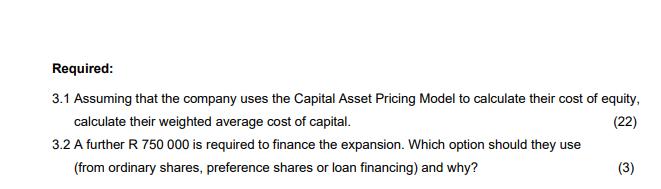

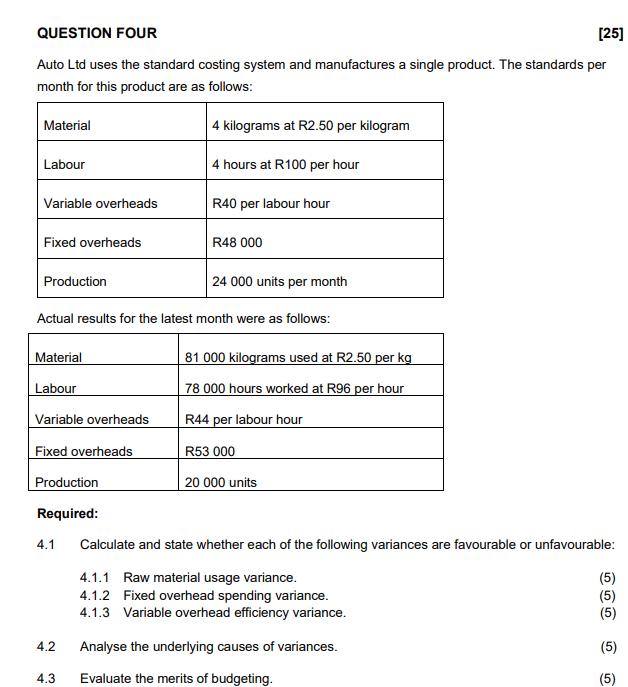

QUESTION TWO The management of Aaltic Incorporated is considering two investment opportunities: The first alternative involves the purchase of new machinery for R500 000 which will enable the company to modernise its plant. The machinery is expected to have a useful life of 5 years and no salvage value is anticipated. The modernisation is expected to increase efficiency, resulting in an increase of R142 000 in annual net cash flows. The second alternative involves purchasing a truck. The truck costs R500 000. Its useful life is expected to be 5 years and a salvage value of R100 000 is anticipated. The truck is expected to generate R320 000 per year in additional revenues. The driver's salary and other cash operating expenses are expected to amount to R180 000 per year. Note: Aaltic Incorporated desires a rate of return of 12%. The straight-line method of depreciation is used. Calculate the: [25] 2.1 2.2 2.3 Payback Period for the first alternative. Accounting Rate of Return for the first alternative. Net Present Value for both alternatives. (5) (4) (16) QUESTION THREE [25] Palter Ltd, operate in the fabrication industry. They feel that some of their machines need to be replaced. They seek your help in order to calculate their cost of capital. Their present capital structure is as follows: 600 000 R2 ordinary shares trading at R2,40 per share. 200 000 preference shares trading at R2,50 per share (issued at R3 per share). 10% per annum interest. A bank loan of R1 000 000 at 12 % per annum interest. Additional data a. The company's beta is 1,4. Market return is 15% and the risk free rate is 6%. b. Company tax rate is 28%. c. Current dividend is 50c per share and they expect their dividends to grow by 7% per annum. Required: 3.1 Assuming that the company uses the Capital Asset Pricing Model to calculate their cost of equity, calculate their weighted average cost of capital. (22) 3.2 A further R 750 000 is required to finance the expansion. Which option should they use (from ordinary shares, preference shares or loan financing) and why? (3) QUESTION FOUR [25] Auto Ltd uses the standard costing system and manufactures a single product. The standards per month for this product are as follows: Material Labour Variable overheads Fixed overheads Production Material Labour Variable overheads Fixed overheads Production Required: Actual results for the latest month were as follows: 4.1 4.2 4 kilograms at R2.50 per kilogram 4 hours at R100 per hour R40 per labour hour 4.3 R48 000 24 000 units per month 81 000 kilograms used at R2.50 per kg 78 000 hours worked at R96 per hour R44 per labour hour R53 000 20 000 units Calculate and state whether each of the following variances are favourable or unfavourable: 4.1.1 Raw material usage variance. 4.1.2 Fixed overhead spending variance. 4.1.3 Variable overhead efficiency variance. Analyse the underlying causes of variances. Evaluate the merits of budgeting. (5) (5) (5) (5) (5)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started