Question1:

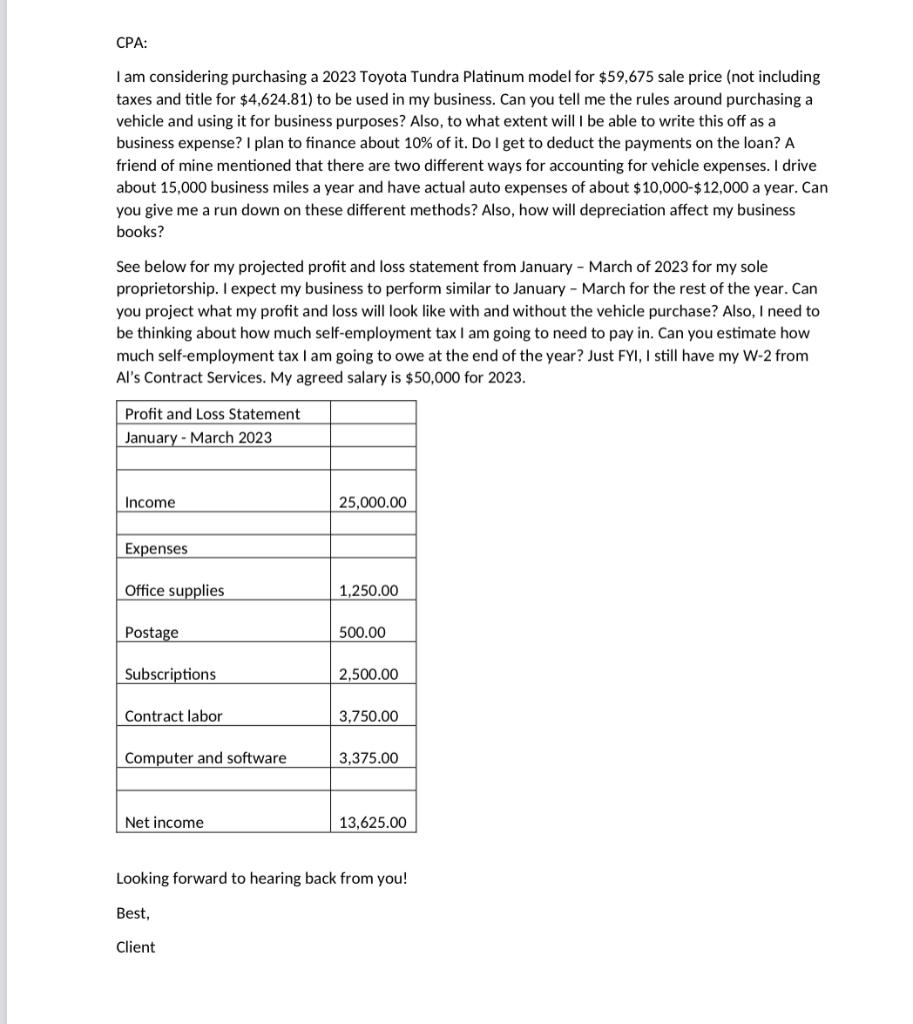

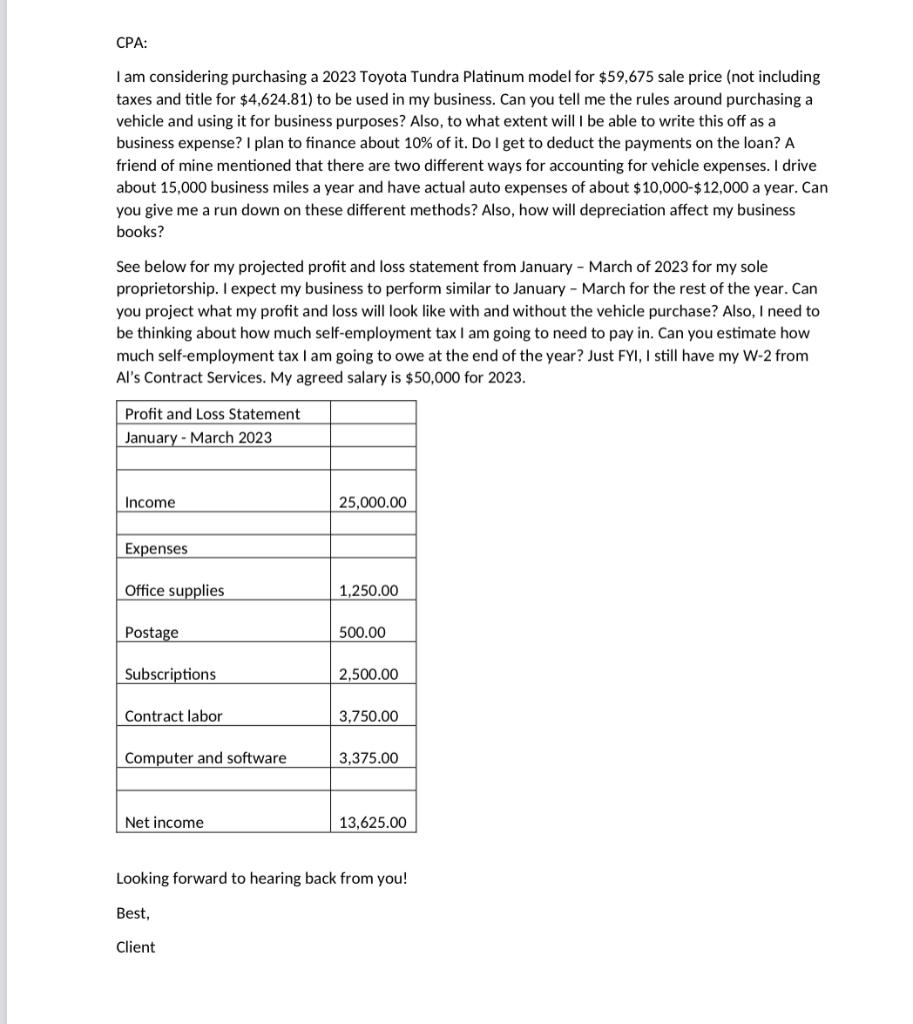

CPA: I am considering purchasing a 2023 Toyota Tundra Platinum model for $59,675 sale price (not including taxes and title for $4,624.81 ) to be used in my business. Can you tell me the rules around purchasing a vehicle and using it for business purposes? Also, to what extent will I be able to write this off as a business expense? I plan to finance about 10% of it. Do I get to deduct the payments on the loan? A friend of mine mentioned that there are two different ways for accounting for vehicle expenses. I drive about 15,000 business miles a year and have actual auto expenses of about $10,000$12,000 a year. Can you give me a run down on these different methods? Also, how will depreciation affect my business books? See below for my projected profit and loss statement from January - March of 2023 for my sole proprietorship. I expect my business to perform similar to January - March for the rest of the year. Can you project what my profit and loss will look like with and without the vehicle purchase? Also, I need to be thinking about how much self-employment tax I am going to need to pay in. Can you estimate how much self-employment tax I am going to owe at the end of the year? Just FYI, I still have my W-2 from Al's Contract Services. My agreed salary is $50,000 for 2023. Looking forward to hearing back from you! Best, Client CPA: I am considering purchasing a 2023 Toyota Tundra Platinum model for $59,675 sale price (not including taxes and title for $4,624.81 ) to be used in my business. Can you tell me the rules around purchasing a vehicle and using it for business purposes? Also, to what extent will I be able to write this off as a business expense? I plan to finance about 10% of it. Do I get to deduct the payments on the loan? A friend of mine mentioned that there are two different ways for accounting for vehicle expenses. I drive about 15,000 business miles a year and have actual auto expenses of about $10,000$12,000 a year. Can you give me a run down on these different methods? Also, how will depreciation affect my business books? See below for my projected profit and loss statement from January - March of 2023 for my sole proprietorship. I expect my business to perform similar to January - March for the rest of the year. Can you project what my profit and loss will look like with and without the vehicle purchase? Also, I need to be thinking about how much self-employment tax I am going to need to pay in. Can you estimate how much self-employment tax I am going to owe at the end of the year? Just FYI, I still have my W-2 from Al's Contract Services. My agreed salary is $50,000 for 2023. Looking forward to hearing back from you! Best, Client