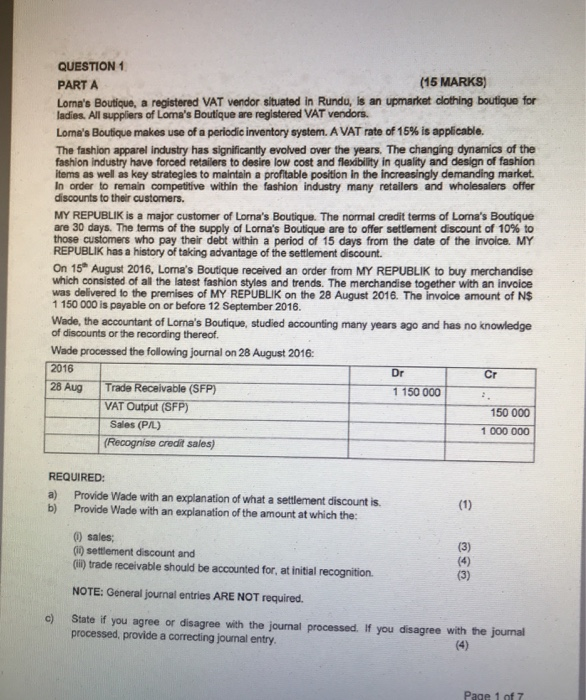

QUESTION1 PART A (15 MARKS) Lorna's Boutique, a registered VAT vendor situated in Rundu, is an upmarket clothing boutique for ladies. All suppliers of Loma's Boutique are registered VAT vendors. Lomas Boutique makes use of a periodic inventory system. A VAT rate of 15% is applicable. The fashion apparel industry has significantly evolved over the years. The changing dynamics of the fashion industry have forced retailers to desire low cost and flexibility in quality and design of fashion items as well as key strategies to maintain a profitable position in the increasingly demanding market In order to remain competitive within the fashion industry many retailers and wholesalers offer discounts to their customers. MY REPUBLIK is a major customer of Lona's Boutique. The normal credit terms of Loma's Boutique are 30 days. The terms of the supply of Lomas Boutique are to offer settlement discount of 10% to those customers who pay their debt within a period of 15 days from the date of the invoice. MY REPUBLIK has a history of taking advantage of the settlement discount On 15 August 2016, Loma's Boutique received an order from MY REPUBLIK to buy merchandise which consisted of all the latest fashion styles and trends. The merchandise together with an invoice was delivered to the premises of MY REPUBLIK on the 28 August 2016. The invoice amount of N$ 150 000 is payable on or before 12 September 2016. Wade, the accountant of Loma's Boutique, studied accounting many years ago and has no knowledge of discounts or the recording thereof Wade processed the following journal on 28 August 2016 2016 Dr Cr 28 Aug Trade Receivable (SFP) 150 000 VAT Output (SFP) Sales (PA (Recognise credit sales) 150 000 1 000 000 REQUIRED: a) Provide Wade with an explanation of what a settlement discount is b) Provide Wade with an explanation of the amount at which the: (i) sales; (1) settlement discount and (il) trade receivable should be accounted for, at initial recognition. NOTE: General journal entries ARE NOT required o) State i you agree or disagree with the journal processed. if you disagree with the journal processed, provide a correcting jounal entry