Question

Question (use Excel to show full calculations) Research what the actual bank provisions are for Covid relief in South Africa and how they can affect

Question (use Excel to show full calculations)

Research what the actual bank provisions are for Covid relief in South Africa and how they can affect clients.

Furthermore, you will work on 2 scenarios in which the clients will extend their loan terms and those when they choose to increase their payments (when they resume payments) to remain within the same loan term/period or simply pay the outstanding interest as a lump sum in order to resume normal payments while remaining within the same loan period.

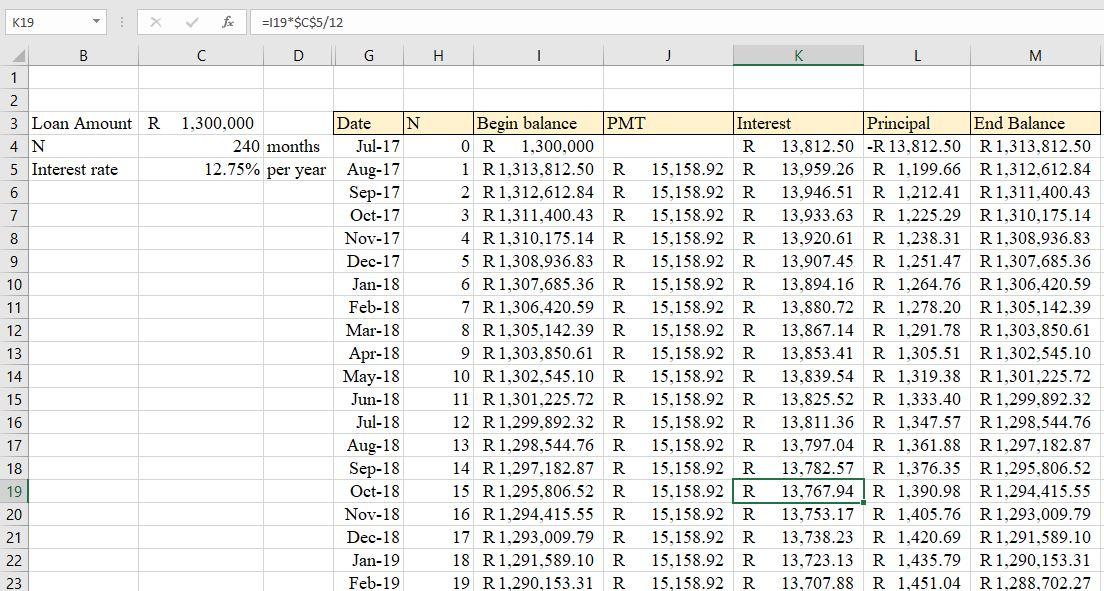

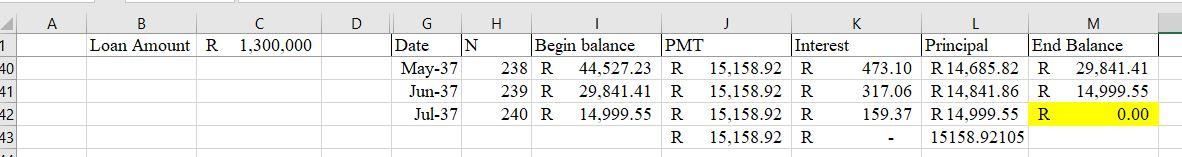

Client A: Bought a R 1.3 million house in July 2017. First mortgage instalment was in August 2017.The loan term was 20 years and the interest based on the risk profile was 12.75% per annum.

Client B: Bought a R 2.8 million house in Feb 2005. First instalment in April 2005. Loan term was also 20 years. Interest charged was 12.25% per annum.

Question: How will these 2 clients be affected by taking a payment holiday? For each client determine the following:

i.) How much in total interest (and total payments) they would have paid for the entire loan term if they had not taken a break in payments.

ii.) How much in total interest (total payments) they will pay if they take the payment holiday from i.e. miss payments from March to September 2020. Show how their loan term would change.

iii.) How much in total interest (total payments) they will pay if they take the payment holiday but choose to settle the accrued interest between March and September 2020. How much the accrued interest lump sum payment would be to maintain the original payment for the remaining loan term?

iv.) How much total interest will be paid if they decide to the payment holiday but increase their monthly instalments from October going forward so as to remain within the same loan term? Determine that new payment.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

THIS IS HOW I PRESENT THE RESULTS IN EXCEL SHEET BUT I AM NOT SURE ABOUT MY RESULTS FROM QUESTION iii) to iv) i used Goal Seek in Excel:

K19 X =119*$C$5/12 B C D G H M 1 2 3 Loan Amount R 4 N 5 Interest rate 6 7 8 9 10 11 12 13 14 15 16 1,300,000 Date N 240 months Jul-17 12.75% per year Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Begin balance PMT Interest Principal End Balance 0 R 1,300,000 R 13,812.50 R 13,812.50 R 1,313,812.50 1 R1,313,812.50 R 15,158.92 R 13,959.26 R 1,199.66 R1,312,612.84 2 R1,312,612.84 R 15,158.92 R 13.946.51 R 1,212.41 R1,311,400.43 3 R1,311,400.43 R 15,158.92 R 13,933.63 R 1.225.29 R 1,310,175.14 4 R 1,310,175.14 R 15,158.92 R 13,920.61 R 1,238.31 R 1,308,936.83 5 R 1,308,936.83 R 15.158.92 R 13.907.45 R 1,251.47 R1,307,685.36 6 R 1,307,685.36 R 15,158.92 R 13.894.16 R 1,264.76 R 1,306,420.59 7 R 1,306,420.59 R 15,158.92 R 13,880.72 R 1.278.20 R 1,305,142.39 8 R1,305,142.39 R 15,158.92 R 13,867.14 R 1.291.78 R 1.303,850.61 9 R 1,303,850.61 R 15,158.92 R 13,853.41 R 1,305.51 R1,302,545.10 10 R 1,302,545.10 R 15,158.92 R 13,839.54 R 1,319.38 R1,301,225.72 11 R1,301,225.72 R 15,158.92 R 13,825.52 R 1,333.40 R 1,299.892.32 12 R 1,299.892.32 R 15,158.92 R 13.811.36 R 1,347.57 R1,298,544.76 13 R 1,298,544.76 R 15,158.92 R 13.797.04 R 1,361.88 R 1,297,182.87 R 1,297,182.87 R 15,158.92 R 13,782.57 R 1,376.35 R 1,295,806.52 15 R 1,295,806.52 R 15.158.92 R 13,767.94 R 1,390.98 R 1,294,415.55 R 1,294,415.55 R 15,158.92 R 13,753.17 R 1,405.76 R 1,293,009.79 17 R 1,293,009.79 R 15,158.92 R 13,738.23 R 1,420.69 R 1,291,589.10 18 R 1,291,589.10 R 15,158.92 R 13,723.13 R 1,435.79 R 1,290,153.31 19 R 1,290,153.31 R 15,158.92 R 13.707.88 R 1,451.04 R 1,288,702.27 17 18 19 20 21 22 23 A D B Loan Amount R C 1.300.000 1 40 G Date N May-37 Jun-37 Jul-37 H J K M Begin balance PMT Interest Principal End Balance 238 R 44,527.23 R 15.158.92 R 473.10 R 14.685.82 R 29,841.41 239 R 29.841.41 R 15.158.92 R 317.06 R 14.841.86 R 14.999.55 240 R 14.999.55 R 15,158.92 R 159.37 R 14.999.55 R 0.00 R 15,158.92 R 15158.92105 41 42 43 K19 X =119*$C$5/12 B C D G H M 1 2 3 Loan Amount R 4 N 5 Interest rate 6 7 8 9 10 11 12 13 14 15 16 1,300,000 Date N 240 months Jul-17 12.75% per year Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 Nov-18 Dec-18 Jan-19 Feb-19 Begin balance PMT Interest Principal End Balance 0 R 1,300,000 R 13,812.50 R 13,812.50 R 1,313,812.50 1 R1,313,812.50 R 15,158.92 R 13,959.26 R 1,199.66 R1,312,612.84 2 R1,312,612.84 R 15,158.92 R 13.946.51 R 1,212.41 R1,311,400.43 3 R1,311,400.43 R 15,158.92 R 13,933.63 R 1.225.29 R 1,310,175.14 4 R 1,310,175.14 R 15,158.92 R 13,920.61 R 1,238.31 R 1,308,936.83 5 R 1,308,936.83 R 15.158.92 R 13.907.45 R 1,251.47 R1,307,685.36 6 R 1,307,685.36 R 15,158.92 R 13.894.16 R 1,264.76 R 1,306,420.59 7 R 1,306,420.59 R 15,158.92 R 13,880.72 R 1.278.20 R 1,305,142.39 8 R1,305,142.39 R 15,158.92 R 13,867.14 R 1.291.78 R 1.303,850.61 9 R 1,303,850.61 R 15,158.92 R 13,853.41 R 1,305.51 R1,302,545.10 10 R 1,302,545.10 R 15,158.92 R 13,839.54 R 1,319.38 R1,301,225.72 11 R1,301,225.72 R 15,158.92 R 13,825.52 R 1,333.40 R 1,299.892.32 12 R 1,299.892.32 R 15,158.92 R 13.811.36 R 1,347.57 R1,298,544.76 13 R 1,298,544.76 R 15,158.92 R 13.797.04 R 1,361.88 R 1,297,182.87 R 1,297,182.87 R 15,158.92 R 13,782.57 R 1,376.35 R 1,295,806.52 15 R 1,295,806.52 R 15.158.92 R 13,767.94 R 1,390.98 R 1,294,415.55 R 1,294,415.55 R 15,158.92 R 13,753.17 R 1,405.76 R 1,293,009.79 17 R 1,293,009.79 R 15,158.92 R 13,738.23 R 1,420.69 R 1,291,589.10 18 R 1,291,589.10 R 15,158.92 R 13,723.13 R 1,435.79 R 1,290,153.31 19 R 1,290,153.31 R 15,158.92 R 13.707.88 R 1,451.04 R 1,288,702.27 17 18 19 20 21 22 23 A D B Loan Amount R C 1.300.000 1 40 G Date N May-37 Jun-37 Jul-37 H J K M Begin balance PMT Interest Principal End Balance 238 R 44,527.23 R 15.158.92 R 473.10 R 14.685.82 R 29,841.41 239 R 29.841.41 R 15.158.92 R 317.06 R 14.841.86 R 14.999.55 240 R 14.999.55 R 15,158.92 R 159.37 R 14.999.55 R 0.00 R 15,158.92 R 15158.92105 41 42 43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started