Question

QUESTION(a) A gold mining company under a CVP analysis reveals a selling price of gold at US$55/g with the following information: Cost ElementDirect MaterialDirect LabourFactory

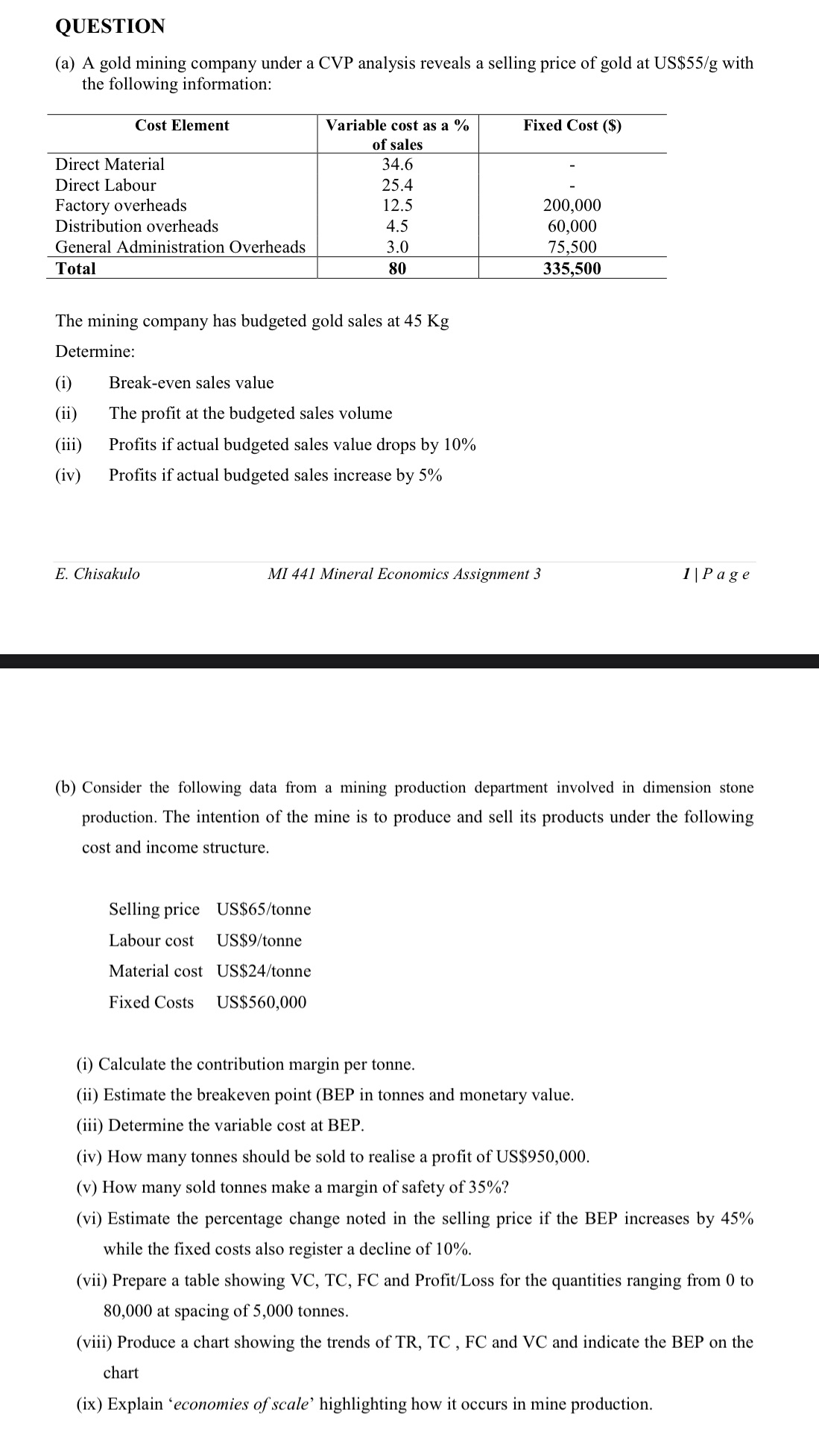

QUESTION(a) A gold mining company under a CVP analysis reveals a selling price of gold at US$55/g with the following information: Cost ElementDirect MaterialDirect LabourFactory overheadsDistribution overheadsGeneral Administration Overheads TotalVariable cost as a % of sales34.625.412.54.53.080Fixed Cost ($)--200,000 60,000 75,500 335,500 The mining company has budgeted gold sales at 45 Kg Determine:(i) Break-even sales value(ii) The profit at the budgeted sales volume(iii) Profits if actual budgeted sales value drops by 10%(iv) Profits if actual budgeted sales increase by 5% E. Chisakulo MI 441 Mineral Economics Assignment 31 | P a g e(b) Consider the following data from a mining production department involved in dimension stone production. The intention of the mine is to produce and sell its products under the following cost and income structure.Selling price Labour cost Material cost Fixed CostsUS$65/tonne US$9/tonne US$24/tonne US$560,000(i) Calculate the contribution margin per tonne.(ii) Estimate the breakeven point (BEP in tonnes and monetary value.(iii) Determine the variable cost at BEP.(iv) How many tonnes should be sold to realise a profit of US$950,000.(v) How many sold tonnes make a margin of safety of 35%?(vi) Estimate the percentage change noted in the selling price if the BEP increases by 45%while the fixed costs also register a decline of 10%.(vii) draw a table showing VC, TC, FC and Profit/Loss for the quantities ranging from 0 to80,000 at spacing of 5,000 tonnes.(viii) Produce a chart showing the trends of TR, TC , FC and VC and indicate the BEP on thechart(ix) Explain 'economies of scale' highlighting how it occurs in mine production.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started