Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question-Anuradha Enterprises manufactures and sells black phenyl worth Rs.20,000 white phenyl worth Rs.25,000, scented phenyl worth Rs.10,000 and naphthalene balls worth Rs.5,000every month. The firm's

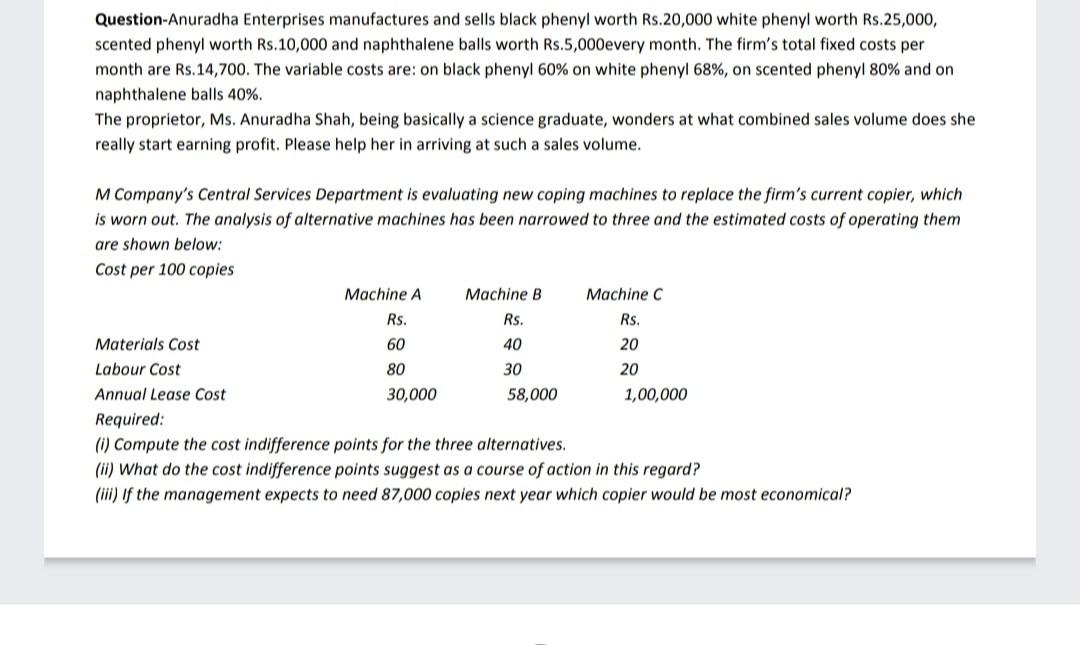

Question-Anuradha Enterprises manufactures and sells black phenyl worth Rs.20,000 white phenyl worth Rs.25,000, scented phenyl worth Rs.10,000 and naphthalene balls worth Rs.5,000every month. The firm's total fixed costs per month are Rs.14,700. The variable costs are: on black phenyl 60% on white phenyl 68%, on scented phenyl 80% and on naphthalene balls 40%. The proprietor, Ms. Anuradha Shah, being basically a science graduate, wonders at what combined sales volume does she really start earning profit. Please help her in arriving at such a sales volume. M Company's Central Services Department is evaluating new coping machines to replace the firm's current copier, which is worn out. The analysis of alternative machines has been narrowed to three and the estimated costs of operating them are shown below: Cost per 100 copies Machine A Machine B Machine C Rs. Rs. Rs. Materials Cost 60 40 20 Labour Cost 80 30 20 Annual Lease Cost 30,000 58,000 1,00,000 Required: (1) Compute the cost indifference points for the three alternatives. (ii) What do the cost indifference points suggest as a course of action in this regard? (ii) If the management expects to need 87,000 copies next year which copier would be most economical

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started