Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: When I find the the allowance for impairment of AR and the expected credit loss for the FY 2021, should I use the balance

Question: When I find the the allowance for impairment of AR and the expected credit loss for the FY 2021, should I use the balance of AR on B/S in FY 2020 or 2021?

Thank you.

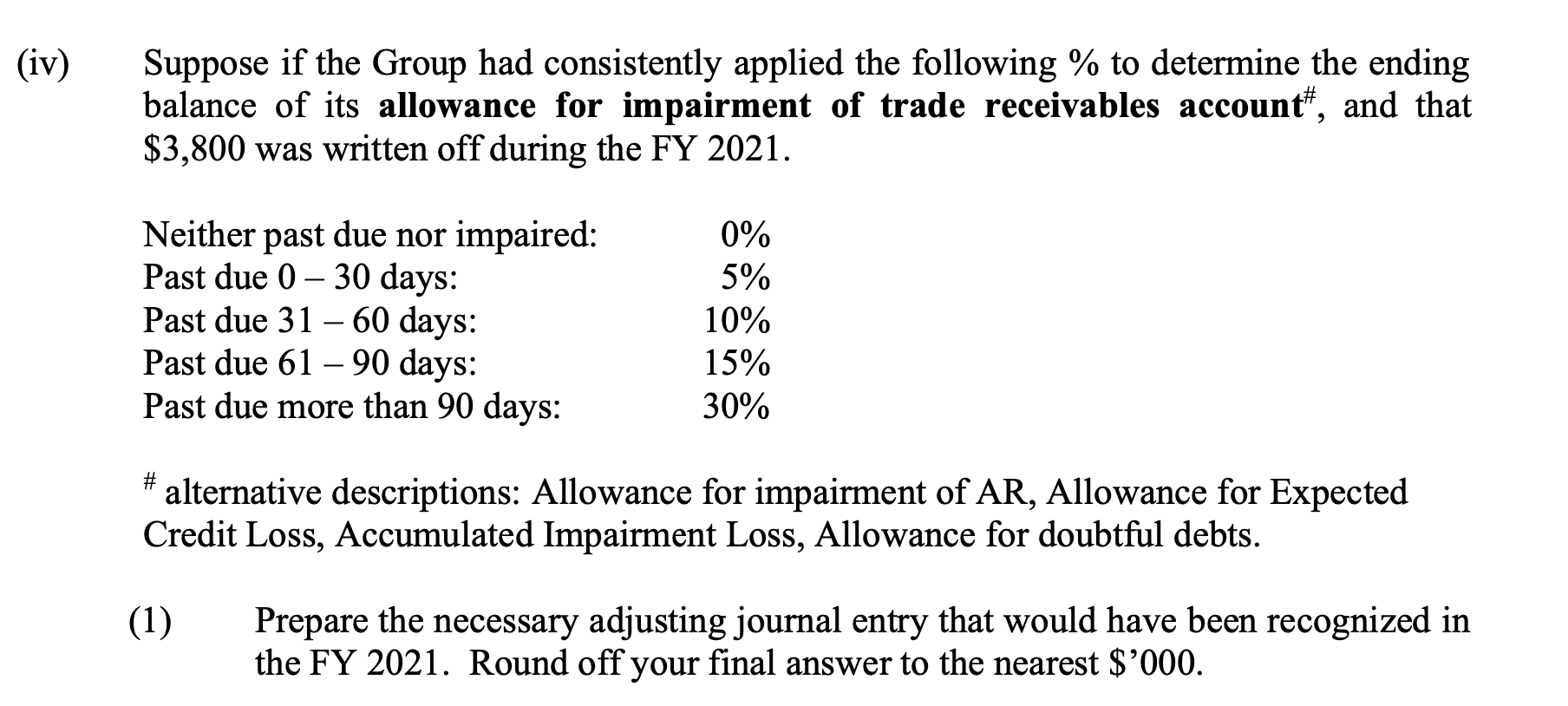

Suppose if the Group had consistently applied the following % to determine the ending balance of its allowance for impairment of trade receivables account #, and that $3,800 was written off during the FY 2021 . # alternative descriptions: Allowance for impairment of AR, Allowance for Expected Credit Loss, Accumulated Impairment Loss, Allowance for doubtful debts. (1) Prepare the necessary adjusting journal entry that would have been recognized in the FY 2021. Round off your final answer to the nearest $000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started