Answered step by step

Verified Expert Solution

Question

1 Approved Answer

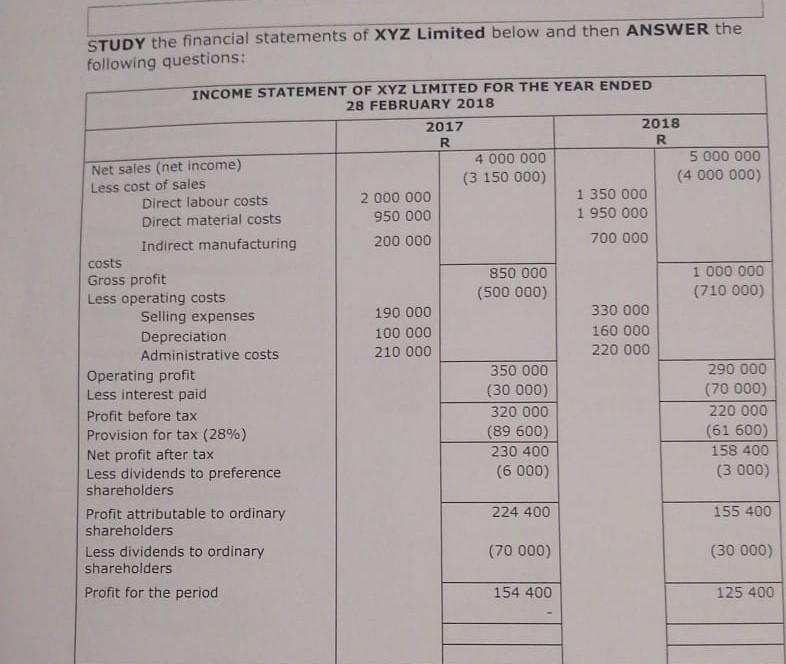

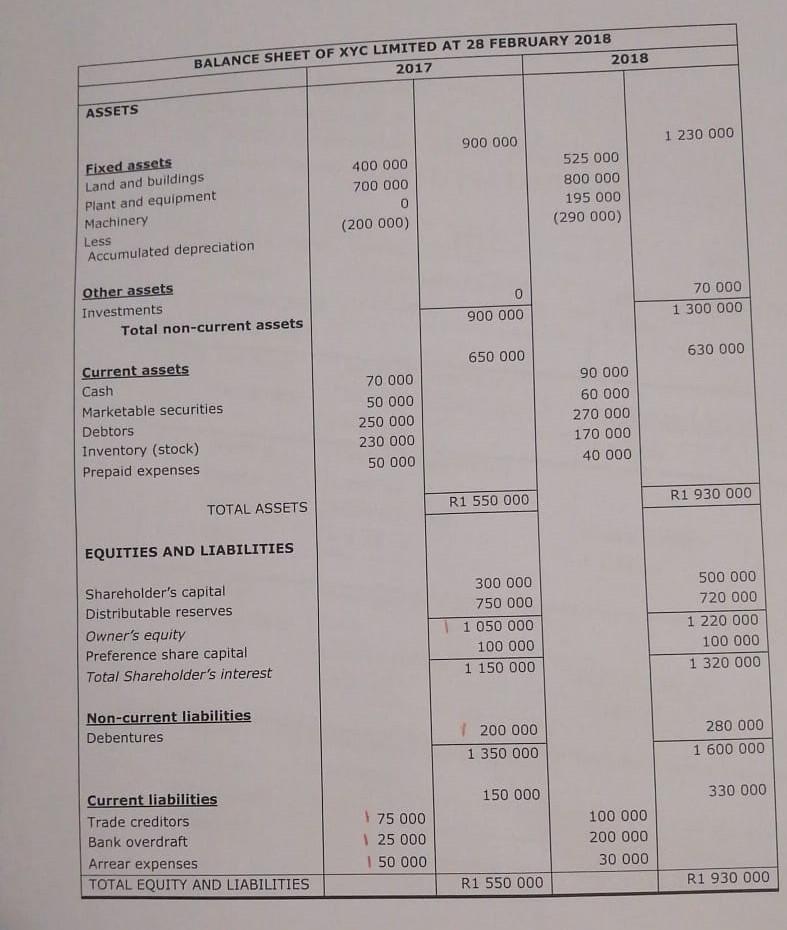

Question:1 Calculate Yield on SHAREHOLDERS Interest STUDY the financial statements of XYZ Limited below and then ANSWER the following questions: INCOME STATEMENT OF XYZ LIMITED

Question:1

Calculate Yield on SHAREHOLDERS Interest

STUDY the financial statements of XYZ Limited below and then ANSWER the following questions: INCOME STATEMENT OF XYZ LIMITED FOR THE YEAR ENDED 28 FEBRUARY 2018 2017 2018 R R 4 000 000 5 000 000 Net sales (net income) Less cost of sales (3 150 000) (4 000 000) Direct labour costs 2 000 000 1 350 000 Direct material costs 950 000 1 950 000 Indirect manufacturing 200 000 700 000 costs Gress profit 850 000 1 000 000 Less operating costs (500 000) (710 000) Selling expenses 190 000 330 000 Depreciation 100 000 160 000 Administrative costs 210 000 220 000 Operating profit 350 000 290 000 Less interest paid (30 000) (70 000) Profit before tax 320 000 220 000 Provision for tax (28%) (89 600) (61 600) Net profit after tax 230 400 158 400 Less dividends to preference (6 000) (3 000) shareholders Profit attributable to ordinary 224 400 155 400 shareholders Less dividends to ordinary (70 000) (30 000) shareholders Profit for the period 154 400 125 400 BALANCE SHEET OF XYC LIMITED AT 28 FEBRUARY 2018 2017 2018 ASSETS 1 230 000 900 000 Fixed assets Land and buildings Plant and equipment Machinery Less Accumulated depreciation 400 000 700 000 0 (200 000) 525 000 800 000 195 000 (290 000) Other assets Investments Total non-current assets 70 000 1 300 000 900 000 650 000 630 000 Current assets Cash Marketable securities Debtors Inventory (stock) Prepaid expenses 70 000 50 000 250 000 230 000 50 000 90 000 60 000 270 000 170 000 40 000 TOTAL ASSETS R1 550 000 R1 930 000 EQUITIES AND LIABILITIES Shareholder's capital Distributable reserves Owner's equity Preference share capital Total Shareholder's interest 300 000 750 000 1 1 050 000 100 000 1 150 000 500 000 720 000 1 220 000 100 000 1 320 000 Non-current liabilities Debentures 1 200 000 1 350 000 280 000 1 600 000 150 000 330 000 Current liabilities Trade creditors Bank overdraft Arrear expenses TOTAL EQUITY AND LIABILITIES 75 000 1 25 000 150 000 100 000 200 000 30 000 R1 550 000 R1 930 000 STUDY the financial statements of XYZ Limited below and then ANSWER the following questions: INCOME STATEMENT OF XYZ LIMITED FOR THE YEAR ENDED 28 FEBRUARY 2018 2017 2018 R R 4 000 000 5 000 000 Net sales (net income) Less cost of sales (3 150 000) (4 000 000) Direct labour costs 2 000 000 1 350 000 Direct material costs 950 000 1 950 000 Indirect manufacturing 200 000 700 000 costs Gress profit 850 000 1 000 000 Less operating costs (500 000) (710 000) Selling expenses 190 000 330 000 Depreciation 100 000 160 000 Administrative costs 210 000 220 000 Operating profit 350 000 290 000 Less interest paid (30 000) (70 000) Profit before tax 320 000 220 000 Provision for tax (28%) (89 600) (61 600) Net profit after tax 230 400 158 400 Less dividends to preference (6 000) (3 000) shareholders Profit attributable to ordinary 224 400 155 400 shareholders Less dividends to ordinary (70 000) (30 000) shareholders Profit for the period 154 400 125 400 BALANCE SHEET OF XYC LIMITED AT 28 FEBRUARY 2018 2017 2018 ASSETS 1 230 000 900 000 Fixed assets Land and buildings Plant and equipment Machinery Less Accumulated depreciation 400 000 700 000 0 (200 000) 525 000 800 000 195 000 (290 000) Other assets Investments Total non-current assets 70 000 1 300 000 900 000 650 000 630 000 Current assets Cash Marketable securities Debtors Inventory (stock) Prepaid expenses 70 000 50 000 250 000 230 000 50 000 90 000 60 000 270 000 170 000 40 000 TOTAL ASSETS R1 550 000 R1 930 000 EQUITIES AND LIABILITIES Shareholder's capital Distributable reserves Owner's equity Preference share capital Total Shareholder's interest 300 000 750 000 1 1 050 000 100 000 1 150 000 500 000 720 000 1 220 000 100 000 1 320 000 Non-current liabilities Debentures 1 200 000 1 350 000 280 000 1 600 000 150 000 330 000 Current liabilities Trade creditors Bank overdraft Arrear expenses TOTAL EQUITY AND LIABILITIES 75 000 1 25 000 150 000 100 000 200 000 30 000 R1 550 000 R1 930 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started