Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question2 (4+2+4) a. A bond with 5 years to maturity and coupon payment is 9 percent and market price is TK. 1035, par value TK.

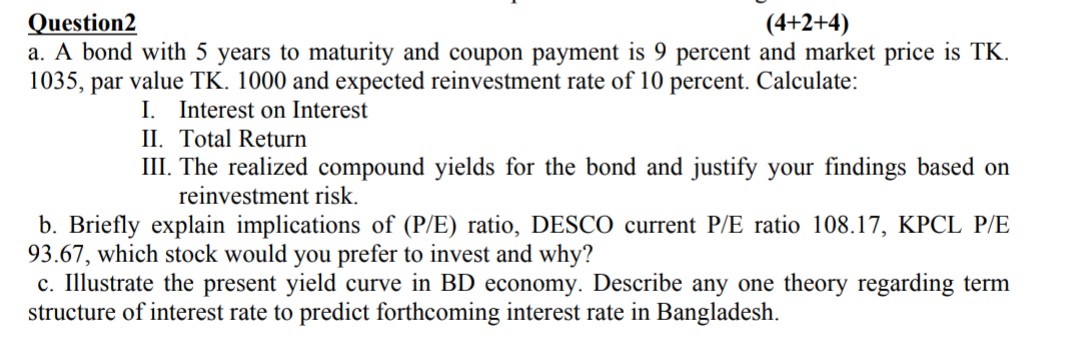

Question2 (4+2+4) a. A bond with 5 years to maturity and coupon payment is 9 percent and market price is TK. 1035, par value TK. 1000 and expected reinvestment rate of 10 percent. Calculate: I. Interest on Interest II. Total Return III. The realized compound yields for the bond and justify your findings based on reinvestment risk. b. Briefly explain implications of (P/E) ratio, DESCO current P/E ratio 108.17, KPCL P/E 93.67, which stock would you prefer to invest and why? c. Illustrate the present yield curve in BD economy. Describe any one theory regarding term structure of interest rate to predict forthcoming interest rate in Bangladesh. Question2 (4+2+4) a. A bond with 5 years to maturity and coupon payment is 9 percent and market price is TK. 1035, par value TK. 1000 and expected reinvestment rate of 10 percent. Calculate: I. Interest on Interest II. Total Return III. The realized compound yields for the bond and justify your findings based on reinvestment risk. b. Briefly explain implications of (P/E) ratio, DESCO current P/E ratio 108.17, KPCL P/E 93.67, which stock would you prefer to invest and why? c. Illustrate the present yield curve in BD economy. Describe any one theory regarding term structure of interest rate to predict forthcoming interest rate in Bangladesh

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started