Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO Your company Chief Finance Officer (CPO) recently read on the Business Daily about the notion that adjusting the capital structure can increase market

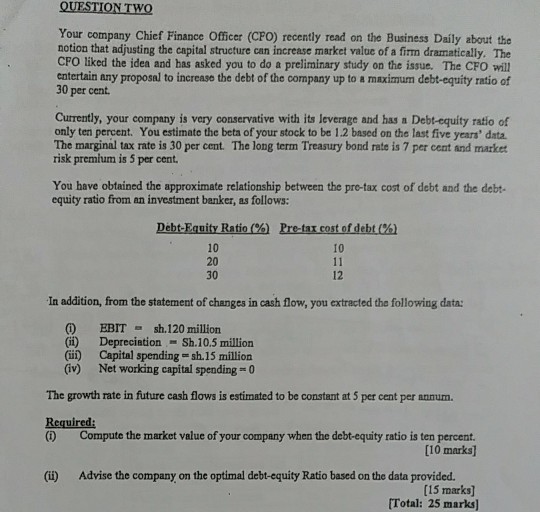

QUESTION TWO Your company Chief Finance Officer (CPO) recently read on the Business Daily about the notion that adjusting the capital structure can increase market value of a firm dramatically. The CFO liked the idea and has asked you to do a preliminary study on the issue. The CFO will entertain any proposal to increase the debt of the company up to a maximum debt-equity ratio of 30 per cent Currently, your company is very conservative with its leverage and has a Debt-equity ratio of only ten percent. You estimate the beta of your stock to be 1.2 based on the last five years' data. The marginal tax rate is 30 per cent. The long term Treasury bond rate is 7 per cent and market risk premium is 5 per cent You have obtained the approximate relationship between the pre-tax cost of debt and the debt equity ratio from an investment banker, as follows Debt-Equity Ratio(%) 10 20 30 Pre-tax cost of debt(%) 10 12 In addition, from the statement of changes in cash flow, you extracted the following data: 0 EBITsh.120 million (ii) Depreciation Sh.10.5 million (ii) Capital spending sh.15 million (iv) Net working capital spending 0 The growth rate in future cash flows is estimated to be constant at 5 per cent per annum. Required: () Compute the market value of your company when the debt-equity ratio is ten percent. [10 marks] () Advise the company on the optimal debt-equity Ratio based on the data provided. [15 marks] Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started