Answered step by step

Verified Expert Solution

Question

1 Approved Answer

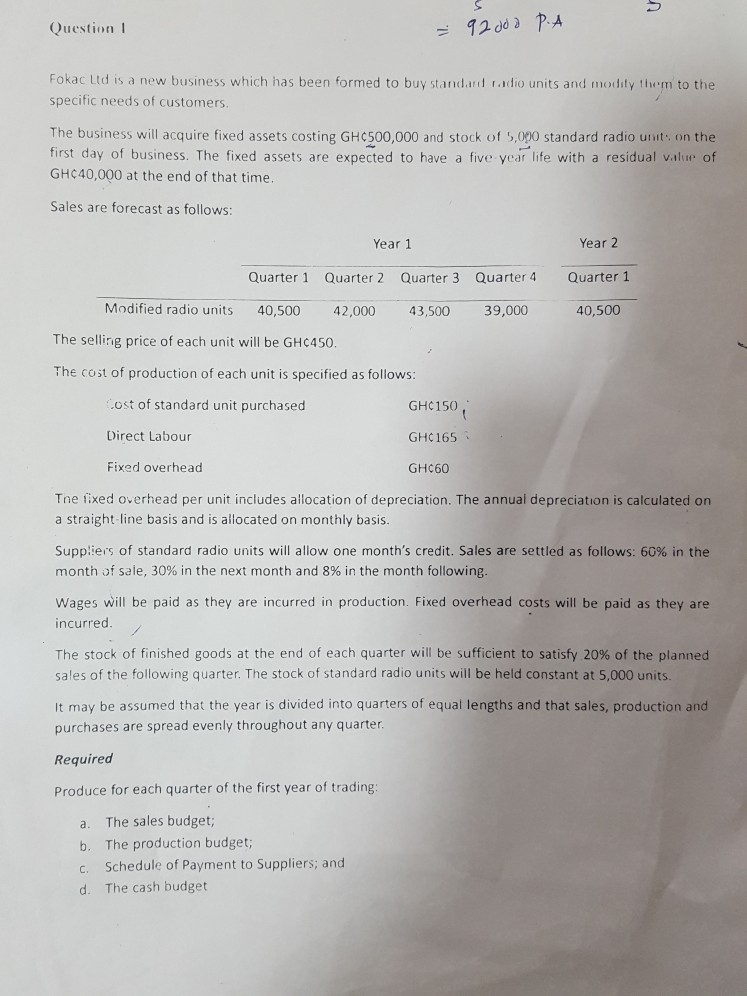

QuestionI Fokac Ltd is a new business which has been formed to buy standad radio units and modity them to the specific needs of customers

QuestionI Fokac Ltd is a new business which has been formed to buy standad radio units and modity them to the specific needs of customers The business will acquire fixed assets costing GHC500,000 and stock of 5,090 standard radio unit on the first day of business. The fixed assets are expected to have a five year life with a residual valiue of GHC40,000 at the end of that time. Sales are forecast as follows: Year 2 Quarter 1 40,500 Year 1 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Modified radio units 40,500 42,000 43,500 39,000 The sellirng price of each unit will be GHc450. The cost of production of each unit is specified as follows: ost of standard unit purchased Direct Labour Fixed overhead GHC150 GHC 165 GH60 Tne fixed overhead per unit includes allocation of depreciation. The annual depreciation is calculated on a straight line basis and is allocated on monthly basis. suppliers of standard radio units will allow one month's credit. Sales are settled as follows: 60% in the month of sale, 30% in the next month and 8% in the month following Wages will be paid as they are incurred in production. Fixed overhead costs will be paid as they are incurred. The stock of finished goods at the end of each quarter will be sufficient to satisfy 20% of the planned sales of the following quarter. The stock of standard radio units will be held constant at 5,000 units It may be assumed that the year is divided into quarters of equal lengths and that sales, production and purchases are spread evenly throughout any quarter Required Produce for each quarter of the first year of trading: a. The sales budget; b. The production budget; c. Schedule of Payment to Suppliers; and d. The cash budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started