Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: With a dramatic downturn in profitability in 2005 , the advisory board for California Choppers (CC), with the concurrence of the owner, Arlen Doakes,

Question:

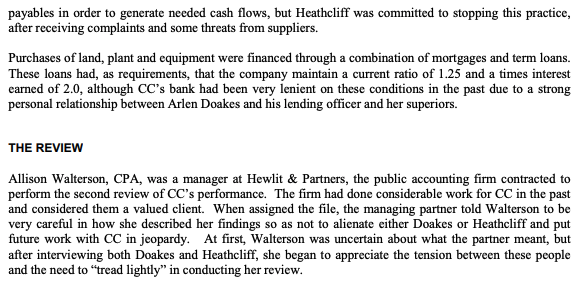

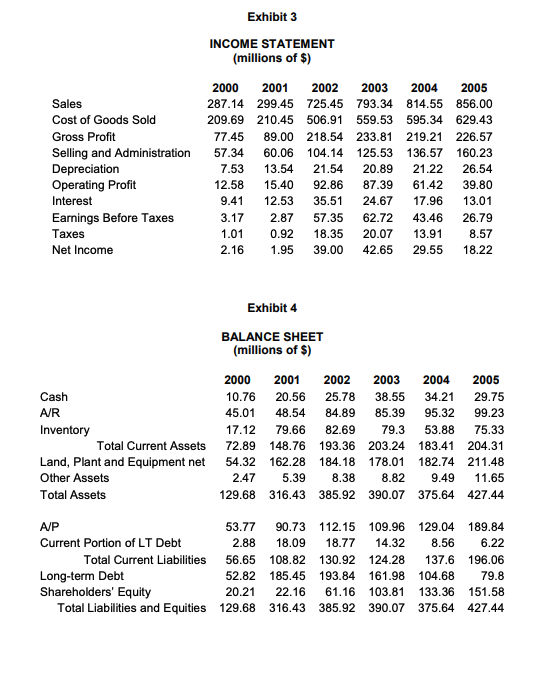

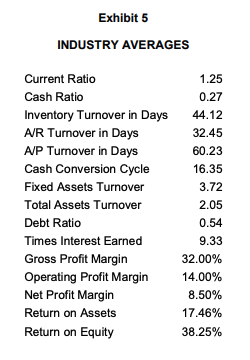

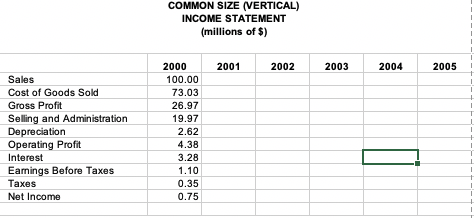

With a dramatic downturn in profitability in 2005 , the advisory board for California Choppers (CC), with the concurrence of the owner, Arlen Doakes, agreed to hire another consulting group to review operations and make suggestions for getting the company "back on track." Secretly, Doakes hoped this review would give him the ammunition he needed to terminate the current chief executive officer (CEO), Jane Heathcliff, whose cautious manner, Doakes felt had been a drag on company expansion. Among the financial conditions requiring analysis were liquidity, asset management, long-term debt-paying ability and profitability (see Exhibits 1 and 2). COMPANY BACKGROUND CC was a manufacturer of large, high-end motorcycles that catered primarily to older, wealthier motorcycle enthusiasts who were trying to regain some of the excitement of their youth. The company had also acquired some notoriety amongst teenagers because of the sponsorship of a TV show by the same name. The TV show demonstrated the production of custom-made motorcycles, which was how the company got its start in the late 1960s, under its current owner, Arlen Doakes. Doakes's daughter, Amber, also starred in the show, serving as the lead welder, mechanic and designer. Critics had given the show high ratings for Doakes's humorous and forgetful manner, while his daughter played the "straight woman," correcting all her father's mistakes and generally getting the job done each week. The custom choppers produced were sold through an online auction service, and the proceeds were denoted to motorcycle safety programs in a number of western states. The company also generated modest revenues by licensing its logo for t-shirts and posters. Up to 2000, CC's sales were largely in the states of California, Arizona, Nevada, New Mexico, Oregon and Washington. In 2001, the company undertook a major expansion in order to develop the remainder of the U.S. market with hopes of possibly growing overseas. The decision to expand was based on a review the company had had done of its operations, which resulted in a scathing evaluation of its performance. Not only was the company not effectively developing its markets, its production processes were found to be inefficient, its operating costs were excessive, and its use of financial leverage was far too high. Doakes had strong technical knowledge of motorcycles, but he did not have the business sense and discipline needed to operate what had become a major corporation. He also enjoyed a very luxurious lifestyle, recycling little of his profits back into the company prior to 2000 . A NEW CHIEF EXECUTIVE OFFICER In 2001, Doakes agreed to step down as CEO and hired Jane Heathcliff, P. Eng., as his replacement. Heathcliff had over 20 years of engineering and management experience at another major domestic motorcycle manufacturer, and she was highly respected by her colleagues. Also, based on advice from the consultants, Doakes organized a corporate advisory board made up of experienced industry professionals with whom he had strong personal relationships. This was not, however, a board of directors as Doakes continued to own 100 per cent of the company. The newly formed advisory board was expected to provide valuable input for Heathcliff. Although not indicated in the report, the consultants also strongly felt that, as the new CEO, Heathcliff would need the support of the board to overcome Doakes's aggressive and allknowing manner. Doakes assumed the role of chairman of the advisory board and co-head of product development, along with his daughter Amber Doakes. Both father and daughter would continue to do the TV show. Heathcliff immediately began developing markets in the rest of the United States by encouraging existing motorcycle dealerships to carry CC's products. She also invested heavily in new factory equipment to accommodate the expected higher sales volumes and to increase factory efficiency. Initially, the new CEO was very careful not to incur unnecessary overhead costs and, instead, focused on debt reduction. In 2004 and 2005, Heathcliff did undertake the construction of a new corporate headquarters building, along with a new product development facility, which was to be managed by Amber Doakes under the supervision of her father. The advisory board concurred with this decision after heavy lobbying by Arlen Doakes; they also advised Heathcliff to begin expansion into the Canadian and European markets, despite her recommendation that CC complete its expansion in the U.S. market before undertaking expensive development work abroad. Prior to 2000, CC's performance was poor, but its non-unionized workforce continued to receive aboveaverage wage rates. Arlen Doakes had great empathy for these people, having started out as a line worker at an auto manufacturing facility himself. Many of the supervisors were people who had been with him since the company began, and he was committed to treating them well. Also, he had refused repeated requests by his production staff to outsource the production of parts to lower-wages factories in Mexico and Asia. Arlen Doakes was truly a "flag waving" American, and he felt strongly that a California Chopper should be "Made in the U.S.A." In late 2003, CC gave its workforce a large increase in wages and benefits, and Arlen Doakes made a public announcement that the company must share its new-found success with its workforce. FINANCIAL INFORMATION CC's financial statements for the period of 2000 through 2005 can be found in Exhibits 3 and 4 . Industry averages are found in Exhibit 5. CC offered its customers industry-average credit terms of net 30 , but varied from that regularly in order to provide encouragement to new dealers to carry CC's products. CC also received credit terms of net 60 on average for its purchases of parts and supplies. It the past, the company had regularly stretched its payables in order to generate needed cash flows, but Heathcliff was committed to stopping this practice, after receiving complaints and some threats from suppliers. Purchases of land, plant and equipment were financed through a combination of mortgages and term loans. These loans had, as requirements, that the company maintain a current ratio of 1.25 and a times interest earned of 2.0, although CC's bank had been very lenient on these conditions in the past due to a strong personal relationship between Arlen Doakes and his lending officer and her superiors. THE REVIEW Allison Walterson, CPA, was a manager at Hewlit \& Partners, the public accounting firm contracted to perform the second review of CC's performance. The firm had done considerable work for CC in the past and considered them a valued client. When assigned the file, the managing partner told Walterson to be very careful in how she described her findings so as not to alienate either Doakes or Heathcliff and put future work with CC in jeopardy. At first, Walterson was uncertain about what the partner meant, but after interviewing both Doakes and Heathcliff, she began to appreciate the tension between these people and the need to "tread lightly" in conducting her review. Exhibit 3 INCOME STATEMENT Imilliame net Exhibit 5 INDUSTRY AVERAGES CurrentRatioCashRatioInventoryTurnoverinDaysAVRTurnoverinDaysAVPTurnoverinDaysCashConversionCycleFixedAssetsTurnoverTotalAssetsTurnoverDebtRatioTimesInterestEarnedGrossProfitMarginOperatingProfitMarginNetProfitMarginReturnonAssetsReturnonEquity1.250.2744.1232.4560.2316.353.722.050.549.3332.00%14.00%8.50%17.46%38.25% COMMON SIZE (VERTICAL) INCOME STATEMENT (millions of \$) With a dramatic downturn in profitability in 2005 , the advisory board for California Choppers (CC), with the concurrence of the owner, Arlen Doakes, agreed to hire another consulting group to review operations and make suggestions for getting the company "back on track." Secretly, Doakes hoped this review would give him the ammunition he needed to terminate the current chief executive officer (CEO), Jane Heathcliff, whose cautious manner, Doakes felt had been a drag on company expansion. Among the financial conditions requiring analysis were liquidity, asset management, long-term debt-paying ability and profitability (see Exhibits 1 and 2). COMPANY BACKGROUND CC was a manufacturer of large, high-end motorcycles that catered primarily to older, wealthier motorcycle enthusiasts who were trying to regain some of the excitement of their youth. The company had also acquired some notoriety amongst teenagers because of the sponsorship of a TV show by the same name. The TV show demonstrated the production of custom-made motorcycles, which was how the company got its start in the late 1960s, under its current owner, Arlen Doakes. Doakes's daughter, Amber, also starred in the show, serving as the lead welder, mechanic and designer. Critics had given the show high ratings for Doakes's humorous and forgetful manner, while his daughter played the "straight woman," correcting all her father's mistakes and generally getting the job done each week. The custom choppers produced were sold through an online auction service, and the proceeds were denoted to motorcycle safety programs in a number of western states. The company also generated modest revenues by licensing its logo for t-shirts and posters. Up to 2000, CC's sales were largely in the states of California, Arizona, Nevada, New Mexico, Oregon and Washington. In 2001, the company undertook a major expansion in order to develop the remainder of the U.S. market with hopes of possibly growing overseas. The decision to expand was based on a review the company had had done of its operations, which resulted in a scathing evaluation of its performance. Not only was the company not effectively developing its markets, its production processes were found to be inefficient, its operating costs were excessive, and its use of financial leverage was far too high. Doakes had strong technical knowledge of motorcycles, but he did not have the business sense and discipline needed to operate what had become a major corporation. He also enjoyed a very luxurious lifestyle, recycling little of his profits back into the company prior to 2000 . A NEW CHIEF EXECUTIVE OFFICER In 2001, Doakes agreed to step down as CEO and hired Jane Heathcliff, P. Eng., as his replacement. Heathcliff had over 20 years of engineering and management experience at another major domestic motorcycle manufacturer, and she was highly respected by her colleagues. Also, based on advice from the consultants, Doakes organized a corporate advisory board made up of experienced industry professionals with whom he had strong personal relationships. This was not, however, a board of directors as Doakes continued to own 100 per cent of the company. The newly formed advisory board was expected to provide valuable input for Heathcliff. Although not indicated in the report, the consultants also strongly felt that, as the new CEO, Heathcliff would need the support of the board to overcome Doakes's aggressive and allknowing manner. Doakes assumed the role of chairman of the advisory board and co-head of product development, along with his daughter Amber Doakes. Both father and daughter would continue to do the TV show. Heathcliff immediately began developing markets in the rest of the United States by encouraging existing motorcycle dealerships to carry CC's products. She also invested heavily in new factory equipment to accommodate the expected higher sales volumes and to increase factory efficiency. Initially, the new CEO was very careful not to incur unnecessary overhead costs and, instead, focused on debt reduction. In 2004 and 2005, Heathcliff did undertake the construction of a new corporate headquarters building, along with a new product development facility, which was to be managed by Amber Doakes under the supervision of her father. The advisory board concurred with this decision after heavy lobbying by Arlen Doakes; they also advised Heathcliff to begin expansion into the Canadian and European markets, despite her recommendation that CC complete its expansion in the U.S. market before undertaking expensive development work abroad. Prior to 2000, CC's performance was poor, but its non-unionized workforce continued to receive aboveaverage wage rates. Arlen Doakes had great empathy for these people, having started out as a line worker at an auto manufacturing facility himself. Many of the supervisors were people who had been with him since the company began, and he was committed to treating them well. Also, he had refused repeated requests by his production staff to outsource the production of parts to lower-wages factories in Mexico and Asia. Arlen Doakes was truly a "flag waving" American, and he felt strongly that a California Chopper should be "Made in the U.S.A." In late 2003, CC gave its workforce a large increase in wages and benefits, and Arlen Doakes made a public announcement that the company must share its new-found success with its workforce. FINANCIAL INFORMATION CC's financial statements for the period of 2000 through 2005 can be found in Exhibits 3 and 4 . Industry averages are found in Exhibit 5. CC offered its customers industry-average credit terms of net 30 , but varied from that regularly in order to provide encouragement to new dealers to carry CC's products. CC also received credit terms of net 60 on average for its purchases of parts and supplies. It the past, the company had regularly stretched its payables in order to generate needed cash flows, but Heathcliff was committed to stopping this practice, after receiving complaints and some threats from suppliers. Purchases of land, plant and equipment were financed through a combination of mortgages and term loans. These loans had, as requirements, that the company maintain a current ratio of 1.25 and a times interest earned of 2.0, although CC's bank had been very lenient on these conditions in the past due to a strong personal relationship between Arlen Doakes and his lending officer and her superiors. THE REVIEW Allison Walterson, CPA, was a manager at Hewlit \& Partners, the public accounting firm contracted to perform the second review of CC's performance. The firm had done considerable work for CC in the past and considered them a valued client. When assigned the file, the managing partner told Walterson to be very careful in how she described her findings so as not to alienate either Doakes or Heathcliff and put future work with CC in jeopardy. At first, Walterson was uncertain about what the partner meant, but after interviewing both Doakes and Heathcliff, she began to appreciate the tension between these people and the need to "tread lightly" in conducting her review. Exhibit 3 INCOME STATEMENT Imilliame net Exhibit 5 INDUSTRY AVERAGES CurrentRatioCashRatioInventoryTurnoverinDaysAVRTurnoverinDaysAVPTurnoverinDaysCashConversionCycleFixedAssetsTurnoverTotalAssetsTurnoverDebtRatioTimesInterestEarnedGrossProfitMarginOperatingProfitMarginNetProfitMarginReturnonAssetsReturnonEquity1.250.2744.1232.4560.2316.353.722.050.549.3332.00%14.00%8.50%17.46%38.25% COMMON SIZE (VERTICAL) INCOME STATEMENT (millions of \$)

With a dramatic downturn in profitability in 2005 , the advisory board for California Choppers (CC), with the concurrence of the owner, Arlen Doakes, agreed to hire another consulting group to review operations and make suggestions for getting the company "back on track." Secretly, Doakes hoped this review would give him the ammunition he needed to terminate the current chief executive officer (CEO), Jane Heathcliff, whose cautious manner, Doakes felt had been a drag on company expansion. Among the financial conditions requiring analysis were liquidity, asset management, long-term debt-paying ability and profitability (see Exhibits 1 and 2). COMPANY BACKGROUND CC was a manufacturer of large, high-end motorcycles that catered primarily to older, wealthier motorcycle enthusiasts who were trying to regain some of the excitement of their youth. The company had also acquired some notoriety amongst teenagers because of the sponsorship of a TV show by the same name. The TV show demonstrated the production of custom-made motorcycles, which was how the company got its start in the late 1960s, under its current owner, Arlen Doakes. Doakes's daughter, Amber, also starred in the show, serving as the lead welder, mechanic and designer. Critics had given the show high ratings for Doakes's humorous and forgetful manner, while his daughter played the "straight woman," correcting all her father's mistakes and generally getting the job done each week. The custom choppers produced were sold through an online auction service, and the proceeds were denoted to motorcycle safety programs in a number of western states. The company also generated modest revenues by licensing its logo for t-shirts and posters. Up to 2000, CC's sales were largely in the states of California, Arizona, Nevada, New Mexico, Oregon and Washington. In 2001, the company undertook a major expansion in order to develop the remainder of the U.S. market with hopes of possibly growing overseas. The decision to expand was based on a review the company had had done of its operations, which resulted in a scathing evaluation of its performance. Not only was the company not effectively developing its markets, its production processes were found to be inefficient, its operating costs were excessive, and its use of financial leverage was far too high. Doakes had strong technical knowledge of motorcycles, but he did not have the business sense and discipline needed to operate what had become a major corporation. He also enjoyed a very luxurious lifestyle, recycling little of his profits back into the company prior to 2000 . A NEW CHIEF EXECUTIVE OFFICER In 2001, Doakes agreed to step down as CEO and hired Jane Heathcliff, P. Eng., as his replacement. Heathcliff had over 20 years of engineering and management experience at another major domestic motorcycle manufacturer, and she was highly respected by her colleagues. Also, based on advice from the consultants, Doakes organized a corporate advisory board made up of experienced industry professionals with whom he had strong personal relationships. This was not, however, a board of directors as Doakes continued to own 100 per cent of the company. The newly formed advisory board was expected to provide valuable input for Heathcliff. Although not indicated in the report, the consultants also strongly felt that, as the new CEO, Heathcliff would need the support of the board to overcome Doakes's aggressive and allknowing manner. Doakes assumed the role of chairman of the advisory board and co-head of product development, along with his daughter Amber Doakes. Both father and daughter would continue to do the TV show. Heathcliff immediately began developing markets in the rest of the United States by encouraging existing motorcycle dealerships to carry CC's products. She also invested heavily in new factory equipment to accommodate the expected higher sales volumes and to increase factory efficiency. Initially, the new CEO was very careful not to incur unnecessary overhead costs and, instead, focused on debt reduction. In 2004 and 2005, Heathcliff did undertake the construction of a new corporate headquarters building, along with a new product development facility, which was to be managed by Amber Doakes under the supervision of her father. The advisory board concurred with this decision after heavy lobbying by Arlen Doakes; they also advised Heathcliff to begin expansion into the Canadian and European markets, despite her recommendation that CC complete its expansion in the U.S. market before undertaking expensive development work abroad. Prior to 2000, CC's performance was poor, but its non-unionized workforce continued to receive aboveaverage wage rates. Arlen Doakes had great empathy for these people, having started out as a line worker at an auto manufacturing facility himself. Many of the supervisors were people who had been with him since the company began, and he was committed to treating them well. Also, he had refused repeated requests by his production staff to outsource the production of parts to lower-wages factories in Mexico and Asia. Arlen Doakes was truly a "flag waving" American, and he felt strongly that a California Chopper should be "Made in the U.S.A." In late 2003, CC gave its workforce a large increase in wages and benefits, and Arlen Doakes made a public announcement that the company must share its new-found success with its workforce. FINANCIAL INFORMATION CC's financial statements for the period of 2000 through 2005 can be found in Exhibits 3 and 4 . Industry averages are found in Exhibit 5. CC offered its customers industry-average credit terms of net 30 , but varied from that regularly in order to provide encouragement to new dealers to carry CC's products. CC also received credit terms of net 60 on average for its purchases of parts and supplies. It the past, the company had regularly stretched its payables in order to generate needed cash flows, but Heathcliff was committed to stopping this practice, after receiving complaints and some threats from suppliers. Purchases of land, plant and equipment were financed through a combination of mortgages and term loans. These loans had, as requirements, that the company maintain a current ratio of 1.25 and a times interest earned of 2.0, although CC's bank had been very lenient on these conditions in the past due to a strong personal relationship between Arlen Doakes and his lending officer and her superiors. THE REVIEW Allison Walterson, CPA, was a manager at Hewlit \& Partners, the public accounting firm contracted to perform the second review of CC's performance. The firm had done considerable work for CC in the past and considered them a valued client. When assigned the file, the managing partner told Walterson to be very careful in how she described her findings so as not to alienate either Doakes or Heathcliff and put future work with CC in jeopardy. At first, Walterson was uncertain about what the partner meant, but after interviewing both Doakes and Heathcliff, she began to appreciate the tension between these people and the need to "tread lightly" in conducting her review. Exhibit 3 INCOME STATEMENT Imilliame net Exhibit 5 INDUSTRY AVERAGES CurrentRatioCashRatioInventoryTurnoverinDaysAVRTurnoverinDaysAVPTurnoverinDaysCashConversionCycleFixedAssetsTurnoverTotalAssetsTurnoverDebtRatioTimesInterestEarnedGrossProfitMarginOperatingProfitMarginNetProfitMarginReturnonAssetsReturnonEquity1.250.2744.1232.4560.2316.353.722.050.549.3332.00%14.00%8.50%17.46%38.25% COMMON SIZE (VERTICAL) INCOME STATEMENT (millions of \$) With a dramatic downturn in profitability in 2005 , the advisory board for California Choppers (CC), with the concurrence of the owner, Arlen Doakes, agreed to hire another consulting group to review operations and make suggestions for getting the company "back on track." Secretly, Doakes hoped this review would give him the ammunition he needed to terminate the current chief executive officer (CEO), Jane Heathcliff, whose cautious manner, Doakes felt had been a drag on company expansion. Among the financial conditions requiring analysis were liquidity, asset management, long-term debt-paying ability and profitability (see Exhibits 1 and 2). COMPANY BACKGROUND CC was a manufacturer of large, high-end motorcycles that catered primarily to older, wealthier motorcycle enthusiasts who were trying to regain some of the excitement of their youth. The company had also acquired some notoriety amongst teenagers because of the sponsorship of a TV show by the same name. The TV show demonstrated the production of custom-made motorcycles, which was how the company got its start in the late 1960s, under its current owner, Arlen Doakes. Doakes's daughter, Amber, also starred in the show, serving as the lead welder, mechanic and designer. Critics had given the show high ratings for Doakes's humorous and forgetful manner, while his daughter played the "straight woman," correcting all her father's mistakes and generally getting the job done each week. The custom choppers produced were sold through an online auction service, and the proceeds were denoted to motorcycle safety programs in a number of western states. The company also generated modest revenues by licensing its logo for t-shirts and posters. Up to 2000, CC's sales were largely in the states of California, Arizona, Nevada, New Mexico, Oregon and Washington. In 2001, the company undertook a major expansion in order to develop the remainder of the U.S. market with hopes of possibly growing overseas. The decision to expand was based on a review the company had had done of its operations, which resulted in a scathing evaluation of its performance. Not only was the company not effectively developing its markets, its production processes were found to be inefficient, its operating costs were excessive, and its use of financial leverage was far too high. Doakes had strong technical knowledge of motorcycles, but he did not have the business sense and discipline needed to operate what had become a major corporation. He also enjoyed a very luxurious lifestyle, recycling little of his profits back into the company prior to 2000 . A NEW CHIEF EXECUTIVE OFFICER In 2001, Doakes agreed to step down as CEO and hired Jane Heathcliff, P. Eng., as his replacement. Heathcliff had over 20 years of engineering and management experience at another major domestic motorcycle manufacturer, and she was highly respected by her colleagues. Also, based on advice from the consultants, Doakes organized a corporate advisory board made up of experienced industry professionals with whom he had strong personal relationships. This was not, however, a board of directors as Doakes continued to own 100 per cent of the company. The newly formed advisory board was expected to provide valuable input for Heathcliff. Although not indicated in the report, the consultants also strongly felt that, as the new CEO, Heathcliff would need the support of the board to overcome Doakes's aggressive and allknowing manner. Doakes assumed the role of chairman of the advisory board and co-head of product development, along with his daughter Amber Doakes. Both father and daughter would continue to do the TV show. Heathcliff immediately began developing markets in the rest of the United States by encouraging existing motorcycle dealerships to carry CC's products. She also invested heavily in new factory equipment to accommodate the expected higher sales volumes and to increase factory efficiency. Initially, the new CEO was very careful not to incur unnecessary overhead costs and, instead, focused on debt reduction. In 2004 and 2005, Heathcliff did undertake the construction of a new corporate headquarters building, along with a new product development facility, which was to be managed by Amber Doakes under the supervision of her father. The advisory board concurred with this decision after heavy lobbying by Arlen Doakes; they also advised Heathcliff to begin expansion into the Canadian and European markets, despite her recommendation that CC complete its expansion in the U.S. market before undertaking expensive development work abroad. Prior to 2000, CC's performance was poor, but its non-unionized workforce continued to receive aboveaverage wage rates. Arlen Doakes had great empathy for these people, having started out as a line worker at an auto manufacturing facility himself. Many of the supervisors were people who had been with him since the company began, and he was committed to treating them well. Also, he had refused repeated requests by his production staff to outsource the production of parts to lower-wages factories in Mexico and Asia. Arlen Doakes was truly a "flag waving" American, and he felt strongly that a California Chopper should be "Made in the U.S.A." In late 2003, CC gave its workforce a large increase in wages and benefits, and Arlen Doakes made a public announcement that the company must share its new-found success with its workforce. FINANCIAL INFORMATION CC's financial statements for the period of 2000 through 2005 can be found in Exhibits 3 and 4 . Industry averages are found in Exhibit 5. CC offered its customers industry-average credit terms of net 30 , but varied from that regularly in order to provide encouragement to new dealers to carry CC's products. CC also received credit terms of net 60 on average for its purchases of parts and supplies. It the past, the company had regularly stretched its payables in order to generate needed cash flows, but Heathcliff was committed to stopping this practice, after receiving complaints and some threats from suppliers. Purchases of land, plant and equipment were financed through a combination of mortgages and term loans. These loans had, as requirements, that the company maintain a current ratio of 1.25 and a times interest earned of 2.0, although CC's bank had been very lenient on these conditions in the past due to a strong personal relationship between Arlen Doakes and his lending officer and her superiors. THE REVIEW Allison Walterson, CPA, was a manager at Hewlit \& Partners, the public accounting firm contracted to perform the second review of CC's performance. The firm had done considerable work for CC in the past and considered them a valued client. When assigned the file, the managing partner told Walterson to be very careful in how she described her findings so as not to alienate either Doakes or Heathcliff and put future work with CC in jeopardy. At first, Walterson was uncertain about what the partner meant, but after interviewing both Doakes and Heathcliff, she began to appreciate the tension between these people and the need to "tread lightly" in conducting her review. Exhibit 3 INCOME STATEMENT Imilliame net Exhibit 5 INDUSTRY AVERAGES CurrentRatioCashRatioInventoryTurnoverinDaysAVRTurnoverinDaysAVPTurnoverinDaysCashConversionCycleFixedAssetsTurnoverTotalAssetsTurnoverDebtRatioTimesInterestEarnedGrossProfitMarginOperatingProfitMarginNetProfitMarginReturnonAssetsReturnonEquity1.250.2744.1232.4560.2316.353.722.050.549.3332.00%14.00%8.50%17.46%38.25% COMMON SIZE (VERTICAL) INCOME STATEMENT (millions of \$) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started