Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Palter Ltd, operate in the fabrication industry. They feel that some of their machines need to be replaced. They seek your help in order

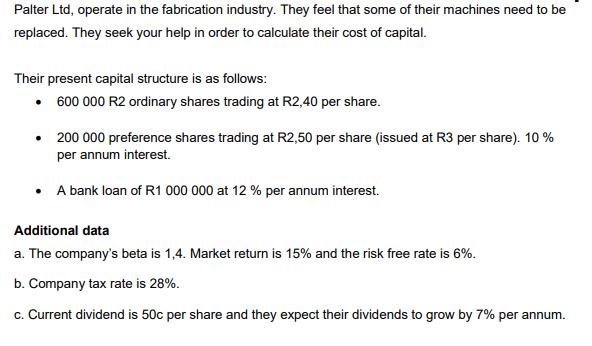

Palter Ltd, operate in the fabrication industry. They feel that some of their machines need to be replaced. They seek your help in order to calculate their cost of capital. Their present capital structure is as follows: 600 000 R2 ordinary shares trading at R2,40 per share. 200 000 preference shares trading at R2,50 per share (issued at R3 per share). 10 % per annum interest. A bank loan of R1 000 000 at 12 % per annum interest. Additional data a. The company's beta is 1,4. Market return is 15% and the risk free rate is 6%. b. Company tax rate is 28%. c. Current dividend is 50c per share and they expect their dividends to grow by 7% per annum. Required: 3.1 Assuming that the company uses the Capital Asset Pricing Model to calculate their cost of equity. (22) calculate their weighted average cost of capital. 3.2 A further R 750 000 is required to finance the expansion. Which option should they use (from ordinary shares, preference shares or loan financing) and why? (3)

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started