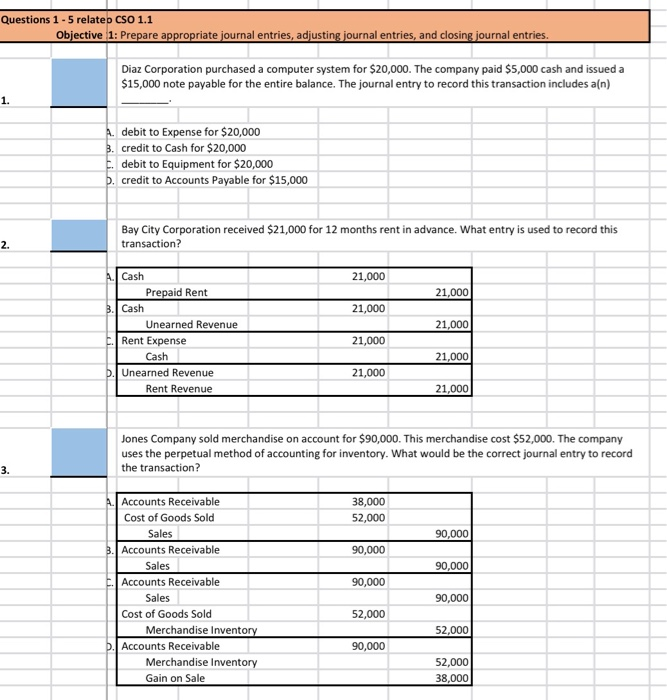

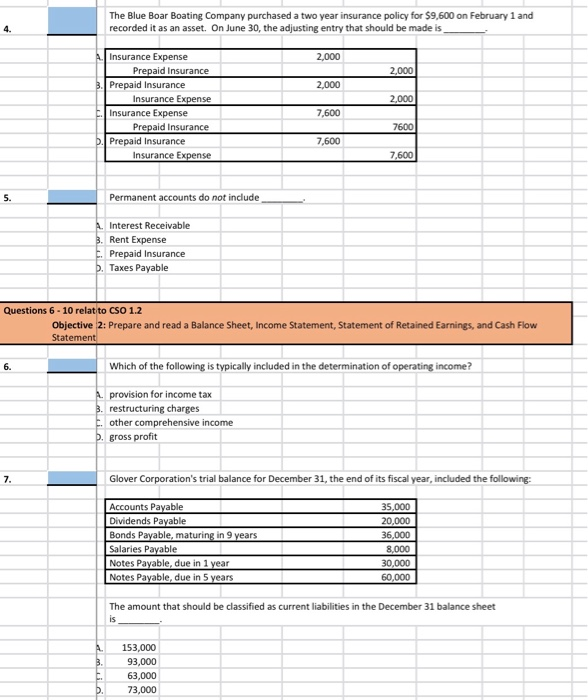

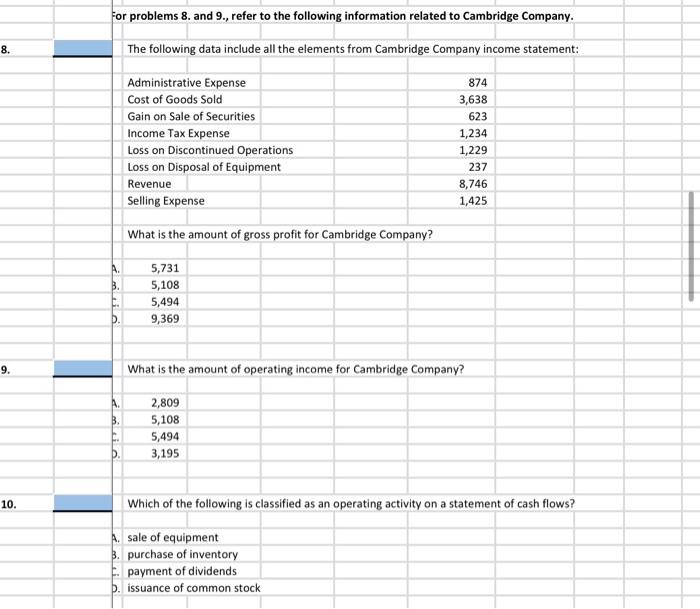

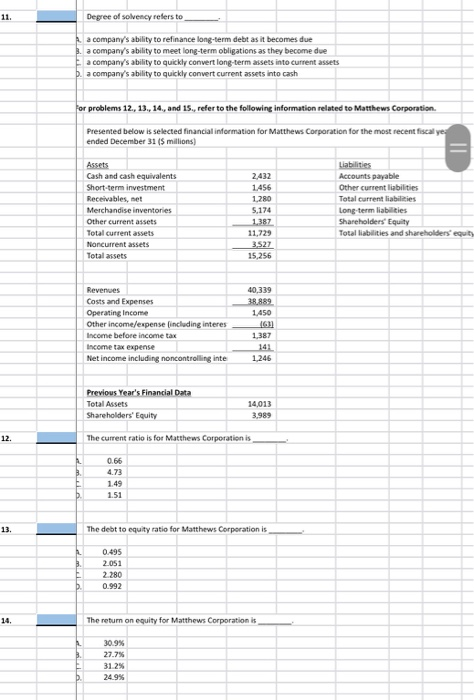

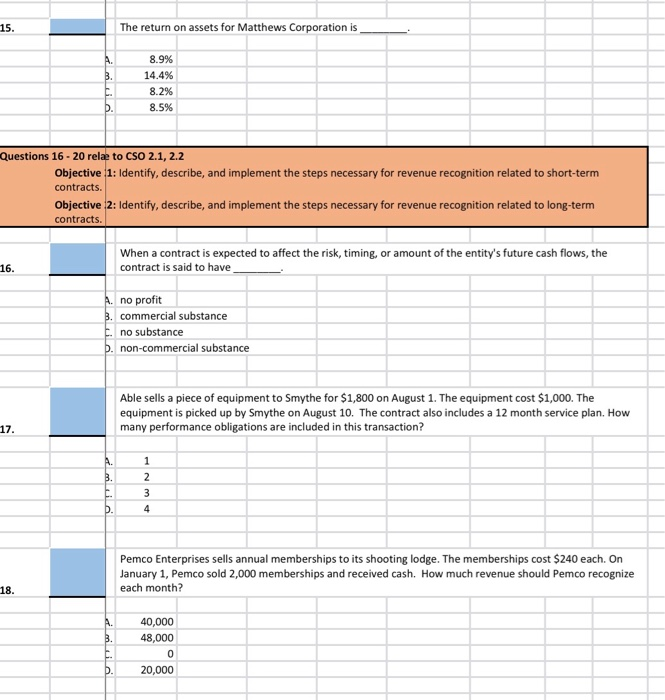

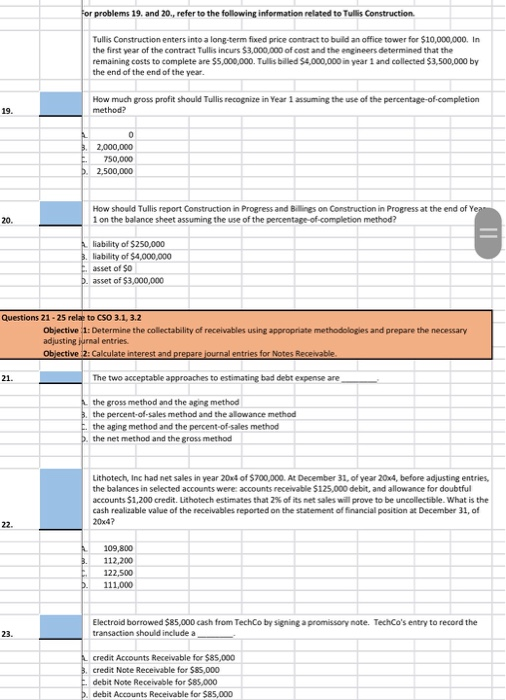

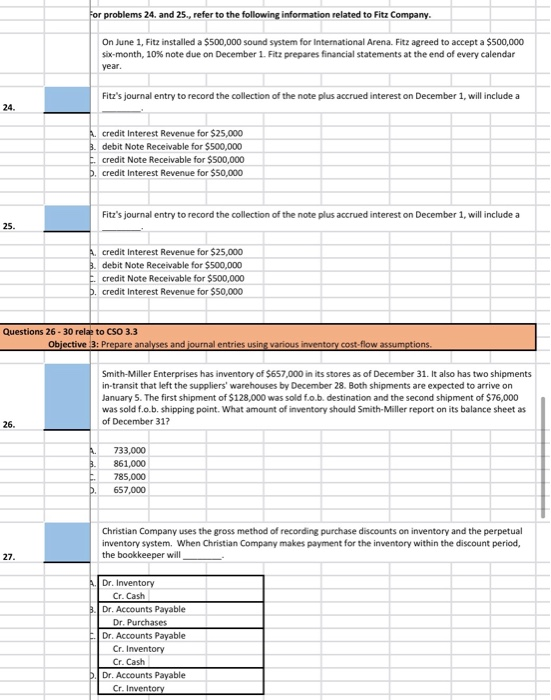

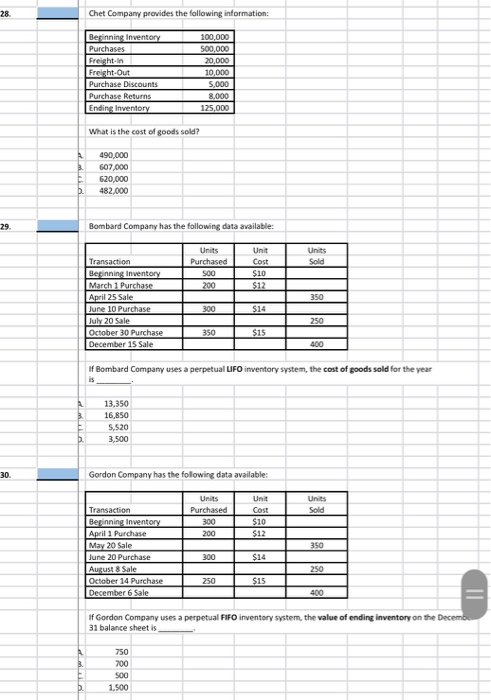

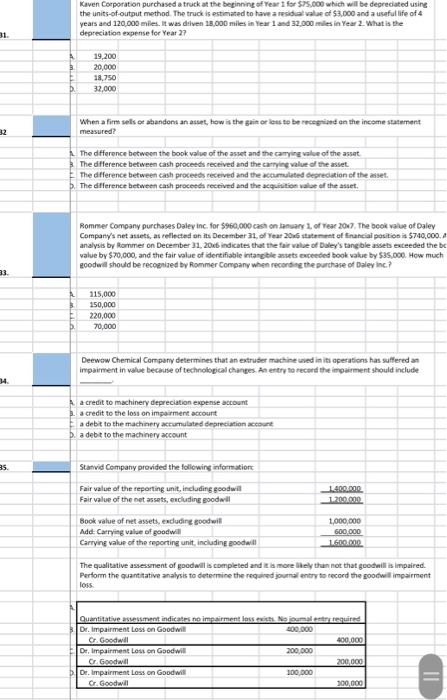

Questions 1 - 5 related CSO 1.1 Objective 1: Prepare appropriate journal entries, adjusting journal entries, and closing journal entries. Diaz Corporation purchased a computer system for $20,000. The company paid $5,000 cash and issued a $15,000 note payable for the entire balance. The journal entry to record this transaction includes a(n) A. debit to Expense for $20,000 3. credit to Cash for $20,000 debit to Equipment for $20,000 credit to Accounts Payable for $15,000 Bay City Corporation received $21,000 for 12 months rent in advance. What entry is used to record this transaction? 21,000 21,000 21,000 21,000 A Cash Prepaid Rent B. Cash Unearned Revenue Rent Expense Cash D. Unearned Revenue Rent Revenue 21,000 21,000 21,000 21,000 Jones Company sold merchandise on account for $90,000. This merchandise cost $52,000. The company uses the perpetual method of accounting for inventory. What would be the correct journal entry to record the transaction? 38,000 52,000 90,000 90,000 90,000 90,000 Al Accounts Receivable Cost of Goods Sold Sales B. Accounts Receivable Sales C. Accounts Receivable Sales Cost of Goods Sold Merchandise Inventory D. Accounts Receivable Merchandise Inventory Gain on Sale 90,000 52,000 52,000 90,000 52,000 38,000 The Blue Boar Boating Company purchased a two year insurance policy for $9,600 on February 1 and recorded it as an asset. On June 30, the adjusting entry that should be made is 2,000 2,000 2,000 2,000 1. Insurance Expense Prepaid Insurance 3. Prepaid Insurance Insurance Expense Insurance Expense Prepaid insurance b. Prepaid Insurance Insurance Expense 7,600 7600 7,600 7,600 5.- Permanent accounts do not include A. Interest Receivable 3. Rent Expense 1. Prepaid Insurance b. Taxes Payable Questions 6 - 10 relat to CSO 1.2 Objective 2: Prepare and read a Balance Sheet, Income Statement, Statement of Retained Earnings, and Cash Flow Statement Which of the following is typically included in the determination of operating income? A provision for income tax 3. restructuring charges . other comprehensive income D. gross profit Glover Corporation's trial balance for December 31, the end of its fiscal year, included the following: Accounts Payable Dividends Payable Bonds Payable, maturing in 9 years Salaries Payable Notes Payable, due in 1 year Notes Payable, due in 5 years 35,000 20,000 36,000 8,000 30,000 60,000 The amount that should be classified as current liabilities in the December 31 balance sheet 153,000 93,000 63,000 73,000 For problems 8. and 9., refer to the following information related to Cambridge Company. The following data include all the elements from Cambridge Company income statement: Administrative Expense Cost of Goods Sold Gain on Sale of Securities Income Tax Expense Loss on Discontinued Operations Loss on Disposal of Equipment Revenue Selling Expense 874 3,638 623 1,234 1,229 237 8,746 1,425 What is the amount of gross profit for Cambridge Company? 5,731 5,108 5,494 9,369 What is the amount of operating income for Cambridge Company? 2,809 5,108 5,494 3,195 10. Which of the following is classified as an operating activity on a statement of cash flows? A. sale of equipment B. purchase of inventory F. payment of dividends D. issuance of common stock Degree of solvency refers to a company's ability to refinance long-term debt as it becomes due B. a company's ability to meet long-term obligations as they become due a company's ability to quickly convert long-term assets into current assets D. a company's ability to quickly convert current assets into cash For problems 12., 13., 14., and 15., refer to the following information related to Matthews Corporation Presented below is selected financial information for Matthews Corporation for the most recent fiscal ye ended December 31 ($ millions) 2.432 1.456 1.280 Assets Cash and cash equivalents Short-term investment Receivables, net Merchandise inventories Other current assets Total current assets Noncurrent assets Total assets Liabilities Accounts payable Other current liabilities Total current liabilities Long-term liabilities Shareholders' Equity Total liabilities and shareholders' equity 5.174 1387 11,729 3,527 15,256 40.339 38 889 1.450 Revenues Costs and Expenses Operating Income Other income/expense including interes Income before income tax Income tax expense Net income including noncontrolling inte 1187 14: 1.246 Previous Year's Financial Data Total Assets Shareholders' Equity 14.013 3.989 The current ratio is for Matthews Corporation is The debt to equity ratio for Matthews Corporation is 0.495 2.051 2 280 0.992 The return on equity for Matthews Corporation is 30.9% 27.7% 31 295 24.9% The return on assets for Matthews Corporation is 8.9% 14.4% 8.2% 8.5% Questions 16-20 rela to CSO 2.1, 2.2 Objective 1: Identify, describe, and implement the steps necessary for revenue recognition related to short-term contracts. Objective 2: Identify, describe, and implement the steps necessary for revenue recognition related to long-term contracts. When a contract is expected to affect the risk, timing, or amount of the entity's future cash flows, the contract is said to have 16. A. no profit B. commercial substance no substance D. non-commercial substance Able sells a piece of equipment to Smythe for $1,800 on August 1. The equipment cost $1,000. The equipment is picked up by Smythe on August 10. The contract also includes a 12 month service plan. How many performance obligations are included in this transaction? 2 3 Pemco Enterprises sells annual memberships to its shooting lodge. The memberships cost $240 each. On January 1, Pemco sold 2,000 memberships and received cash. How much revenue should Pemco recognize each month? 40,000 48,000 20,000 for problems 19. and 20., refer to the following information related to Tulis Construction Tullis Construction enters into a long-term fixed price contract to build an office tower for $10.000.000. In the first year of the contract Tulis incurs $3.000.000 of cost and the engineers determined that the remaining costs to complete are $5,000,000. Tulis billed $4,000,000 in year 1 and collected $3,500,000 by the end of the end of the year. How much gross profit should Tulis recognize in Year 1 assuming the use of the percentage of completion method 19 2,000,000 750,000 b. 2,500,000 20 How should Tullis report Construction in Progress and Bilines on Construction in Progress at the end of Year 1 on the balance sheet assuming the use of the percentage of completion method? liability of $250,000 liability of $4,000,000 asset of $0 b.asset of $3,000,000 Questions 21 - 25 rela to CSO 3.1, 3.2 Objective 1: Determine the collectability of receivables using appropriate methodologies and prepare the necessary adjusting jurnal entries. Obiective 2: Calculate interest and prepare journal entries for Notes Receivable The two acceptable approaches to estimating bad debt expense are the gross method and the aging method 3. the percent of sales method and the allowance method the aging method and the percent-of-sales method b. the net method and the gross method Lithotech, Inc had net sales in year 20 of $700,000. At December 31. of year 2014, before adjusting entries the balances in selected accounts were accounts receivable $125.000 debit, and allowance for doubtful accounts $1.200 credit. Lithotech estimates that 2% of its net sales will prove to be uncollectible. What is the cash realicable value of the receivables reported on the statement of financial position at December 31, of 204? 109,800 112,200 122.500 111.000 Electroid borrowed $85,000 cash from TechCo by signing a promissory note. TechCo's entry to record the transaction should include credit Accounts Receivable for $85.000 3. credit Note Receivable for SAS.000 Edebit Note Receivable for $85.000 b. debit Accounts Receivable for $85.000 For problems 24. and 25., refer to the following information related to Fitz Company. On June 1, Fitz installed a $500,000 sound system for International Arena. Fitz agreed to accept a $500,000 six-month, 10% note due on December 1. Fitz prepares financial statements at the end of every calendar year. Fitz's journal entry to record the collection of the note plus accrued interest on December 1, will include a 24. A. credit Interest Revenue for $25,000 3. debit Note Receivable for $500,000 credit Note Receivable for $500,000 b. credit Interest Revenue for $50,000 Fitz's journal entry to record the collection of the note plus accrued interest on December 1, will include a 25. A. credit Interest Revenue for $25,000 B. debit Note Receivable for $500,000 1. credit Note Receivable for $500,000 b. credit Interest Revenue for $50,000 Questions 26 - 30 rela to CSO 3.3 Objective 3: Prepare analyses and journal entries using various inventory cost-flow assumptions. Smith-Miller Enterprises has inventory of $657,000 in its stores as of December 31. It also has two shipments in transit that left the suppliers' warehouses by December 28. Both shipments are expected to arrive on January 5. The first shipment of $128,000 was sold f.o.b. destination and the second shipment of $76,000 was sold f.o.b. shipping point. What amount of inventory should Smith-Miller report on its balance sheet as of December 317 26. 733,000 861,000 785,000 657,000 Christian Company uses the gross method of recording purchase discounts on inventory and the perpetual inventory system. When Christian Company makes payment for the inventory within the discount period, the bookkeeper will 27. Dr. Inventory Cr. Cash B. Dr. Accounts Payable Dr. Purchases Dr. Accounts Payable Cr. Inventory Cr. Cash Dr. Accounts Payable Cr. Inventory Chet Company provides the following information Beginning inventory Purchases Freight-in Freight-Out Purchase Discounts Purchase Returns Ending Inventory 100.000 500.000 20.000 10,000 S.000 8.000 125.000 What is the cost of goods sold? 490,000 607 000 620,000 482,000 Bombard Company has the following data available: Units Units Purchased Sold Unit Cost $10 $12 SOO 200 350 Transaction Beginning inventory March 1 Purchase April 25 Sale June 10 Purchase I July 20 Sale October 30 Purchase December 15 Sale 300 $14 250 350 $15 400 of Bombard Company uses a perpetual LIFO inventory system, the cost of goods sold for the year 13,350 16,850 5,520 3.500 Gordon Company has the following data available: Units Purchased 300 Sold Cost $10 $12 350 Beginning inventory April 1Purchase May 20 Sale June 20 Purchase Auct Sale October 14 Purchase December 6 Sale 300 S 14 250 $15 400 of Gordon Company uses a perpetual FIFO inventory system, the value of ending inventory on the December 31 balance sheet is 750 700 500 1.500 Kaven Corporation purchased a truck at the beginning of Year 1 for $75.which will be depreciated using the units of output method. The truck is estimated to have a residual of $2.000 and a selfie of 4 years and 120.000 miles. It was driven 1 000 miles in urd 12000 Year What is the depreciation expense for Year 27 19,200 20 000 1.750 or abandonanthesis the girls to be read on the income statement When a firm measured The difference between the book value of these and the camping of the The difference between cash proceeds received and the carrying Value of the The difference between cash proceeds received and the counted depreciation of the The difference between cash proceeds received and the acquisition value of the asset set Rommer Company purchases Daley inc. for 960.000 cash onl y of Year 2017. The book value of Daley Company's net assets, as reflected on its December 31. of Year 2016 mentofacial position is $740,000 analysis by Rommer on December 31 20 indicates that the wall of Duty's tangible w ewceeded the be value by $70,000, and the fair value of identifiable anbeste ded book value by S5 000. How much goodwill should be recognized by Rommer Company when recording the purchase of Daleyinc.? 115,000 150,000 220,000 70,000 Deewow Chemical Company determines that an extruder machine wed in its operations has suffered an impairment in value because of technolopical changes. An entry to record the impairment should include a credit to machinery depreciation expense account a credit to the loss on impairment account a debit to the machinery accumulated depreciation account Da debit to the machinery account Stanvid Company provided the following information Fair value of the reporting unit, including goodwill Fair value of the new s, excluding goodwill LARRA 12 1.000.000 Book value of net assets, excluding goodwill Add: Carrying value of goodwill Carrying value of the reporting unit including soda The qualitative assessment of goods come and more than not that go e d Perform the quantitative analysis to determine the required journal entry to record the goodwill impairment o required Louitative indicati Demparent Loss on Goodwil O Goodwill Dr. Impairment loss on Goodwil 600 l 200.00 De Impairment Loss on Goodwill O Goodal 900.000