Answered step by step

Verified Expert Solution

Question

1 Approved Answer

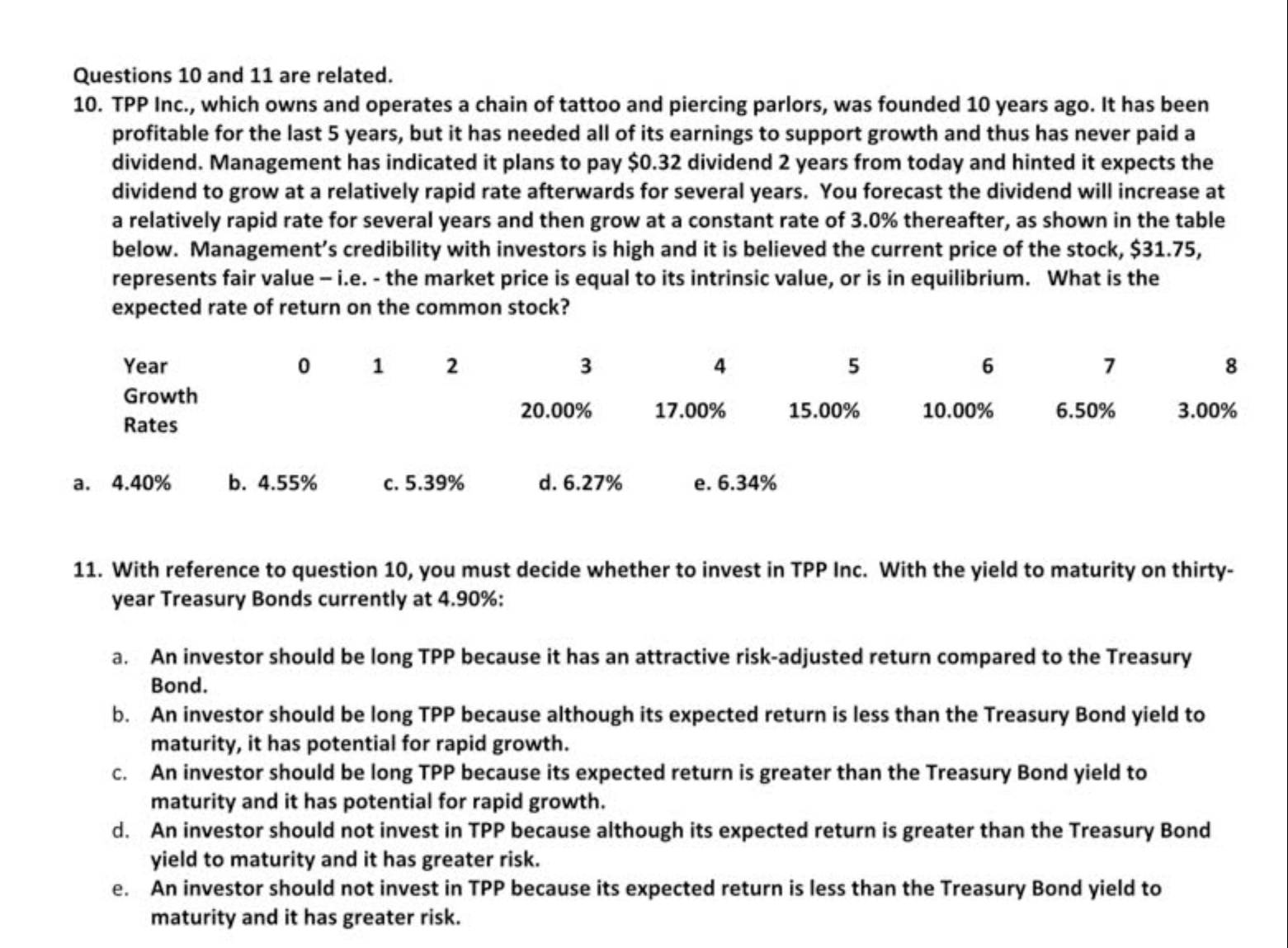

Questions 1 0 and 1 1 are related. TPP Inc., which owns and operates a chain of tattoo and piercing parlors, was founded 1 0

Questions and are related.

TPP Inc., which owns and operates a chain of tattoo and piercing parlors, was founded years ago. It has been

profitable for the last years, but it has needed all of its earnings to support growth and thus has never paid a

dividend. Management has indicated it plans to pay $ dividend years from today and hinted it expects the

dividend to grow at a relatively rapid rate afterwards for several years. You forecast the dividend will increase at

a relatively rapid rate for several years and then grow at a constant rate of thereafter, as shown in the table

below. Management's credibility with investors is high and it is believed the current price of the stock, $

represents fair value ie the market price is equal to its intrinsic value, or is in equilibrium. What is the

expected rate of return on the common stock?

Year

Growth

Rates

a

b

c

d

e

With reference to question you must decide whether to invest in TPP Inc. With the yield to maturity on thirty

year Treasury Bonds currently at :

a An investor should be long TPP because it has an attractive riskadjusted return compared to the Treasury

Bond.

b An investor should be long TPP because although its expected return is less than the Treasury Bond yield to

maturity, it has potential for rapid growth.

c An investor should be long TPP because its expected return is greater than the Treasury Bond yield to

maturity and it has potential for rapid growth.

d An investor should not invest in TPP because although its expected return is greater than the Treasury Bond

yield to maturity and it has greater risk.

e An investor should not invest in TPP because its expected return is less than the Treasury Bond yield to

maturity and it has greater risk.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started