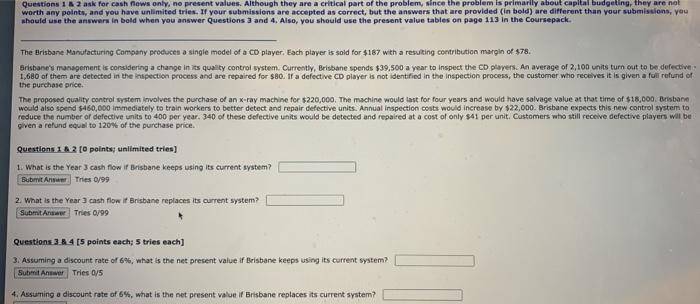

Questions 1 & 2 ask for cash rows only, no present values. Although they are a critical part of the problem since the problem is primarily about capital budgeting, they are not worth any points, and you have unlimited tries. If your submissions are accepted as correct, but the answers that are provided (in bold) are different than your submissions, you should use the answers in bold when you answer Questions 3 and 4. Also, you should use the present value tables on page 113 in the Coursepack. The Brisbane Manufacturing Company produces a single model of a CD player. Each player is sold for $187 with a resulting contribution margin of $78. Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $39,500 a year to Inspect the CD players. An average of 2,100 units turn out to be defective 1,680 of them are detected in the inspection process and are repaired for $80. If a defective CD player is not identified in the inspection process, the customer who receives it is given a full refund of the purchase price The proposed quality control system involves the purchase of an x-ray machine for $220,000. The machine would last for four years and would have salvage value at that time of $18,000. Brisbane would also spend $460,000 immediately to train workers to better detect and repair defective units. Annual inspection cost would increase by $22,000. Brisbane expects this new control system to reduce the number of defective units to 400 per year. 340 of these defective units would be detected and repaired at a cost of only $41 per unit. Customers who still receive defective players will be given a refund equal to 120% of the purchase price. Questions 12 points: unlimited tries) 1. What is the Year 3 cash flow if Brisbane keeps using its current system? Bubmit A Tries 0/99 2. What is the Year 3 cash flow if Brisbane replaces its current system? Submit Answer: Tries 0/99 Questions 3.84 [5 points each; 5 tries each) 3. Assuming a discount rate of 6%, what is the net present value if Brisbane keeps using its current system? Submit Ansvar Tries / 4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system? Questions 1 & 2 ask for cash rows only, no present values. Although they are a critical part of the problem since the problem is primarily about capital budgeting, they are not worth any points, and you have unlimited tries. If your submissions are accepted as correct, but the answers that are provided (in bold) are different than your submissions, you should use the answers in bold when you answer Questions 3 and 4. Also, you should use the present value tables on page 113 in the Coursepack. The Brisbane Manufacturing Company produces a single model of a CD player. Each player is sold for $187 with a resulting contribution margin of $78. Brisbane's management is considering a change in its quality control system. Currently, Brisbane spends $39,500 a year to Inspect the CD players. An average of 2,100 units turn out to be defective 1,680 of them are detected in the inspection process and are repaired for $80. If a defective CD player is not identified in the inspection process, the customer who receives it is given a full refund of the purchase price The proposed quality control system involves the purchase of an x-ray machine for $220,000. The machine would last for four years and would have salvage value at that time of $18,000. Brisbane would also spend $460,000 immediately to train workers to better detect and repair defective units. Annual inspection cost would increase by $22,000. Brisbane expects this new control system to reduce the number of defective units to 400 per year. 340 of these defective units would be detected and repaired at a cost of only $41 per unit. Customers who still receive defective players will be given a refund equal to 120% of the purchase price. Questions 12 points: unlimited tries) 1. What is the Year 3 cash flow if Brisbane keeps using its current system? Bubmit A Tries 0/99 2. What is the Year 3 cash flow if Brisbane replaces its current system? Submit Answer: Tries 0/99 Questions 3.84 [5 points each; 5 tries each) 3. Assuming a discount rate of 6%, what is the net present value if Brisbane keeps using its current system? Submit Ansvar Tries / 4. Assuming a discount rate of 6%, what is the net present value if Brisbane replaces its current system