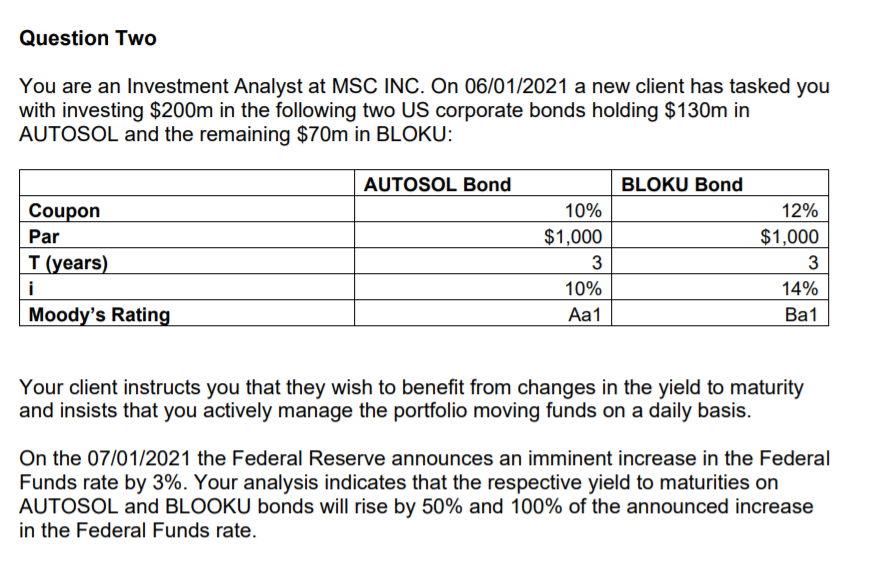

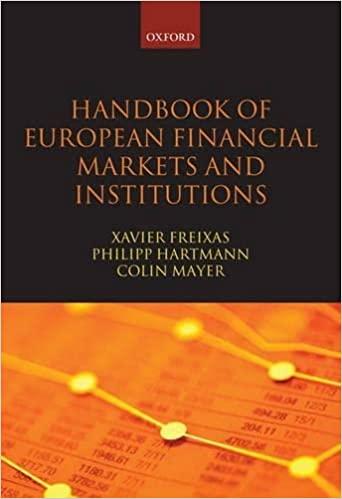

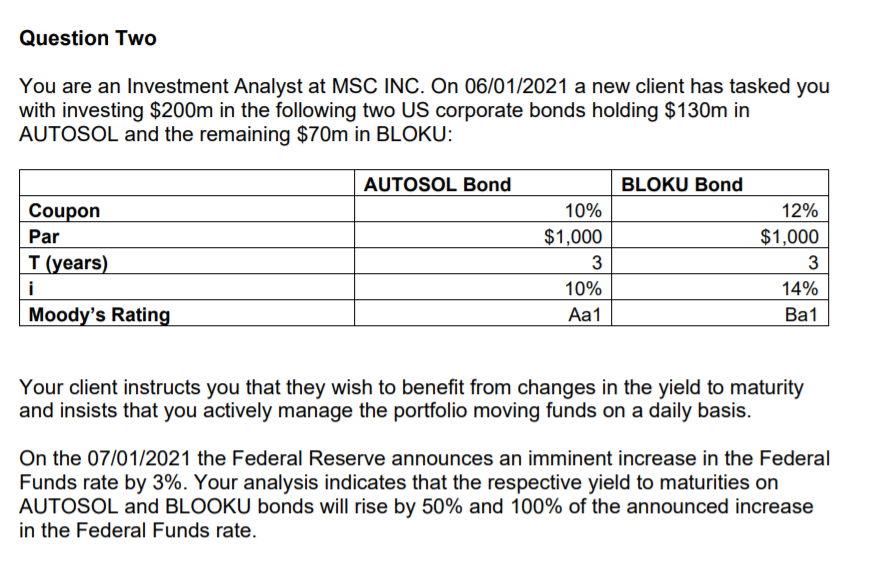

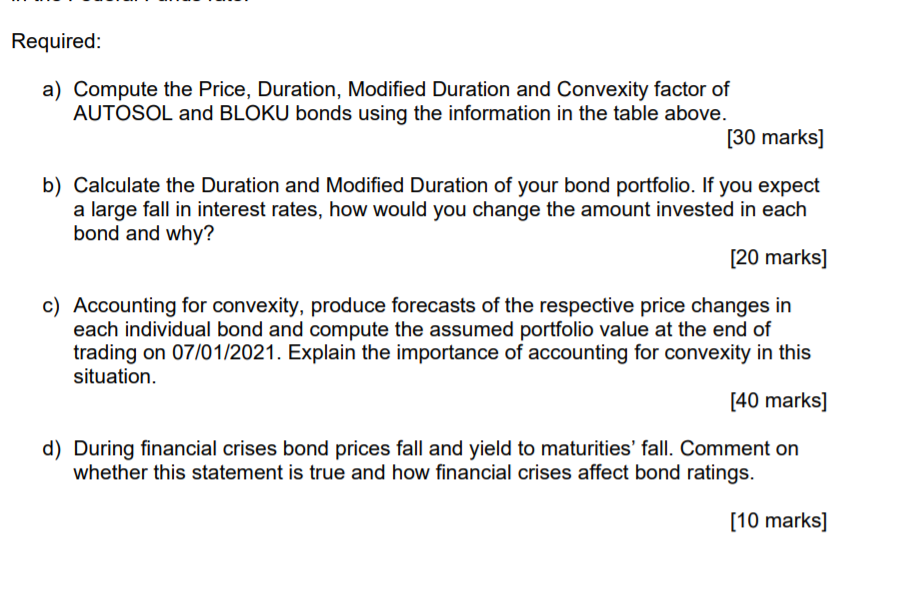

Question Two You are an Investment Analyst at MSC INC. On 06/01/2021 a new client has tasked you with investing $200m in the following two US corporate bonds holding $130m in AUTOSOL and the remaining $70m in BLOKU: AUTOSOL Bond BLOKU Bond Coupon Par T (years) i Moody's Rating 10% $1,000 3 10% Aa1 12% $1,000 3 14% Ba1 Your client instructs you that they wish to benefit from changes in the yield to maturity and insists that you actively manage the portfolio moving funds on a daily basis. On the 07/01/2021 the Federal Reserve announces an imminent increase in the Federal Funds rate by 3%. Your analysis indicates that the respective yield to maturities on AUTOSOL and BLOOKU bonds will rise by 50% and 100% of the announced increase in the Federal Funds rate. Required: a) Compute the Price, Duration, Modified Duration and Convexity factor of AUTOSOL and BLOKU bonds using the information in the table above. [30 marks] b) Calculate the Duration and Modified Duration of your bond portfolio. If you expect a large fall in interest rates, how would you change the amount invested in each bond and why? [20 marks] c) Accounting for convexity, produce forecasts of the respective price changes in each individual bond and compute the assumed portfolio value at the end of trading on 07/01/2021. Explain the importance of accounting for convexity in this situation. [40 marks] d) During financial crises bond prices fall and yield to maturities' fall. Comment on whether this statement is true and how financial crises affect bond ratings. [10 marks] Question Two You are an Investment Analyst at MSC INC. On 06/01/2021 a new client has tasked you with investing $200m in the following two US corporate bonds holding $130m in AUTOSOL and the remaining $70m in BLOKU: AUTOSOL Bond BLOKU Bond Coupon Par T (years) i Moody's Rating 10% $1,000 3 10% Aa1 12% $1,000 3 14% Ba1 Your client instructs you that they wish to benefit from changes in the yield to maturity and insists that you actively manage the portfolio moving funds on a daily basis. On the 07/01/2021 the Federal Reserve announces an imminent increase in the Federal Funds rate by 3%. Your analysis indicates that the respective yield to maturities on AUTOSOL and BLOOKU bonds will rise by 50% and 100% of the announced increase in the Federal Funds rate. Required: a) Compute the Price, Duration, Modified Duration and Convexity factor of AUTOSOL and BLOKU bonds using the information in the table above. [30 marks] b) Calculate the Duration and Modified Duration of your bond portfolio. If you expect a large fall in interest rates, how would you change the amount invested in each bond and why? [20 marks] c) Accounting for convexity, produce forecasts of the respective price changes in each individual bond and compute the assumed portfolio value at the end of trading on 07/01/2021. Explain the importance of accounting for convexity in this situation. [40 marks] d) During financial crises bond prices fall and yield to maturities' fall. Comment on whether this statement is true and how financial crises affect bond ratings. [10 marks]