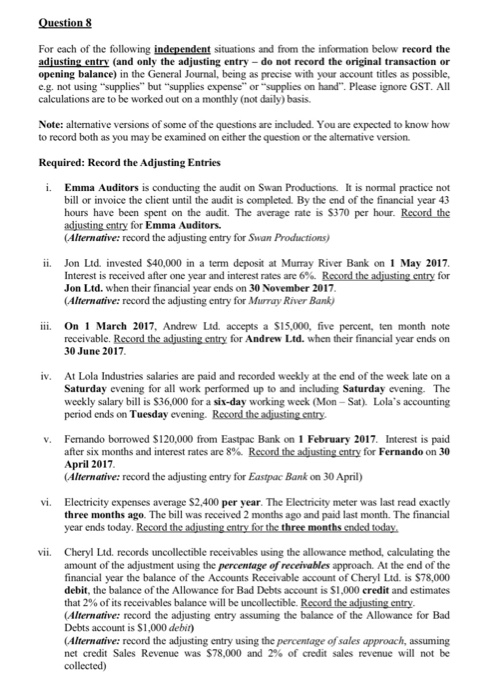

Question8 For each of the following independent situations and from the information below record the adiusting entry (and only the adjusting entry -do not record the original transaction or opening balance) in the General Journal, being as precise with your account titles as possible, e.g. not using "supplies" but "supplies expense" or "supplies on hand". Please ignore GST. All calculations are to be worked out on a monthly (not daily) basis. Note: altemative versions of some of the questions are included. You are expected to know how to record both as you may be examined on either the question or the altemative version. Required: Record the Adjusting Entries i. Emma Auditors is conducting the audit on Swan Productions. It is normal practice not bill or invoice the client until the audit is completed. By the end of the financial year 43 hours have been spent on the audit. The average rate is $370 per hour. Record the for Emma Auditors. (Alternative: record the adjusting entry for Swan Productions) ii. Jon Ltd. invested $40,000 in a term deposit at Murray River Bank on 1 May 2017 Interest is received after one year and interest rates are 6% Recor Jon Ltd. when their financial year ends on 30 November 2017 (Alternative: record the adjusting entry for Murray River Bank) headiustingentry for iii. On 1 March 2017, Andrew Ltd. accepts a S15,000, five percent, ten month note receivable. Record the adjusting entry for Andrew Ltd. when their financial year ends on 30 June 2017 iv. At Lola Industries salaries are paid and recorded weekly at the end of the week late on a Saturday evening for all work performed up to and including Saturday evening. The weekly salary bill is S36,000 for a six-day working week (Mon - Sat). Lola's accounting period ends on Tuesday evening. Record the adjusting entry. v. Femando borrowed $120,000 from Eastpac Bank on 1 February 2017. Interest is paid after six months and interest rates are 8%. Recordteaiustingentry for Fernando on 30 April 2017 (Alternative: record the adjusting entry for Eastpac Bank on 30 April) vi. Electricity expenses average $2,400 per year. The Electricity meter was last read exactly three months ago. The bill was received 2 months ago and paid last month. The financial vii. Cheryl Ltd. records uncollectible receivables using the allowance method, calculating the amount of the adjustment using the percentage ef receivables approach. At the end of the financial year the balance of the Accounts Receivable account of Cheryl Ltd. is $78,000 debit, the balance of the Allowance for Bad Debts account is $1,000 credit and estimates that 2% of its receivables balance will be uncollectible. Alternative: record the adjusting entry assuming the balance of the Allowance for Bad Debts account is $1,000 debit) (Alternative: record the adjusting entry using the percentage of sales approach, assuming net credit Sales Revenue was $78,000 and 2% of credit sales revenue will not be collected)