Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION: What is the difference between Primary and Secondary market? Using Mr. Entrepreneurs IPO as an example, describe the main function of Primary and secondary

QUESTION: What is the difference between Primary and Secondary market? Using Mr. Entrepreneurs IPO as an example, describe the main function of Primary and secondary market? (6 marks)

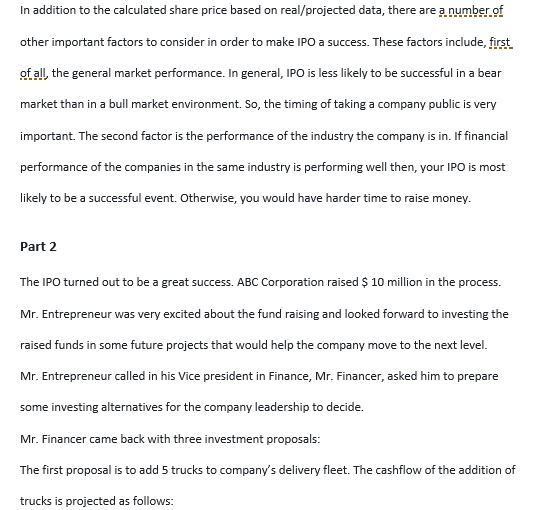

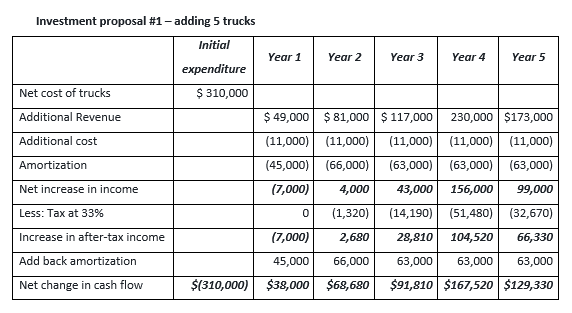

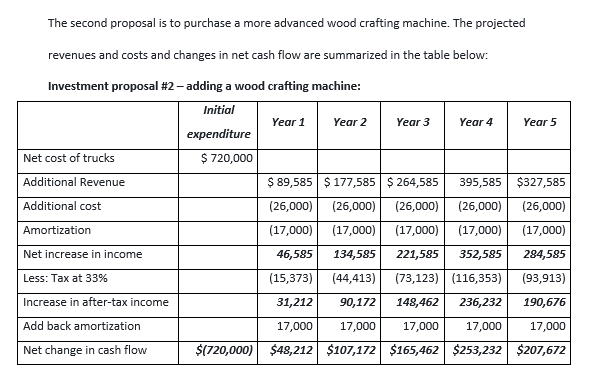

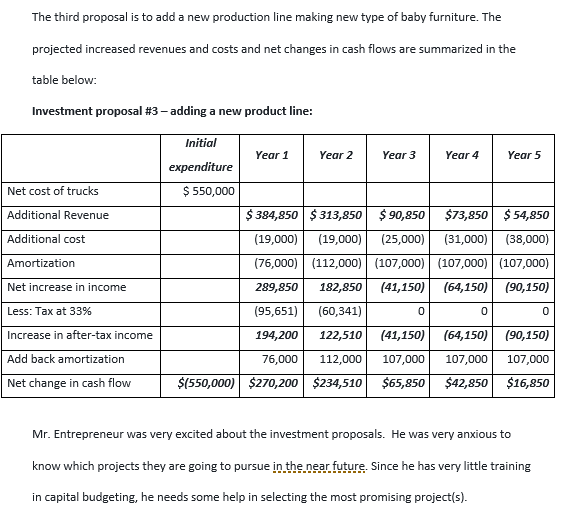

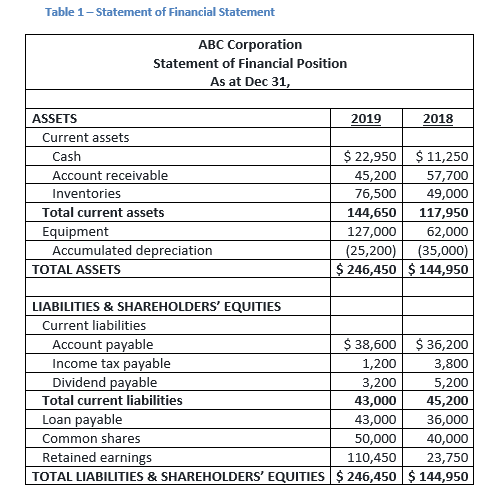

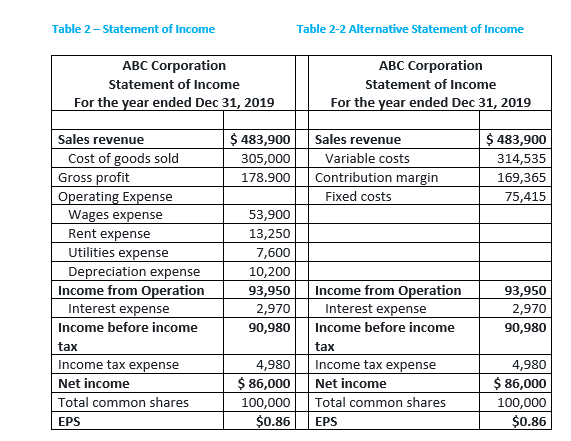

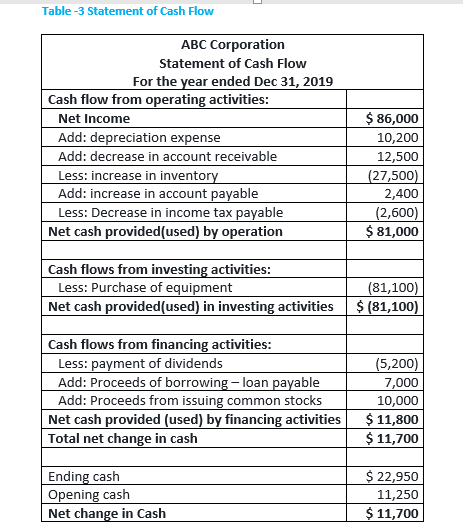

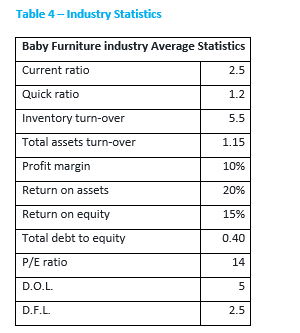

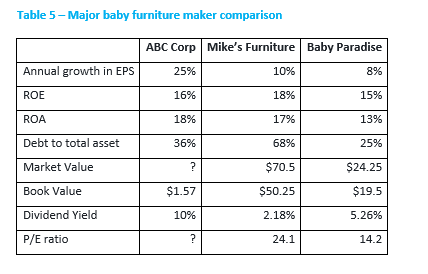

Final Assessment - Mr. Entrepreneur's story continued... This project is an individual assignment. Independent completion, without collaborating with other students is required. This project is based on the course material covered in the following chapters: Chapter 10- Valuation and Rates of Return Chapter 11 - Cost of Capital Chapter 12 - The Capital Budgeting Decision Chapter 14 - Capital Markets Instruction: Read the project material very carefully and answer the questions at the end of the project material. You are expected to answer all the questions in a separate word document. When you provide your answers, you need to write them in full sentences and in a logical manner. Mr. Entrepreneur's Story, continued... Part 1 Because of his business acumen and an element of luck, ABC Corporation has been doing really. well and has become one of the major players in baby furniture industry in North America. Due to its rapid growth, the demand for capita for ABC Corp. is getting more urgent as days go by. Mr. Entrepreneur and his leadership group of the company now are very seriously reconsidering the idea of taking company public - i.e., selling a part of ownership of the company to the public in order to raise the needed capital for company growth. Mr. Entrepreneur rehired the brokerage firm he had consulted previously and wanted some help from them with respect to all aspects of "going public" for the company. The term for this activity in the investment business is called "IPO" initial public offering". One of the major steps in a successful IPO is to price the company share properly. The company's instinct is to price the shares as high as possible so that company can raise a lot of capital from the stock selling. But if the price is set too high, the demand for the stock is going inevitably weak. However, if the share is priced too low, then the company is not going to achieve its fund-raising objectives. Therefore, the trick here is to price the company stock at such a price that is low enough to attack a lot of buying interest in the market, also it is high enough so that company can raise enough funds to meet its growth needs. The first step to perform a valuation of the company stock is to collect company data with respect to its earnings and growth. Then we can do some research regarding how the market is evaluating similar companies in the market. Eventually company can come up a share price that satisfies its needs. The following data are available (both real and projected): The earning growth rate is projected at 30% for the first four years; After that, the growth rate will become more reasonable at 7% per year for the foreseeable future. The 40% of earning was paid out as dividend for year 2019 (From Income Statement). The dividend will be increased at the earning growth rates. The required rate of return (discount rate) is 12.5%. In addition to the calculated share price based on real/projected data, there are a number of other important factors to consider in order to make IPO a success. These factors include, first of all the general market performance. In general, IPO is less likely to be successful in a bear market than in a bull market environment. So, the timing of taking a company public is very important. The second factor is the performance of the industry the company is in. If financial performance of the companies in the same industry is performing well then, your IPO is most likely to be a successful event. Otherwise, you would have harder time to raise money. Part 2 The IPO turned out to be a great success. ABC Corporation raised $ 10 million in the process. Mr. Entrepreneur was very excited about the fund raising and looked forward to investing the raised funds in some future projects that would help the company move to the next level. Mr. Entrepreneur called in his vice president in Finance, Mr. Financer, asked him to prepare some investing alternatives for the company leadership to decide. Mr. Financer came back with three investment proposals: The first proposal is to add 5 trucks to company's delivery fleet. The cashflow of the addition of trucks is projected as follows: Investment proposal #1 - adding 5 trucks Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure Net cost of trucks $ 310,000 Additional Revenue Additional cost Amortization Net increase in income $ 49,000 $ 81,000 $ 117,000 230,000 $173,000 (11,000)| (11,000) (11,000) (11,000) (11,000) (45,000)| (66,000)| (63,000)| (63,000) (63,000) (7,000) 4,000 43,000 156,000 99,000 0 (1,320) (14,190) (51,480) (32,670) (7,000) 2,680 28,810 104,520 66,330 45,000 66,000 63,000 63,000 63,000 $38,000 $68,680 $91,810 $167,520 $129,330 Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $(310,000) The second proposal is to purchase a more advanced wood crafting machine. The projected revenues and costs and changes in net cash flow are summarized in the table below: Investment proposal #2 - adding a wood crafting machine: Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure Net cost of trucks Additional Revenue Additional cost Amortization Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $ 720,000 $ 89,585 $ 177,585 $ 264,585 395,585 $327,585 (26,000) (26,000) (26,000) (26,000) (26,000) (17,000) (17,000) (17,000) (17,000) (17,000) 46,585 134,585 221,585 352,585 284,585 (15,373) (44,413) (73,123)| (116,353) (93,913) 31,212 90,172 148,462 236,232 190,676 17,000 17,000 17,000 17,000 17,000 $(720,000) $48,212 $107,172 $165,462 $253,232 $207,672 The third proposal is to add a new production line making new type of baby furniture. The projected increased revenues and costs and net changes in cash flows are summarized in the table below: Investment proposal #3 - adding a new product line: Net cost of trucks Additional Revenue Additional cost Amortization Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure $ 550,000 $ 384,850 $ 313,850 $ 90,850 $73,850 $ 54,850 (19,000) (19,000) (25,000) (31,000) (38,000) (76,000)| (112,000)| (107,000) (107,000)| (107,000) 289,850 182,850 (41,150)| (64,150) (90,150) (95,651) (60,341) 0 0 0 194,200 122,510 (41,150)| (64,150) (90,150) 76,000 112,000 107,000 107,000 107,000 $(550,000) $270,200 $234,510 $65,850 $42,850 $16,850 Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow Mr. Entrepreneur was very excited about the investment proposals. He was very anxious to know which projects they are going to pursue in the near future. Since he has very little training in capital budgeting, he needs some help in selecting the most promising project(s). Table 1-Statement of Financial Statement ABC Corporation Statement of Financial Position As at Dec 31, ASSETS 2019 2018 Current assets Cash Account receivable Inventories Total current assets Equipment Accumulated depreciation TOTAL ASSETS $ 22,950 $ 11,250 45,200 57,700 76,500 49,000 144,650 117,950 127,000 62,000 (25,200) (35,000) $ 246,450 $ 144,950 LIABILITIES & SHAREHOLDERS' EQUITIES Current liabilities Account payable $ 38,600 $ 36,200 Income tax payable 1,200 3,800 Dividend payable 3,200 5,200 Total current liabilities 43,000 45,200 Loan payable 43,000 36,000 Common shares 50,000 40,000 Retained earnings 110,450 23,750 TOTAL LIABILITIES & SHAREHOLDERS' EQUITIES $ 246,450 $ 144,950 Table 2-Statement of Income Table 2-2 Alternative Statement of Income ABC Corporation Statement of Income For the year ended Dec 31, 2019 ABC Corporation Statement of Income For the year ended Dec 31, 2019 $ 483,900 305,000 178.900 Sales revenue Variable costs Contribution margin Fixed costs $ 483,900 314,535 169,365 75,415 Sales revenue Cost of goods sold Gross profit Operating Expense Wages expense Rent expense Utilities expense Depreciation expense Income from Operation Interest expense Income before income tax Income tax expense Net income Total common shares EPS 53,900 13,250 7,600 10,200 93,950 2,970 90,980 93,950 2,970 90,980 Income from Operation Interest expense Income before income tax Income tax expense Net income Total common shares EPS 4,980 $ 86,000 100,000 $0.86 4,980 $ 86,000 100,000 $0.86 Table -3 Statement of Cash Flow ABC Corporation Statement of Cash Flow For the year ended Dec 31, 2019 Cash flow from operating activities: Net Income Add: depreciation expense Add: decrease in account receivable Less: increase in inventory Add: increase in account payable Less: Decrease in income tax payable Net cash provided(used) by operation $ 86,000 10,200 12,500 (27,500) 2,400 (2,600) $ 81,000 Cash flows from investing activities: Less: Purchase of equipment Net cash provided(used) in investing activities (81,100) $ (81,100) Cash flows from financing activities: Less: payment of dividends Add: Proceeds of borrowing - loan payable Add: Proceeds from issuing common stocks Net cash provided (used) by financing activities Total net change in cash (5,200) 7,000 10,000 $ 11,800 $ 11,700 Ending cash Opening cash Net change in Cash $ 22,950 11,250 $ 11,700 Table 4 - Industry Statistics Baby Furniture industry Average Statistics Current ratio 2.5 Quick ratio 1.2 Inventory turn-over 5.5 Total assets turn-over 1.15 Profit margin 10% Return on assets 20% 15% Return on equity Total debt to equity P/E ratio 0.40 14 D.O.L. 5 D.F.L 2.5 Table 5- Major baby furniture maker comparison ABC Corp Mike's Furniture Baby Paradise Annual growth in EPS 25% 10% 8% ROE 16% 18% 15% ROA 18% 17% 13% 36% 68% 25% ? $70.5 $24.25 Debt to total asset Market Value Book Value Dividend Yield $1.57 $50.25 $19.5 10% 2.18% 5.26% P/E ratio ? 24.1 14.2 Final Assessment - Mr. Entrepreneur's story continued... This project is an individual assignment. Independent completion, without collaborating with other students is required. This project is based on the course material covered in the following chapters: Chapter 10- Valuation and Rates of Return Chapter 11 - Cost of Capital Chapter 12 - The Capital Budgeting Decision Chapter 14 - Capital Markets Instruction: Read the project material very carefully and answer the questions at the end of the project material. You are expected to answer all the questions in a separate word document. When you provide your answers, you need to write them in full sentences and in a logical manner. Mr. Entrepreneur's Story, continued... Part 1 Because of his business acumen and an element of luck, ABC Corporation has been doing really. well and has become one of the major players in baby furniture industry in North America. Due to its rapid growth, the demand for capita for ABC Corp. is getting more urgent as days go by. Mr. Entrepreneur and his leadership group of the company now are very seriously reconsidering the idea of taking company public - i.e., selling a part of ownership of the company to the public in order to raise the needed capital for company growth. Mr. Entrepreneur rehired the brokerage firm he had consulted previously and wanted some help from them with respect to all aspects of "going public" for the company. The term for this activity in the investment business is called "IPO" initial public offering". One of the major steps in a successful IPO is to price the company share properly. The company's instinct is to price the shares as high as possible so that company can raise a lot of capital from the stock selling. But if the price is set too high, the demand for the stock is going inevitably weak. However, if the share is priced too low, then the company is not going to achieve its fund-raising objectives. Therefore, the trick here is to price the company stock at such a price that is low enough to attack a lot of buying interest in the market, also it is high enough so that company can raise enough funds to meet its growth needs. The first step to perform a valuation of the company stock is to collect company data with respect to its earnings and growth. Then we can do some research regarding how the market is evaluating similar companies in the market. Eventually company can come up a share price that satisfies its needs. The following data are available (both real and projected): The earning growth rate is projected at 30% for the first four years; After that, the growth rate will become more reasonable at 7% per year for the foreseeable future. The 40% of earning was paid out as dividend for year 2019 (From Income Statement). The dividend will be increased at the earning growth rates. The required rate of return (discount rate) is 12.5%. In addition to the calculated share price based on real/projected data, there are a number of other important factors to consider in order to make IPO a success. These factors include, first of all the general market performance. In general, IPO is less likely to be successful in a bear market than in a bull market environment. So, the timing of taking a company public is very important. The second factor is the performance of the industry the company is in. If financial performance of the companies in the same industry is performing well then, your IPO is most likely to be a successful event. Otherwise, you would have harder time to raise money. Part 2 The IPO turned out to be a great success. ABC Corporation raised $ 10 million in the process. Mr. Entrepreneur was very excited about the fund raising and looked forward to investing the raised funds in some future projects that would help the company move to the next level. Mr. Entrepreneur called in his vice president in Finance, Mr. Financer, asked him to prepare some investing alternatives for the company leadership to decide. Mr. Financer came back with three investment proposals: The first proposal is to add 5 trucks to company's delivery fleet. The cashflow of the addition of trucks is projected as follows: Investment proposal #1 - adding 5 trucks Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure Net cost of trucks $ 310,000 Additional Revenue Additional cost Amortization Net increase in income $ 49,000 $ 81,000 $ 117,000 230,000 $173,000 (11,000)| (11,000) (11,000) (11,000) (11,000) (45,000)| (66,000)| (63,000)| (63,000) (63,000) (7,000) 4,000 43,000 156,000 99,000 0 (1,320) (14,190) (51,480) (32,670) (7,000) 2,680 28,810 104,520 66,330 45,000 66,000 63,000 63,000 63,000 $38,000 $68,680 $91,810 $167,520 $129,330 Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $(310,000) The second proposal is to purchase a more advanced wood crafting machine. The projected revenues and costs and changes in net cash flow are summarized in the table below: Investment proposal #2 - adding a wood crafting machine: Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure Net cost of trucks Additional Revenue Additional cost Amortization Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $ 720,000 $ 89,585 $ 177,585 $ 264,585 395,585 $327,585 (26,000) (26,000) (26,000) (26,000) (26,000) (17,000) (17,000) (17,000) (17,000) (17,000) 46,585 134,585 221,585 352,585 284,585 (15,373) (44,413) (73,123)| (116,353) (93,913) 31,212 90,172 148,462 236,232 190,676 17,000 17,000 17,000 17,000 17,000 $(720,000) $48,212 $107,172 $165,462 $253,232 $207,672 The third proposal is to add a new production line making new type of baby furniture. The projected increased revenues and costs and net changes in cash flows are summarized in the table below: Investment proposal #3 - adding a new product line: Net cost of trucks Additional Revenue Additional cost Amortization Initial Year 1 Year 2 Year 3 Year 4 Year 5 expenditure $ 550,000 $ 384,850 $ 313,850 $ 90,850 $73,850 $ 54,850 (19,000) (19,000) (25,000) (31,000) (38,000) (76,000)| (112,000)| (107,000) (107,000)| (107,000) 289,850 182,850 (41,150)| (64,150) (90,150) (95,651) (60,341) 0 0 0 194,200 122,510 (41,150)| (64,150) (90,150) 76,000 112,000 107,000 107,000 107,000 $(550,000) $270,200 $234,510 $65,850 $42,850 $16,850 Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow Mr. Entrepreneur was very excited about the investment proposals. He was very anxious to know which projects they are going to pursue in the near future. Since he has very little training in capital budgeting, he needs some help in selecting the most promising project(s). Table 1-Statement of Financial Statement ABC Corporation Statement of Financial Position As at Dec 31, ASSETS 2019 2018 Current assets Cash Account receivable Inventories Total current assets Equipment Accumulated depreciation TOTAL ASSETS $ 22,950 $ 11,250 45,200 57,700 76,500 49,000 144,650 117,950 127,000 62,000 (25,200) (35,000) $ 246,450 $ 144,950 LIABILITIES & SHAREHOLDERS' EQUITIES Current liabilities Account payable $ 38,600 $ 36,200 Income tax payable 1,200 3,800 Dividend payable 3,200 5,200 Total current liabilities 43,000 45,200 Loan payable 43,000 36,000 Common shares 50,000 40,000 Retained earnings 110,450 23,750 TOTAL LIABILITIES & SHAREHOLDERS' EQUITIES $ 246,450 $ 144,950 Table 2-Statement of Income Table 2-2 Alternative Statement of Income ABC Corporation Statement of Income For the year ended Dec 31, 2019 ABC Corporation Statement of Income For the year ended Dec 31, 2019 $ 483,900 305,000 178.900 Sales revenue Variable costs Contribution margin Fixed costs $ 483,900 314,535 169,365 75,415 Sales revenue Cost of goods sold Gross profit Operating Expense Wages expense Rent expense Utilities expense Depreciation expense Income from Operation Interest expense Income before income tax Income tax expense Net income Total common shares EPS 53,900 13,250 7,600 10,200 93,950 2,970 90,980 93,950 2,970 90,980 Income from Operation Interest expense Income before income tax Income tax expense Net income Total common shares EPS 4,980 $ 86,000 100,000 $0.86 4,980 $ 86,000 100,000 $0.86 Table -3 Statement of Cash Flow ABC Corporation Statement of Cash Flow For the year ended Dec 31, 2019 Cash flow from operating activities: Net Income Add: depreciation expense Add: decrease in account receivable Less: increase in inventory Add: increase in account payable Less: Decrease in income tax payable Net cash provided(used) by operation $ 86,000 10,200 12,500 (27,500) 2,400 (2,600) $ 81,000 Cash flows from investing activities: Less: Purchase of equipment Net cash provided(used) in investing activities (81,100) $ (81,100) Cash flows from financing activities: Less: payment of dividends Add: Proceeds of borrowing - loan payable Add: Proceeds from issuing common stocks Net cash provided (used) by financing activities Total net change in cash (5,200) 7,000 10,000 $ 11,800 $ 11,700 Ending cash Opening cash Net change in Cash $ 22,950 11,250 $ 11,700 Table 4 - Industry Statistics Baby Furniture industry Average Statistics Current ratio 2.5 Quick ratio 1.2 Inventory turn-over 5.5 Total assets turn-over 1.15 Profit margin 10% Return on assets 20% 15% Return on equity Total debt to equity P/E ratio 0.40 14 D.O.L. 5 D.F.L 2.5 Table 5- Major baby furniture maker comparison ABC Corp Mike's Furniture Baby Paradise Annual growth in EPS 25% 10% 8% ROE 16% 18% 15% ROA 18% 17% 13% 36% 68% 25% ? $70.5 $24.25 Debt to total asset Market Value Book Value Dividend Yield $1.57 $50.25 $19.5 10% 2.18% 5.26% P/E ratio ? 24.1 14.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started