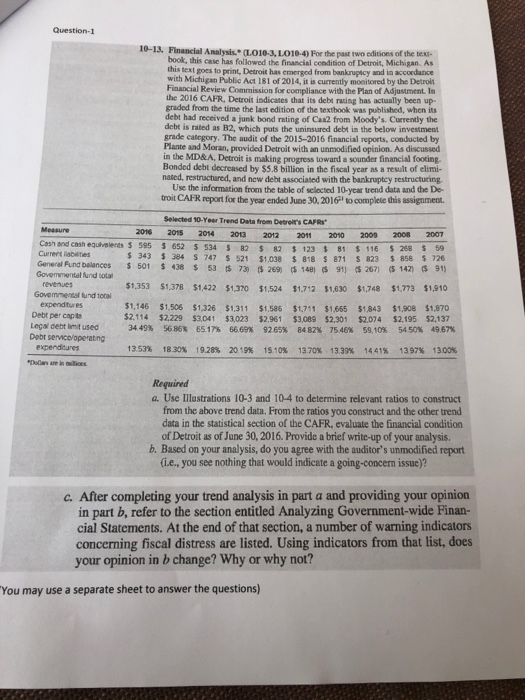

Question-1 10-13. Financial Analysis (L010-3L010.4) For the past two editions of the text book, this case has followed the financial condition of Detroit, Michigan. As this text poes to print, Detroit has emerged from bankruptcy and in accordance with Michigan Public Act 181 of 2014, it is currently monitored by the Detroit Financial Review Commission for compliance with the plan of Adjustment. In the 2016 CAFR, Detroit indicates that its debt rating has actually been up- graded from the time the last edition of the textbook was published, when its debt had received a junk bond rating of Ca2 from Moody's. Currently the debt is rated as B2, which puts the uninsured debt in the below investment grade category. The audit of the 2015-2016 financial reports, conducted by Plante and Moran, provided Detroit with an unmodified opinion. As discussed in the MD&A, Detrait is making progress toward a sounder financial footing. Bonded debt decreased by $5.8 billion in the fiscal year as a result of elimi- nated, restructured, and new deht associated with the bankruptcy restructuring Use the information from the table of selected 10-year trend data and the De- troit CAF report for the year ended June 30, 2016 to complete this assignment Selected 10-Year Trend Data from Debrer's CARS 2015 2014 2013 2012 2011 2010 2009 $ 652 $ 534 82 2 123 $ 81 $116 384 S 747 $521 $1.098 5818 871 $ 823 $ 438 $ 53 $ 73 2 09 1 48) 915 2671 2008 2007 $ 208 59 5 858 $726 5 142) (91) $1378 $1,422 $1.370 $1,624 $1.742 31.630 $1,748 $1,773 $1,910 easure 2016 Cash and cash equivalents 5 595 Current l es $ 343 General Fund balances $ 501 Govermental fund total revenues $1,353 Govom fund total expenditures $1,146 Debt per capito $2.114 Legal debt mit used 34 49% Dobr service/operating expenditures 13.53% Derein $1.506 $1326 $2,229 3.041 56856517 $1,311 $3.023 66 69 $1,585 32.961 9265% $1,711 $1,665 $3.089 $2.301 6482% 75 46% $1,843 2074 59.10% $1,900 $2,195 54 50% $1,870 $2.137 49.67% 18.30% 19.28% 20 19% 15.10% 13.70% 13,39% 14,41% 1397% 13.00% Required a. Use Illustrations 10-3 and 10-4 to determine relevant ratios to construct from the above trend data. From the ratios you construct and the other trend data in the statistical section of the CAFR, evaluate the financial condition of Detroit as of June 30, 2016. Provide a brief write-up of your analysis. b. Based on your analysis, do you agree with the auditor's unmodified report (i.e., you see nothing that would indicate a going-concern issue)? c. After completing your trend analysis in part a and providing your opinion in part b, refer to the section entitled Analyzing Government-wide Finan cial Statements. At the end of that section, a number of warning indicators concerning fiscal distress are listed. Using indicators from that list, does your opinion in b change? Why or why not? "You may use a separate sheet to answer the questions) Question-1 10-13. Financial Analysis (L010-3L010.4) For the past two editions of the text book, this case has followed the financial condition of Detroit, Michigan. As this text poes to print, Detroit has emerged from bankruptcy and in accordance with Michigan Public Act 181 of 2014, it is currently monitored by the Detroit Financial Review Commission for compliance with the plan of Adjustment. In the 2016 CAFR, Detroit indicates that its debt rating has actually been up- graded from the time the last edition of the textbook was published, when its debt had received a junk bond rating of Ca2 from Moody's. Currently the debt is rated as B2, which puts the uninsured debt in the below investment grade category. The audit of the 2015-2016 financial reports, conducted by Plante and Moran, provided Detroit with an unmodified opinion. As discussed in the MD&A, Detrait is making progress toward a sounder financial footing. Bonded debt decreased by $5.8 billion in the fiscal year as a result of elimi- nated, restructured, and new deht associated with the bankruptcy restructuring Use the information from the table of selected 10-year trend data and the De- troit CAF report for the year ended June 30, 2016 to complete this assignment Selected 10-Year Trend Data from Debrer's CARS 2015 2014 2013 2012 2011 2010 2009 $ 652 $ 534 82 2 123 $ 81 $116 384 S 747 $521 $1.098 5818 871 $ 823 $ 438 $ 53 $ 73 2 09 1 48) 915 2671 2008 2007 $ 208 59 5 858 $726 5 142) (91) $1378 $1,422 $1.370 $1,624 $1.742 31.630 $1,748 $1,773 $1,910 easure 2016 Cash and cash equivalents 5 595 Current l es $ 343 General Fund balances $ 501 Govermental fund total revenues $1,353 Govom fund total expenditures $1,146 Debt per capito $2.114 Legal debt mit used 34 49% Dobr service/operating expenditures 13.53% Derein $1.506 $1326 $2,229 3.041 56856517 $1,311 $3.023 66 69 $1,585 32.961 9265% $1,711 $1,665 $3.089 $2.301 6482% 75 46% $1,843 2074 59.10% $1,900 $2,195 54 50% $1,870 $2.137 49.67% 18.30% 19.28% 20 19% 15.10% 13.70% 13,39% 14,41% 1397% 13.00% Required a. Use Illustrations 10-3 and 10-4 to determine relevant ratios to construct from the above trend data. From the ratios you construct and the other trend data in the statistical section of the CAFR, evaluate the financial condition of Detroit as of June 30, 2016. Provide a brief write-up of your analysis. b. Based on your analysis, do you agree with the auditor's unmodified report (i.e., you see nothing that would indicate a going-concern issue)? c. After completing your trend analysis in part a and providing your opinion in part b, refer to the section entitled Analyzing Government-wide Finan cial Statements. At the end of that section, a number of warning indicators concerning fiscal distress are listed. Using indicators from that list, does your opinion in b change? Why or why not? "You may use a separate sheet to answer the questions)