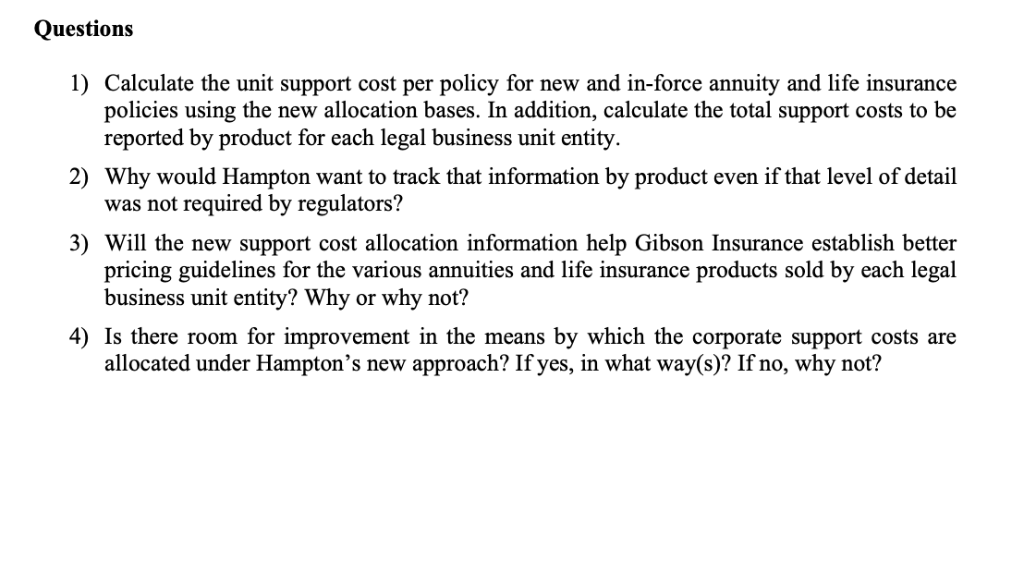

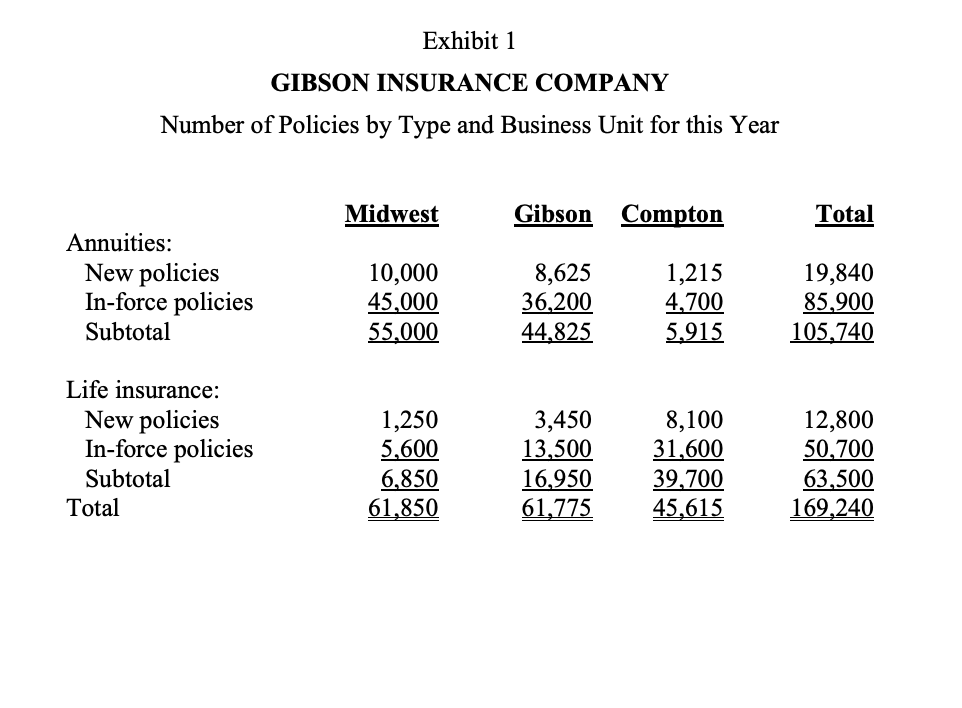

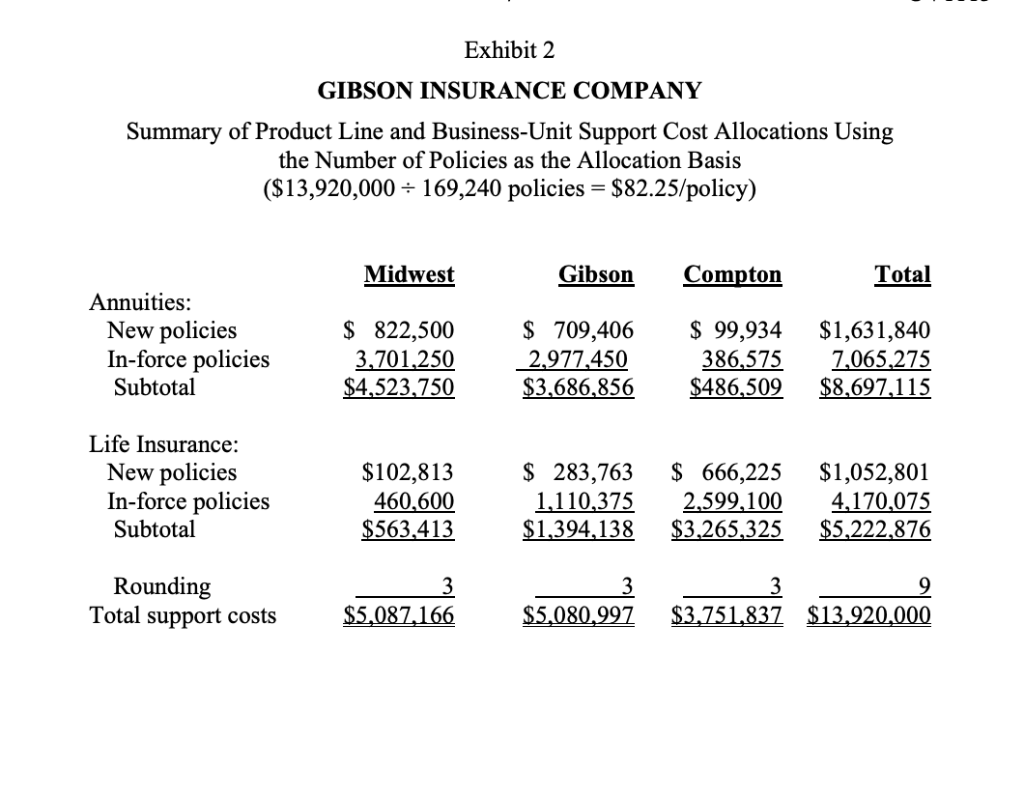

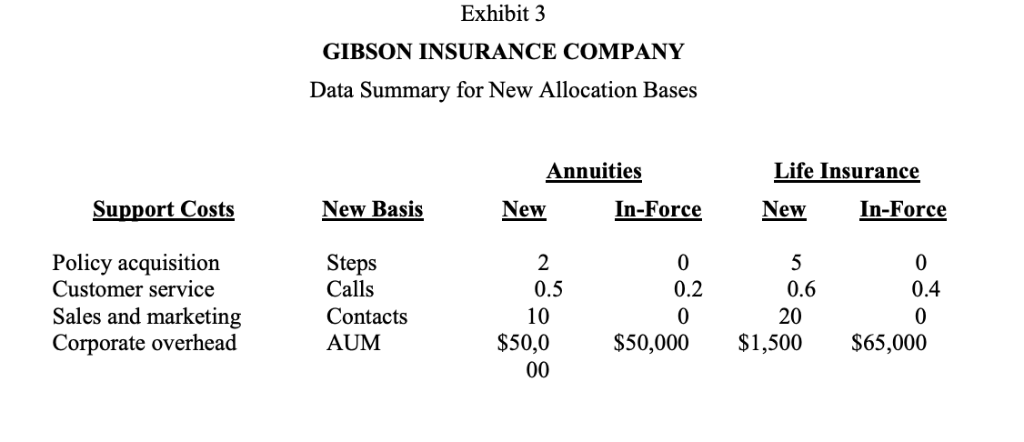

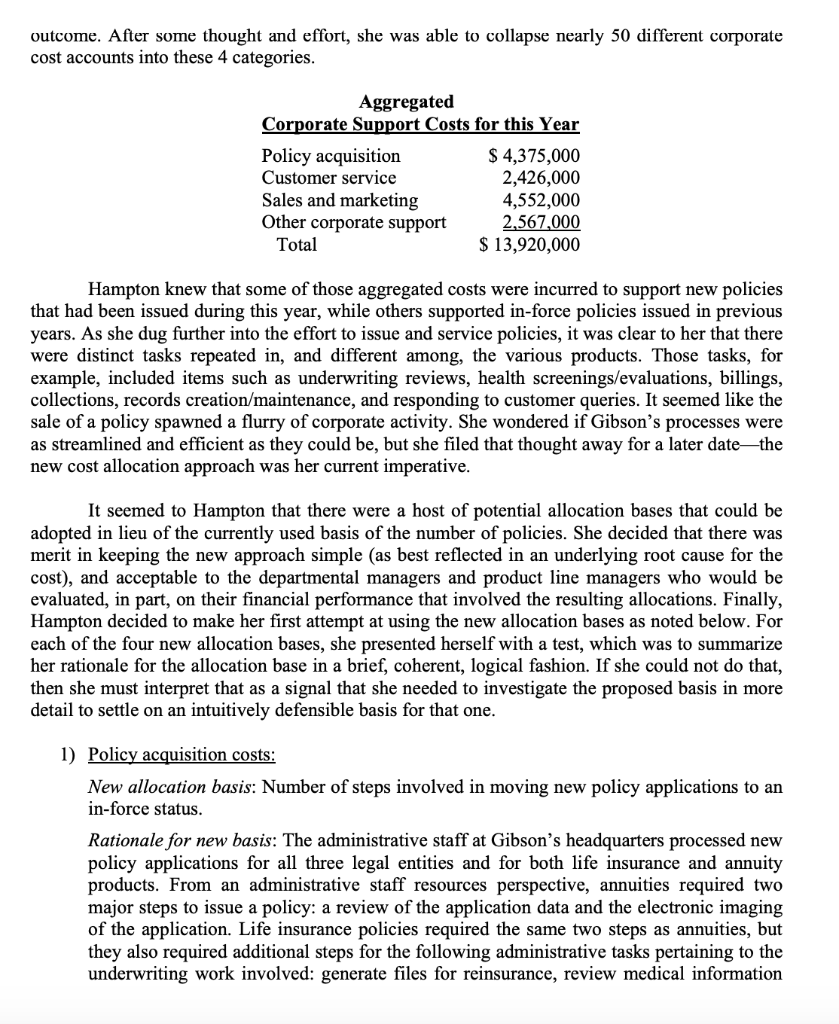

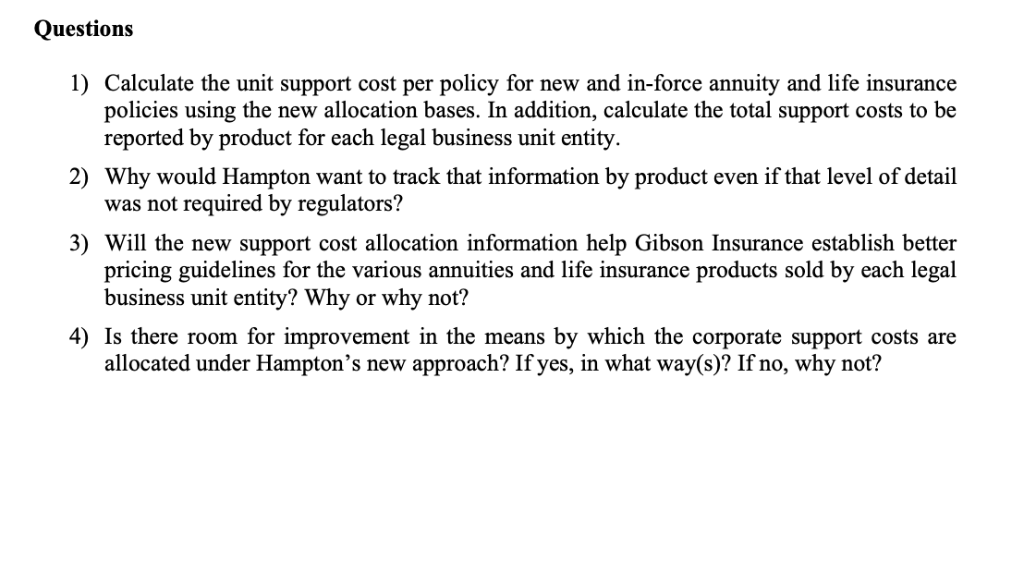

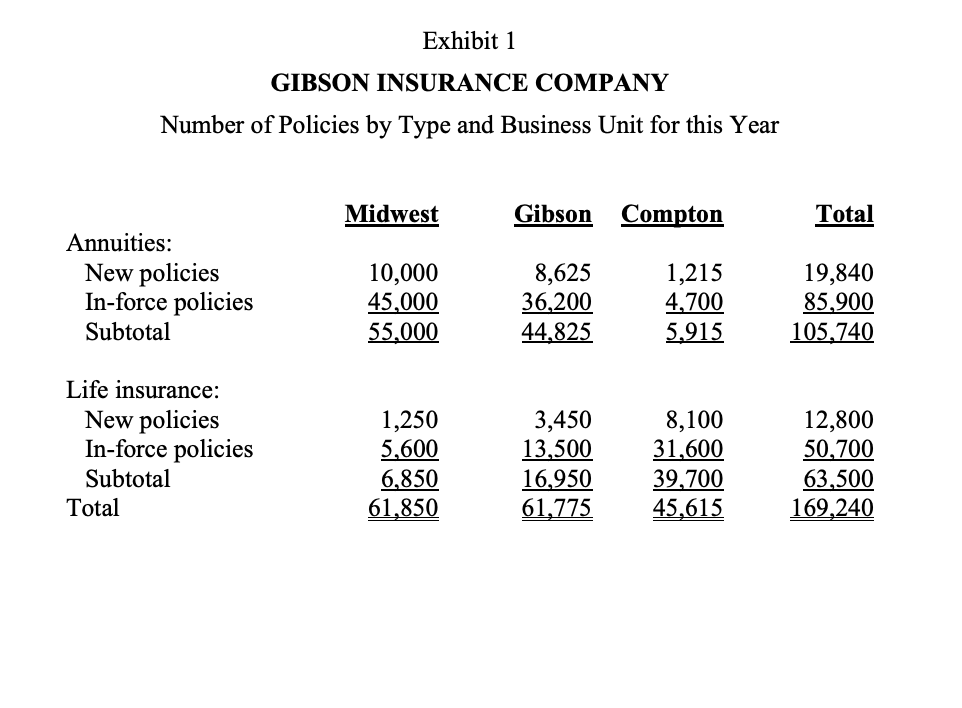

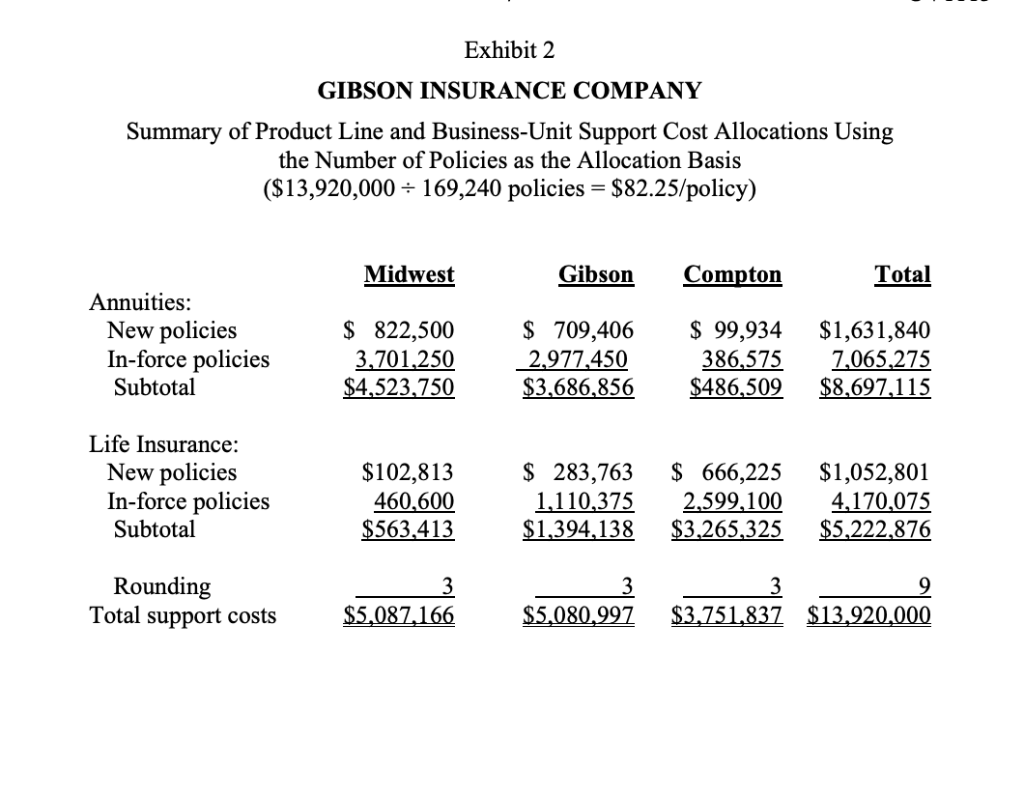

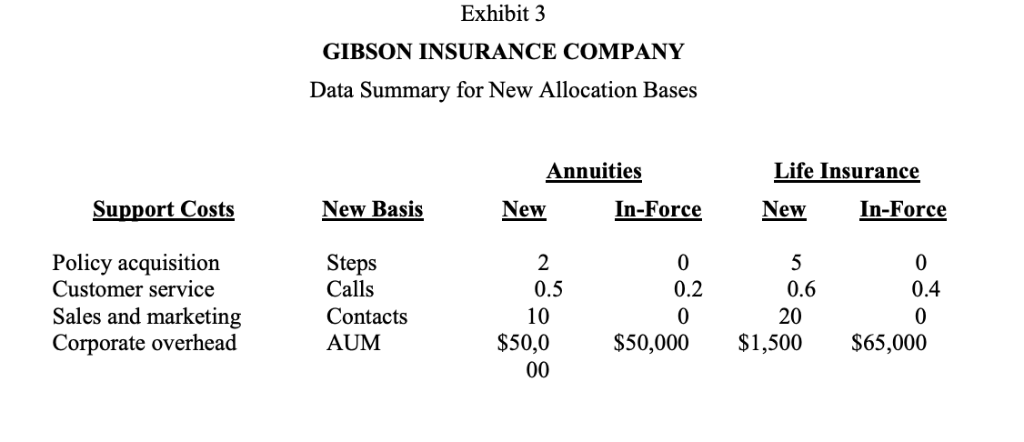

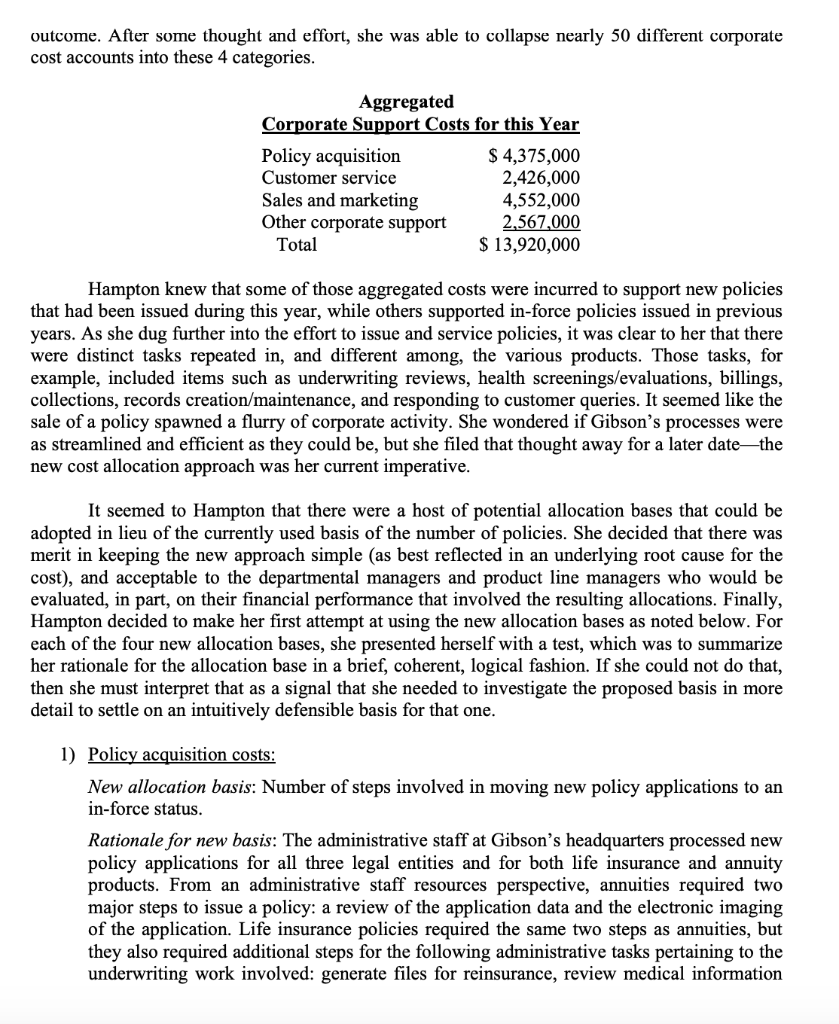

Questions 1) Calculate the unit support cost per policy for new and in-force annuity and life insurance policies using the new allocation bases. In addition, calculate the total support costs to be reported by product for each legal business unit entity. was not required by regulators? pricing guidelines for the various annuities and life insurance products sold by each legal 2) Why would Hampton want to track that information by product even if that level of detail 3) Will the new support cost allocation information help Gibson Insurance establish better business unit entity? Why or why not? 4) Is there room for improvement in the means by which the corporate support costs are allocated under Hampton's new approach? If yes, in what way(s)? If no, why not? Exhibit1 GIBSON INSURANCE COMPANY Number of Policies by Type and Business Unit for this Year Midwest Gibson Compton Total Annuities: New policies In-force policies Subtotal 10,000 45.000 55,000 8,625 36,200 44,82 1,215 4.700 19,840 85,900 5,915105740 Life insurance: New policies In-force policies Subtotal 1,250 5.600 6.850 61850 3,450 13,500 16,950 8,100 31,600 39.700 45,615 12,800 50,700 1,775 63.500 169,240 Total Exhibit2 GIBSON INSURANCE COMPANY Summary of Product Line and Business-Unit Support Cost Allocations Using the Number of Policies as the Allocation Basis (S13,920,000 + 169,240 policies- $82.25/policy) Midwest Gibson Compton Total Annuities: New policies In-force policies Subtotal S 822,500 3.701250 4,523.750 S 709,406$ 99,934 $1,631,840 386,575 7.065.275 $3.686.856 $486.502 S8.697.115 2,977.450 Life Insurance: New policies In-force policies Subtotal $102,813 460,600 $563.413 S 283,763$ 666,225$1,052,801 1.110,375 2.599,100 4,170,075 $3.265 325 $5222 876 $1394.138 Rounding Total support costs Exhibit;3 GIBSON INSURANCE COMPANY Data Summary for New Allocation Bases Annuities Life Insurance Support Costs New Basis New In-Force New In-Force Policy acquisition Customer service Sales and marketing Corporate overhead Steps Calls Contacts AUM 0.5 10 0.2 0 0.6 20 0.4 $50,0 $50,000 $1,500$65,000 outcome. After some thought and effort, she was able to collapse nearly 50 different corporate cost accounts into these 4 categories Aggregated Corporate Support Costs for this Year Policy acquisition Customer service Sales and marketing Other corporate support S 4,375,000 2,426,000 4,552,000 2.567,000 S 13,920,000 Total Hampton knew that some of those aggregated costs were incurred to support new policies that had been issued during this year, while others supported in-force policies issued in previous years. As she dug further into the effort to issue and service policies, it was clear to her that there were distinct tasks repeated in, and different among, the various products. Those tasks, for example, included items such as underwriting reviews, health screenings/evaluations, billings, collections, records creation/maintenance, and responding to customer queries. It seemed like the sale of a policy spawned a flurry of corporate activity. She wondered if Gibson's processes were as streamlined and efficient as they could be, but she filed that thought away for a later date -the new cost allocation approach was her current imperative It seemed to Hampton that there were a host of potential allocation bases that could be adopted in lieu of the currently used basis of the number of policies. She decided that there was merit in keeping the new approach simple (as best reflected in an underlying root cause for the cost), and acceptable to the departmental managers and product line managers who would be evaluated, in part, on their financial performance that involved the resulting allocations. Finally, Hampton decided to make her first attempt at using the new allocation bases as noted below. For each of the four new allocation bases, she presented herself with a test, which was to summarize her rationale for the allocation base in a brief, coherent, logical fashion. If she could not do that, then she must interpret that as a signal that she needed to investigate the proposed basis in more detail to settle on an intuitively defensible basis for that one 1) Policy acquisition costs New allocation basis: Number of steps involved in moving new policy applications to an in-force status Rationale for new basis: The administrative staff at Gibson's headquarters processed new policy applications for all three legal entities and for both life insurance and annuity products. From an administrative staff resources perspective, annuities required two major steps to issue a policy: a review of the application data and the electronic imaging of the application. Life insurance policies required the same two steps as annuities, but they also required additional steps for the following administrative tasks pertaining to the underwriting work involved: generate files for reinsurance, review medical information Questions 1) Calculate the unit support cost per policy for new and in-force annuity and life insurance policies using the new allocation bases. In addition, calculate the total support costs to be reported by product for each legal business unit entity. was not required by regulators? pricing guidelines for the various annuities and life insurance products sold by each legal 2) Why would Hampton want to track that information by product even if that level of detail 3) Will the new support cost allocation information help Gibson Insurance establish better business unit entity? Why or why not? 4) Is there room for improvement in the means by which the corporate support costs are allocated under Hampton's new approach? If yes, in what way(s)? If no, why not? Exhibit1 GIBSON INSURANCE COMPANY Number of Policies by Type and Business Unit for this Year Midwest Gibson Compton Total Annuities: New policies In-force policies Subtotal 10,000 45.000 55,000 8,625 36,200 44,82 1,215 4.700 19,840 85,900 5,915105740 Life insurance: New policies In-force policies Subtotal 1,250 5.600 6.850 61850 3,450 13,500 16,950 8,100 31,600 39.700 45,615 12,800 50,700 1,775 63.500 169,240 Total Exhibit2 GIBSON INSURANCE COMPANY Summary of Product Line and Business-Unit Support Cost Allocations Using the Number of Policies as the Allocation Basis (S13,920,000 + 169,240 policies- $82.25/policy) Midwest Gibson Compton Total Annuities: New policies In-force policies Subtotal S 822,500 3.701250 4,523.750 S 709,406$ 99,934 $1,631,840 386,575 7.065.275 $3.686.856 $486.502 S8.697.115 2,977.450 Life Insurance: New policies In-force policies Subtotal $102,813 460,600 $563.413 S 283,763$ 666,225$1,052,801 1.110,375 2.599,100 4,170,075 $3.265 325 $5222 876 $1394.138 Rounding Total support costs Exhibit;3 GIBSON INSURANCE COMPANY Data Summary for New Allocation Bases Annuities Life Insurance Support Costs New Basis New In-Force New In-Force Policy acquisition Customer service Sales and marketing Corporate overhead Steps Calls Contacts AUM 0.5 10 0.2 0 0.6 20 0.4 $50,0 $50,000 $1,500$65,000 outcome. After some thought and effort, she was able to collapse nearly 50 different corporate cost accounts into these 4 categories Aggregated Corporate Support Costs for this Year Policy acquisition Customer service Sales and marketing Other corporate support S 4,375,000 2,426,000 4,552,000 2.567,000 S 13,920,000 Total Hampton knew that some of those aggregated costs were incurred to support new policies that had been issued during this year, while others supported in-force policies issued in previous years. As she dug further into the effort to issue and service policies, it was clear to her that there were distinct tasks repeated in, and different among, the various products. Those tasks, for example, included items such as underwriting reviews, health screenings/evaluations, billings, collections, records creation/maintenance, and responding to customer queries. It seemed like the sale of a policy spawned a flurry of corporate activity. She wondered if Gibson's processes were as streamlined and efficient as they could be, but she filed that thought away for a later date -the new cost allocation approach was her current imperative It seemed to Hampton that there were a host of potential allocation bases that could be adopted in lieu of the currently used basis of the number of policies. She decided that there was merit in keeping the new approach simple (as best reflected in an underlying root cause for the cost), and acceptable to the departmental managers and product line managers who would be evaluated, in part, on their financial performance that involved the resulting allocations. Finally, Hampton decided to make her first attempt at using the new allocation bases as noted below. For each of the four new allocation bases, she presented herself with a test, which was to summarize her rationale for the allocation base in a brief, coherent, logical fashion. If she could not do that, then she must interpret that as a signal that she needed to investigate the proposed basis in more detail to settle on an intuitively defensible basis for that one 1) Policy acquisition costs New allocation basis: Number of steps involved in moving new policy applications to an in-force status Rationale for new basis: The administrative staff at Gibson's headquarters processed new policy applications for all three legal entities and for both life insurance and annuity products. From an administrative staff resources perspective, annuities required two major steps to issue a policy: a review of the application data and the electronic imaging of the application. Life insurance policies required the same two steps as annuities, but they also required additional steps for the following administrative tasks pertaining to the underwriting work involved: generate files for reinsurance, review medical information