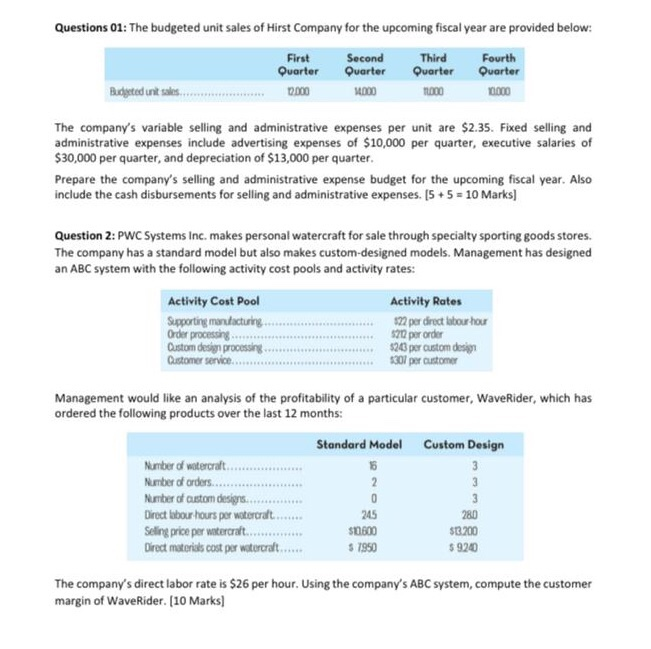

Questions 01: The budgeted unit sales of Hirst Company for the upcoming fiscal year are provided below: First Quarter 0.000 Second Quarter 0 00 Third Quarter Fourth Quarter 0.000 Budgeted unt sales The company's variable selling and administrative expenses per unit are $2.35. Fixed selling and administrative expenses include advertising expenses of $10,000 per quarter, executive salaries of $30,000 per quarter, and depreciation of $13,000 per quarter. Prepare the company's selling and administrative expense budget for the upcoming fiscal year. Also include the cash disbursements for selling and administrative expenses. (5 + 5 = 10 Marks) Question 2: PWC Systems Inc. makes personal watercraft for sale through specialty sporting goods stores. The company has a standard model but also makes custom-designed models. Management has designed an ABC system with the following activity cost pools and activity rates: Activity Cost Pool Supporting manufacturing.. Order processing... Custom design processing Customer service Activity Rates $22 per direct labour hou 570 per order $20 per custom design $301 per customer Management would like an analysis of the profitability of a particular customer, WaveRider, which has ordered the following products over the last 12 months: Standard Model Custom Design Number of watercraft Number of orders Number of custom designs Direct bour hours per watercraft Selling price per watercraft... . Direct materials cost per watercraft...... 245 $0600 57950 280 $3.200 $9200 The company's direct labor rate is $26 per hour. Using the company's ABC system, compute the customer margin of WaveRider. [10 Marks) Questions 01: The budgeted unit sales of Hirst Company for the upcoming fiscal year are provided below: First Quarter 0.000 Second Quarter 0 00 Third Quarter Fourth Quarter 0.000 Budgeted unt sales The company's variable selling and administrative expenses per unit are $2.35. Fixed selling and administrative expenses include advertising expenses of $10,000 per quarter, executive salaries of $30,000 per quarter, and depreciation of $13,000 per quarter. Prepare the company's selling and administrative expense budget for the upcoming fiscal year. Also include the cash disbursements for selling and administrative expenses. (5 + 5 = 10 Marks) Question 2: PWC Systems Inc. makes personal watercraft for sale through specialty sporting goods stores. The company has a standard model but also makes custom-designed models. Management has designed an ABC system with the following activity cost pools and activity rates: Activity Cost Pool Supporting manufacturing.. Order processing... Custom design processing Customer service Activity Rates $22 per direct labour hou 570 per order $20 per custom design $301 per customer Management would like an analysis of the profitability of a particular customer, WaveRider, which has ordered the following products over the last 12 months: Standard Model Custom Design Number of watercraft Number of orders Number of custom designs Direct bour hours per watercraft Selling price per watercraft... . Direct materials cost per watercraft...... 245 $0600 57950 280 $3.200 $9200 The company's direct labor rate is $26 per hour. Using the company's ABC system, compute the customer margin of WaveRider. [10 Marks)