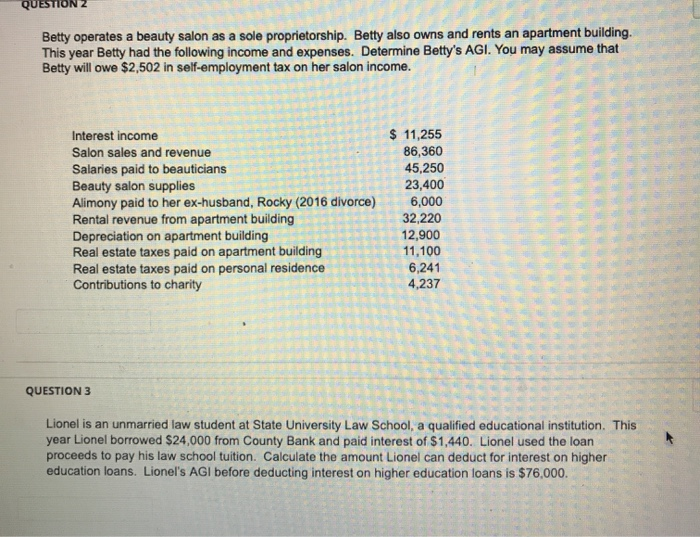

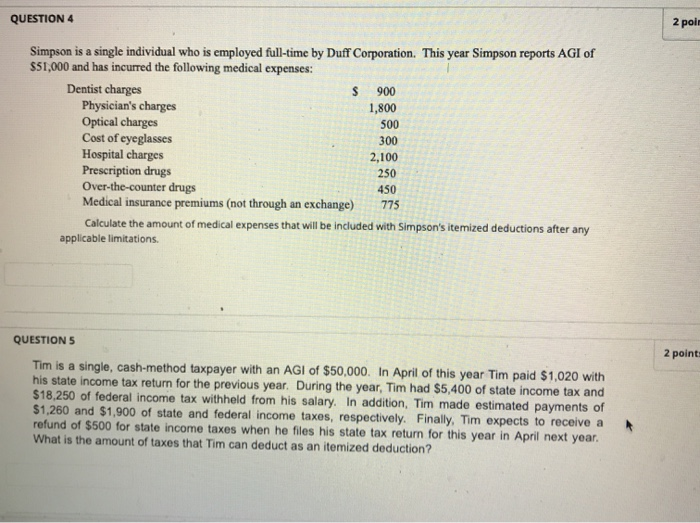

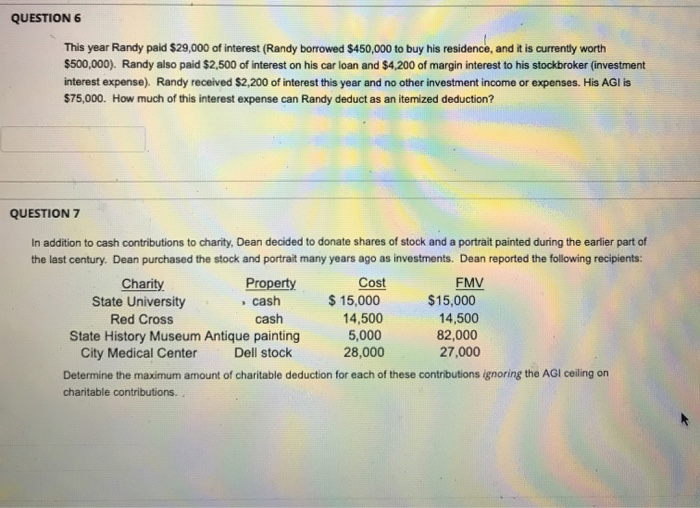

QUESTION Z Betty operates a beauty salon as a sole proprietorship. Betty also owns and rents an apartment building. This year Betty had the following income and expenses. Determine Betty's AGI. You may assume that Betty will owe $2,502 in self-employment tax on her salon income. Interest income Salon sales and revenue Salaries paid to beauticians Beauty salon supplies Alimony paid to her ex-husband, Rocky (2016 divorce) Rental revenue from apartment building Depreciation on apartment building Real estate taxes paid on apartment building Real estate taxes paid on personal residence Contributions to charity $ 11,255 86,360 45,250 23,400 6,000 32,220 12,900 11,100 6,241 QUESTION 3 Lionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $24,000 from County Bank and paid interest of $1,440. Lionel used the loan proceeds to pay his law school tuition Calculate the amount Lionel can deduct for interest on higher education loans. Lionel's AGI before deducting interest on higher education loans is $76,000. QUESTION 4 2 poir Simpson is a single individual who is employed full-time by Duff Corporation. This year Simpson reports AGI of $51,000 and has incurred the following medical expenses: Dentist charges $ 900 Physician's charges 1,800 Optical charges 500 Cost of eyeglasses 300 Hospital charges 2,100 Prescription drugs 250 Over-the-counter drugs Medical insurance premiums (not through an exchange) Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations 450 775 2 point: QUESTIONS Tim is a single, cash-method taxpayer with an AGI of $50,000. In April of this year Tim paid $1,020 with his state income tax return for the previous year. During the year, Tim had $5,400 of state income tax and $18,250 of federal income tax withheld from his salary. In addition, Tim made estimated payments of $1,260 and $1,900 of state and federal income taxes, respectively. Finally, Tim expects to receive a refund of $500 for state income taxes when he files his state tax return for this year in April next year. What is the amount of taxes that Tim can deduct as an itemized deduction? QUESTION 6 This year Randy paid $29,000 of interest (Randy borrowed $450,000 to buy his residence, and it is currently worth $500,000). Randy also paid $2,500 of interest on his car loan and $4,200 of margin interest to his stockbroker (investment interest expense). Randy received $2,200 of interest this year and no other investment income or expenses. His AGI is $75,000. How much of this interest expense can Randy deduct as an itemized deduction? QUESTION 7 In addition to cash contributions to charity, Dean decided to donate shares of stock and a portrait painted during the earlier part of the last century. Dean purchased the stock and portrait many years ago as investments. Dean reported the following recipients: Charity Property Cost FMV State University cash R $ 15,000 $15,000 Red Cross cash 14,500 14,500 State History Museum Antique painting 5,000 82,000 City Medical Center Dell stock 28,000 27,000 Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions