Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question : What problems do you see arising based on DRLinks perspective as the potential buyer? ACCT 3310 GROUP PROJECT - CASE ANALYSIS DRLink System

Question :

What problems do you see arising based on DRLinks perspective as the potential buyer?

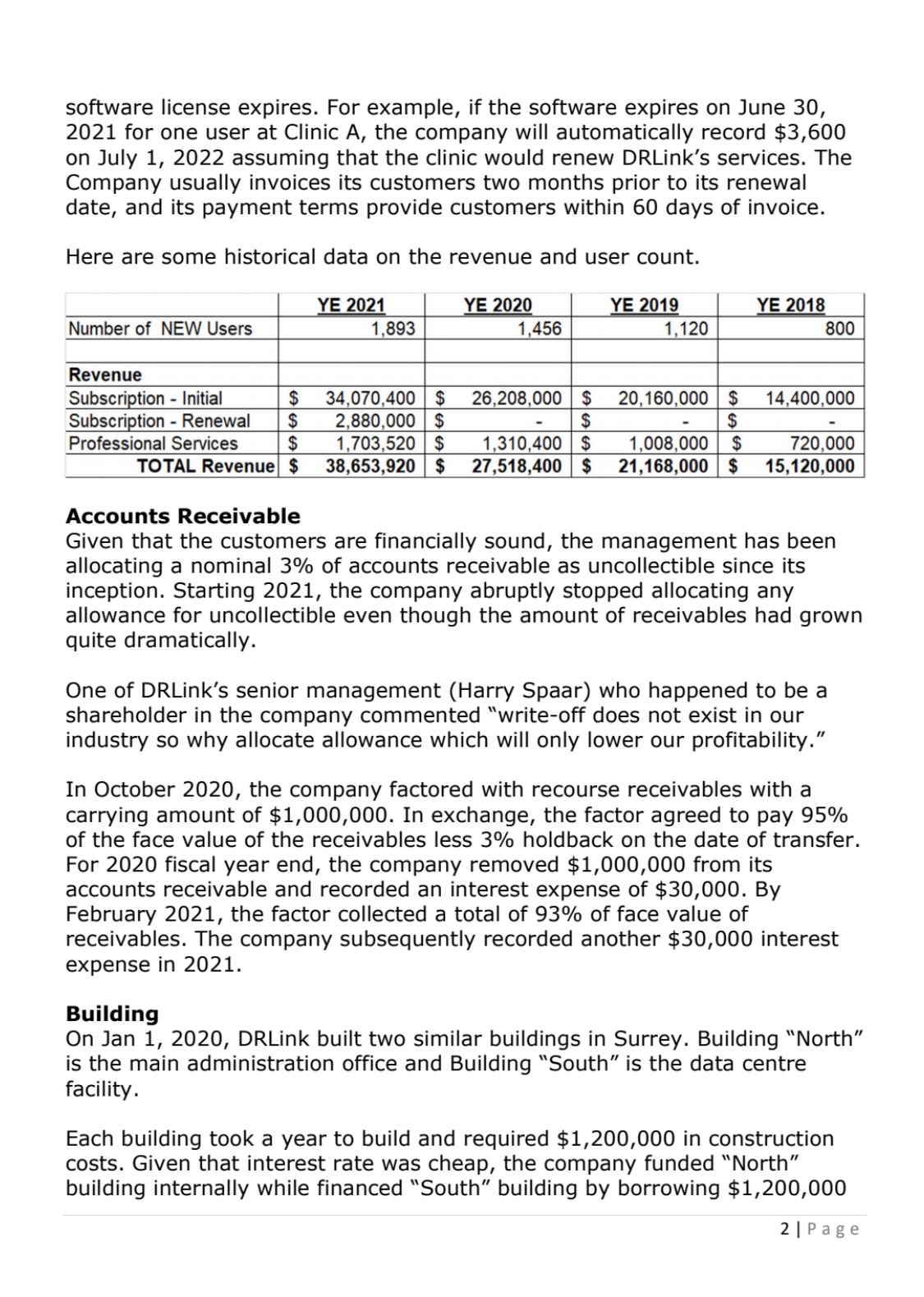

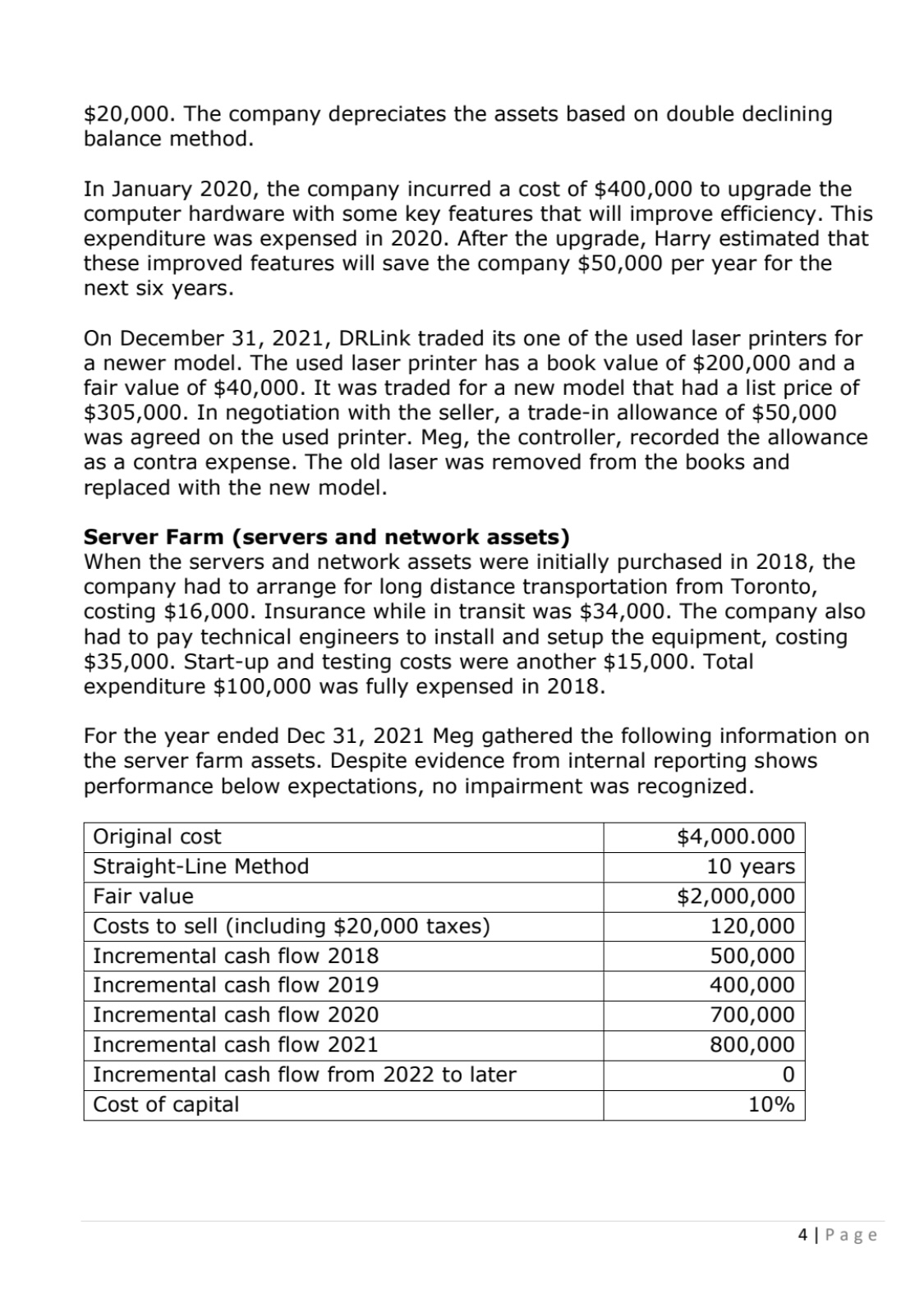

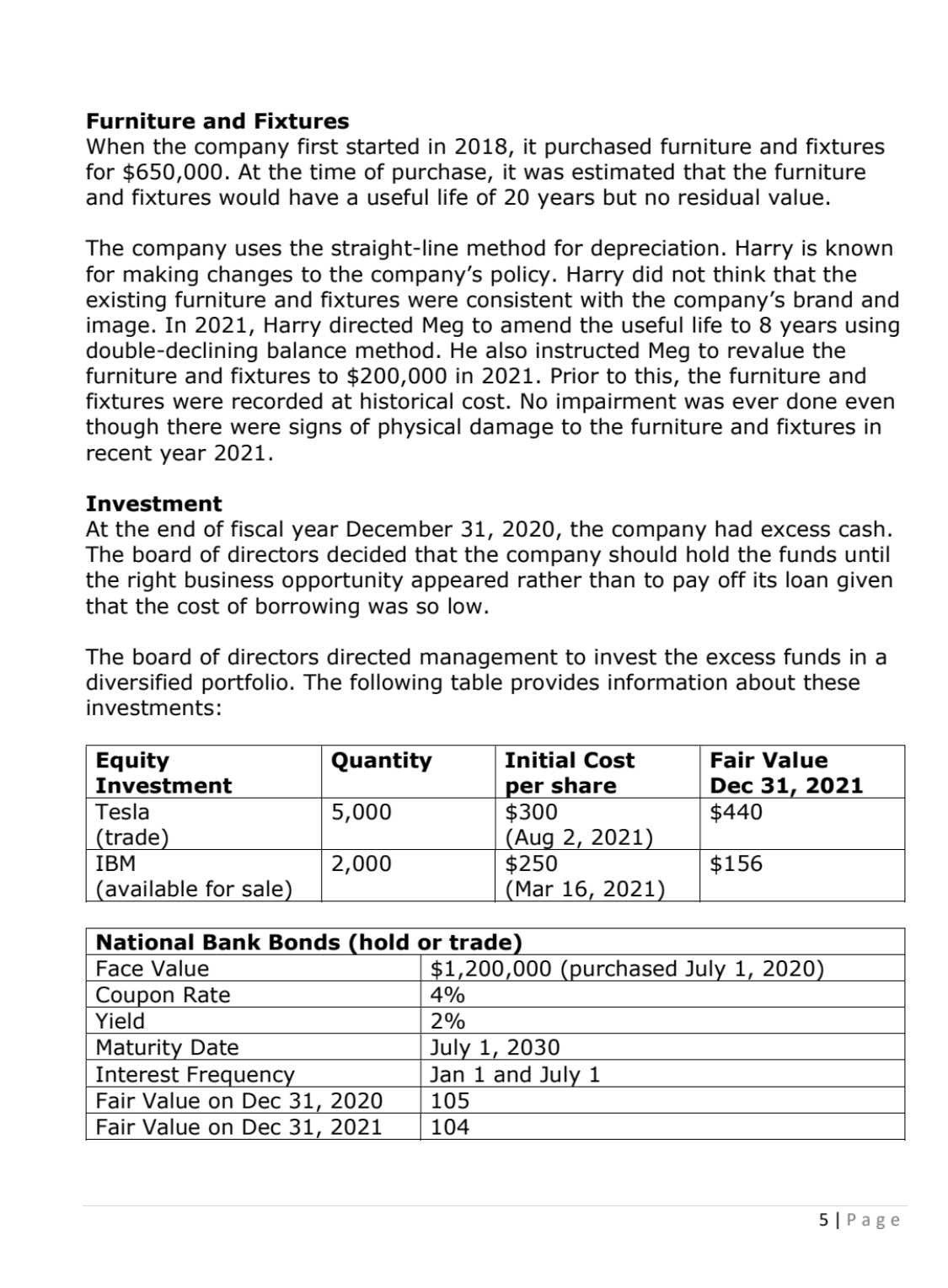

ACCT 3310 GROUP PROJECT - CASE ANALYSIS DRLink System Inc. ("DRLink") is a privately held company specializing in customized medical software to manage patient records for the medical offices, medical laboratories and hospitals across Canada. DRLink users are healthcare administrators and professionals (lab technicians, nurses and doctors) across Canada. The company has been operating from its headquarters in the Lower Mainland of BC since Jan 1, 2018. The company's fiscal year ended December 31, 2021. For the first time since its inception, an external auditor had been appointed to conduct an audit prior to issuing the financial statements planned for April 15, 2022. Revenue The Company's revenue stems from two sources: i) subscription and support, and ii) professional services. Subscription and support revenues: include subscription fees from customers accessing the Company's enterprise cloud computing services, software license renewals, and support revenue from the sales of support and updates beyond the basic subscription fees. Professional service revenues: include professional and advisory services for process mapping, training and product customization. On average, the professional service revenues are 15% of the subscription and support revenues for the first year. Since its inception, DRLink would deliver 70% of the services in the same period as the same of sale (i.e. same year when the contract is signed). The remaining 30% of the services would be delivered in the following year. Given that all the services would be delivered eventually and that the contract is non-cancellable and refundable, the management did not see the need to record revenues at different deliverables. As such, the company has been recording revenue as a single transaction at the point of sale. The price of DRLink system solution is $21,600 per user over a 3-year period for subscription and support. So if the company signs a contract with a customer on September 15, 2021, the company would record $21,600 on that date. At the end of 3 years, there is an annual renewal fee for $3,600 per user. The amount is automatically and fully recognized at the time when the software license expires. For example, if the software expires on June 30, 2021 for one user at Clinic A, the company will automatically record $3,600 on July 1, 2022 assuming that the clinic would renew DRLink's services. The Company usually invoices its customers two months prior to its renewal date, and its payment terms provide customers within 60 days of invoice. Here are some historical data on the revenue and user count. Accounts Receivable Given that the customers are financially sound, the management has been allocating a nominal 3% of accounts receivable as uncollectible since its inception. Starting 2021, the company abruptly stopped allocating any allowance for uncollectible even though the amount of receivables had grown quite dramatically. One of DRLink's senior management (Harry Spaar) who happened to be a shareholder in the company commented "write-off does not exist in our industry so why allocate allowance which will only lower our profitability." In October 2020, the company factored with recourse receivables with a carrying amount of $1,000,000. In exchange, the factor agreed to pay 95% of the face value of the receivables less 3% holdback on the date of transfer. For 2020 fiscal year end, the company removed $1,000,000 from its accounts receivable and recorded an interest expense of $30,000. By February 2021, the factor collected a total of 93% of face value of receivables. The company subsequently recorded another $30,000 interest expense in 2021. Building On Jan 1, 2020, DRLink built two similar buildings in Surrey. Building "North" is the main administration office and Building "South" is the data centre facility. Each building took a year to build and required $1,200,000 in construction costs. Given that interest rate was cheap, the company funded "North" building internally while financed "South" building by borrowing $1,200,000 2) P a g e evenly over the year (i.e. zero at the beginning of the year and increasing to $1,200,000 by the end of the year in 2020.) The interest rate on the loan is 6%. Both buildings were completed by December 31, 2020, and were ready for occupancy immediately. However, due to personal reasons from the senior management, the staff did not move to the two buildings until March 31, 2021. The Controller (Meg Nutt) capitalized the construction costs including borrowing costs for the 15-month period from Jan 1, 2020 to March 31, 2021. The buildings are estimated to have a useful life of 20 years with no residual value. The company uses the straight-line method for depreciation. The two buildings sit on a vacant farmland which belongs to the City of Surrey. The company signed a lease with the Surrey Municipality at an affordable monthly lease rate of $10,000 for 30 years. As part of the lease agreement, the municipality requires DRLink to restore the site to conditions similar to the state prior to the construction (i.e. farmland). The company estimates that it will need to incur $120,000 to dismantle, remove and restore the site at the end of the 30-year lease. No provision was made for this item. Both buildings have been recorded at historical cost. Computer Hardware and Office Equipment When the company purchased computer hardware and office equipment, the invoice was $880,000. Due to Harry's skilful negotiation skill, it was able to reduce the price to $800,000. The seller (vendor) provided a further 1% discount if the entire amount was paid within 30 days. The company paid on the 29th day. DRLink recorded the asset as gross amount while the discount received was recorded as a contra expense. To encourage the company to purchase the latest model of printer/copier, the vendor gave Harry a $50,000 discount voucher on its next purchase of a similar machine. The company paid a total of $60,000 for transportation, installation and testing. During the initial installation setup training, one of the workers accidentally damaged the machine and it costs $25,000 to restore to its original condition. Also, during the initial installation and setup, part of the office including the software engineer department had to be shut down. According to Harry, the loss profit from the shutdown was $150,000. All of these items were expensed in 2018 when the purchase was made initially. At the time of purchase, it was estimated that the computer hardware and office equipment would have a useful life of 10 years with a residual value of 3) P a g e these improved features will save the company $50,000 per year for the next six years. On December 31, 2021, DRLink traded its one of the used laser printers for a newer model. The used laser printer has a book value of $200,000 and a fair value of $40,000. It was traded for a new model that had a list price of $305,000. In negotiation with the seller, a trade-in allowance of $50,000 was agreed on the used printer. Meg, the controller, recorded the allowance as a contra expense. The old laser was removed from the books and replaced with the new model. Server Farm (servers and network assets) When the servers and network assets were initially purchased in 2018, the company had to arrange for long distance transportation from Toronto, costing $16,000. Insurance while in transit was $34,000. The company also had to pay technical engineers to install and setup the equipment, costing $35,000. Start-up and testing costs were another $15,000. Total expenditure $100,000 was fully expensed in 2018 . For the year ended Dec 31, 2021 Meg gathered the following information on the server farm assets. Despite evidence from internal reporting shows performance below expectations, no impairment was recognized. Furniture and Fixtures When the company first started in 2018, it purchased furniture and fixtures for $650,000. At the time of purchase, it was estimated that the furniture and fixtures would have a useful life of 20 years but no residual value. The company uses the straight-line method for depreciation. Harry is known for making changes to the company's policy. Harry did not think that the existing furniture and fixtures were consistent with the company's brand and image. In 2021, Harry directed Meg to amend the useful life to 8 years using double-declining balance method. He also instructed Meg to revalue the furniture and fixtures to $200,000 in 2021 . Prior to this, the furniture and fixtures were recorded at historical cost. No impairment was ever done even though there were signs of physical damage to the furniture and fixtures in recent year 2021. Investment At the end of fiscal year December 31, 2020, the company had excess cash. The board of directors decided that the company should hold the funds until the right business opportunity appeared rather than to pay off its loan given that the cost of borrowing was so low. The board of directors directed management to invest the excess funds in a diversified portfolio. The following table provides information about these investments: Government Grant The Canadian government is actively promoting eHealth solutions for both patients and medical professionals across Canada. In 2018, the federal government provided a forgivable loan of $500,000 to assist DRLink with the purchase of server farm which was supposed to have a useful life of 10 years. When the funding was received in 2018, the company treated it as a revenue by debiting cash and crediting other income. The loan would be forgiven over five years on the condition that the company employs at least four engineering graduates per year assisting with product development. The company only managed to meet this criterion from 2018 to 2020. Conclusion At year end December 31, 2021, DRLink has decided to put the business up for sale in order to capitalize on the tech boom in the medical healthcare industry. In early Jan 2022, Greystone Corporation ("Greystone"), a private equity firm, expressed interest in acquiring DRLink. Before proceeding with a full review and due diligence on DRLink, Greystone hired your auditing company to conduct some initial reviews on DRLink's financial statements as shown in Appendix I. Greystone's accounting policies are based on the IFRS frameworkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started