Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question4 (7+3) a. GPHISPAT has following two assets in portfolio and risk and weights of individual assets are given below: Textile Bank Return (%) 16.50

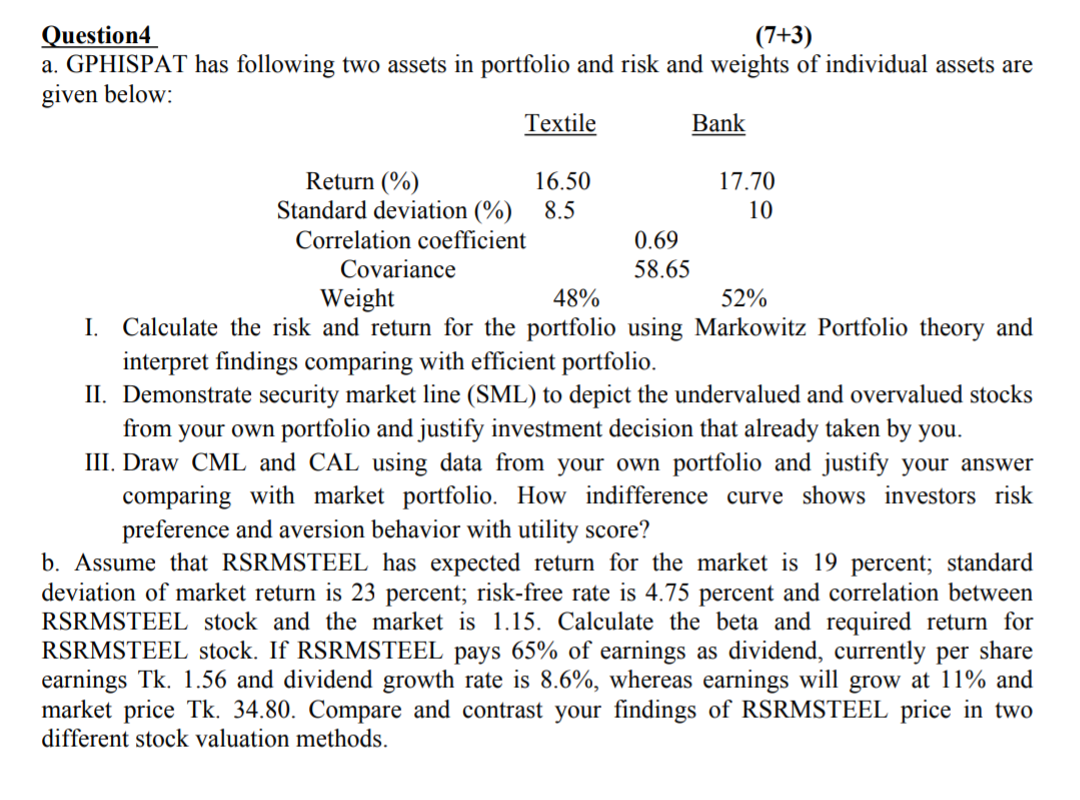

Question4 (7+3) a. GPHISPAT has following two assets in portfolio and risk and weights of individual assets are given below: Textile Bank Return (%) 16.50 17.70 Standard deviation (%) 8.5 10 Correlation coefficient 0.69 Covariance 58.65 Weight 48% 52% I. Calculate the risk and return for the portfolio using Markowitz Portfolio theory and interpret findings comparing with efficient portfolio. II. Demonstrate security market line (SML) to depict the undervalued and overvalued stocks from your own portfolio and justify investment decision that already taken by you. III. Draw CML and CAL using data from your own portfolio and justify your answer comparing with market portfolio. How indifference curve shows investors risk preference and aversion behavior with utility score? b. Assume that RSRMSTEEL has expected return for the market is 19 percent; standard deviation of market return is 23 percent; risk-free rate is 4.75 percent and correlation between RSRMSTEEL stock and the market is 1.15. Calculate the beta and required return for RSRMSTEEL stock. If RSRMSTEEL pays 65% of earnings as dividend, currently per share earnings Tk. 1.56 and dividend growth rate is 8.6%, whereas earnings will grow at 11% and market price Tk. 34.80. Compare and contrast your findings of RSRMSTEEL price in two different stock valuation methods. Question4 (7+3) a. GPHISPAT has following two assets in portfolio and risk and weights of individual assets are given below: Textile Bank Return (%) 16.50 17.70 Standard deviation (%) 8.5 10 Correlation coefficient 0.69 Covariance 58.65 Weight 48% 52% I. Calculate the risk and return for the portfolio using Markowitz Portfolio theory and interpret findings comparing with efficient portfolio. II. Demonstrate security market line (SML) to depict the undervalued and overvalued stocks from your own portfolio and justify investment decision that already taken by you. III. Draw CML and CAL using data from your own portfolio and justify your answer comparing with market portfolio. How indifference curve shows investors risk preference and aversion behavior with utility score? b. Assume that RSRMSTEEL has expected return for the market is 19 percent; standard deviation of market return is 23 percent; risk-free rate is 4.75 percent and correlation between RSRMSTEEL stock and the market is 1.15. Calculate the beta and required return for RSRMSTEEL stock. If RSRMSTEEL pays 65% of earnings as dividend, currently per share earnings Tk. 1.56 and dividend growth rate is 8.6%, whereas earnings will grow at 11% and market price Tk. 34.80. Compare and contrast your findings of RSRMSTEEL price in two different stock valuation methods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started