Answered step by step

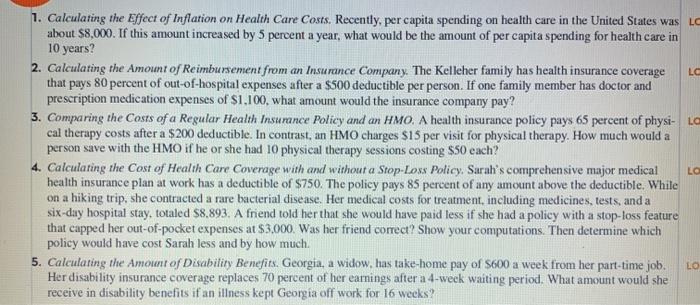

Verified Expert Solution

Question

1 Approved Answer

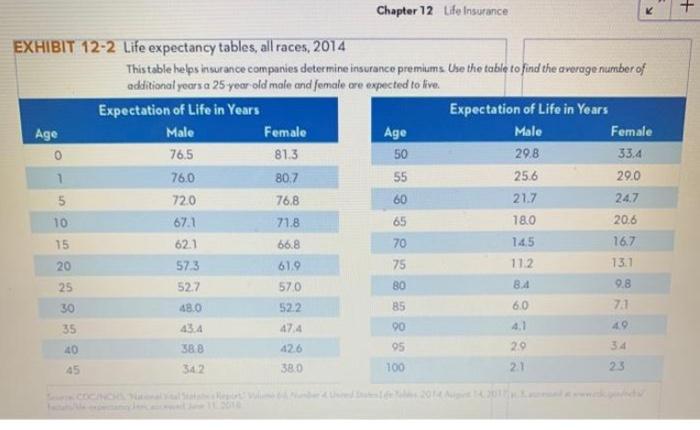

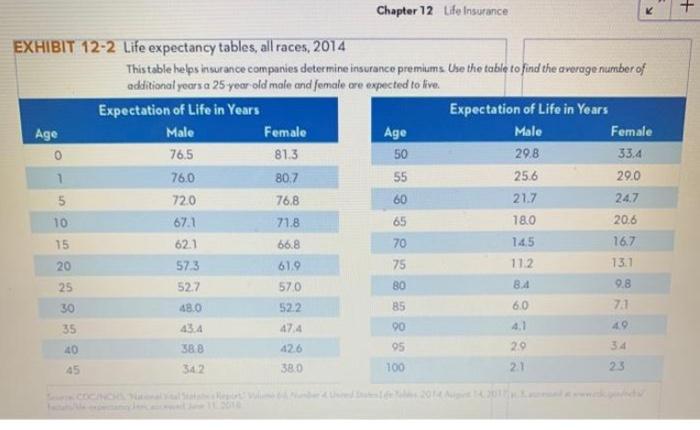

questions 1, 2, 3, and 5 ignore. wrong questions and wrong page Chapter 12 Life Insurance + 1 EXHIBIT 12-2 Life expectancy tables, all races,

questions 1, 2, 3, and 5

ignore. wrong questions and wrong page

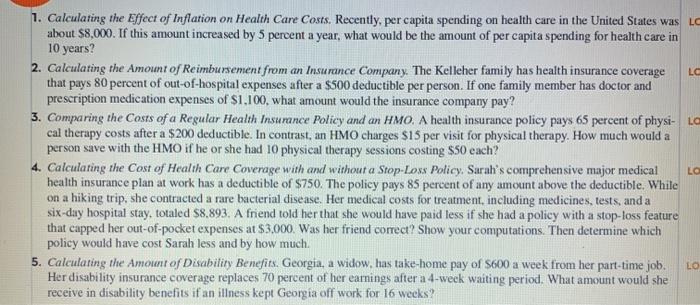

Chapter 12 Life Insurance + 1 EXHIBIT 12-2 Life expectancy tables, all races, 2014 This table helps insurance companies determine insurance premiums Use the table to find the average number of additional years a 25 year old male and female are expected to live Expectation of Life in Years Expectation of Life in Years Age Male Female Age Male Female 0 76,5 81.3 50 29.8 33.4 76.0 80.7 55 25.6 29.0 5 72.0 768 60 21.7 24.7 10 67.1 71.8 65 18.0 20.6 15 621 66.8 70 14.5 16.7 20 573 61.9 75 112 131 25 527 570 BO 8.4 9.8 30 48.0 522 85 6.0 74 35 43 4 474 90 40 388 426 05 29 342 380 100 2.1 23 LC 1. Calculating the Effect of Inflation on Health Care Costs. Recently, per capita spending on health care in the United States was LC about $8,000. If this amount increased by 5 percent a year, what would be the amount of per capita spending for health care in 10 years? 2. Calculating the Amount of Reimbursement from an Insurance Company. The Kelleher family has health insurance coverage that pays 80 percent of out-of-hospital expenses after a $500 deductible per person. If one family member has doctor and prescription medication expenses of $1.100, what amount would the insurance company pay? 3. Comparing the Costs of a Regular Health Insurance Policy and an HMO. A health insurance policy pays 65 percent of physi- LG cal therapy costs after a $200 deductible. In contrast, an HMO charges $15 per visit for physical therapy. How much would a person save with the HMO if he or she had 10 physical therapy sessions costing $50 each? 4. Calculating the Cost of Health Care Coverage with and without a Stop-Loss Policy. Sarah's comprehensive major medical LO health insurance plan at work has a deductible of $750. The policy pays 85 percent of any amount above the deductible. While on a hiking trip, she contracted a rare bacterial disease. Her medical costs for treatment, including medicines, tests, and a six-day hospital stay, totaled 88,893. A friend told her that she would have paid less if she had a policy with a stop-loss feature that capped her out-of-pocket expenses at $3,000. Was her friend correct? Show your computations. Then determine which policy would have cost Sarah less and by how much. 5. Calculating the amount of Disability Benefits. Georgia, a widow, has take-home pay of $600 a week from her part-time job. Her disability insurance coverage replaces 70 percent of her earnings after a 4-week waiting period. What amount would she receive in disability benefits if an illness kept Georgia off work for 16 weeks? LO Chapter 12 Life Insurance + 1 EXHIBIT 12-2 Life expectancy tables, all races, 2014 This table helps insurance companies determine insurance premiums Use the table to find the average number of additional years a 25 year old male and female are expected to live Expectation of Life in Years Expectation of Life in Years Age Male Female Age Male Female 0 76,5 81.3 50 29.8 33.4 76.0 80.7 55 25.6 29.0 5 72.0 768 60 21.7 24.7 10 67.1 71.8 65 18.0 20.6 15 621 66.8 70 14.5 16.7 20 573 61.9 75 112 131 25 527 570 BO 8.4 9.8 30 48.0 522 85 6.0 74 35 43 4 474 90 40 388 426 05 29 342 380 100 2.1 23 LC 1. Calculating the Effect of Inflation on Health Care Costs. Recently, per capita spending on health care in the United States was LC about $8,000. If this amount increased by 5 percent a year, what would be the amount of per capita spending for health care in 10 years? 2. Calculating the Amount of Reimbursement from an Insurance Company. The Kelleher family has health insurance coverage that pays 80 percent of out-of-hospital expenses after a $500 deductible per person. If one family member has doctor and prescription medication expenses of $1.100, what amount would the insurance company pay? 3. Comparing the Costs of a Regular Health Insurance Policy and an HMO. A health insurance policy pays 65 percent of physi- LG cal therapy costs after a $200 deductible. In contrast, an HMO charges $15 per visit for physical therapy. How much would a person save with the HMO if he or she had 10 physical therapy sessions costing $50 each? 4. Calculating the Cost of Health Care Coverage with and without a Stop-Loss Policy. Sarah's comprehensive major medical LO health insurance plan at work has a deductible of $750. The policy pays 85 percent of any amount above the deductible. While on a hiking trip, she contracted a rare bacterial disease. Her medical costs for treatment, including medicines, tests, and a six-day hospital stay, totaled 88,893. A friend told her that she would have paid less if she had a policy with a stop-loss feature that capped her out-of-pocket expenses at $3,000. Was her friend correct? Show your computations. Then determine which policy would have cost Sarah less and by how much. 5. Calculating the amount of Disability Benefits. Georgia, a widow, has take-home pay of $600 a week from her part-time job. Her disability insurance coverage replaces 70 percent of her earnings after a 4-week waiting period. What amount would she receive in disability benefits if an illness kept Georgia off work for 16 weeks? LO Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started