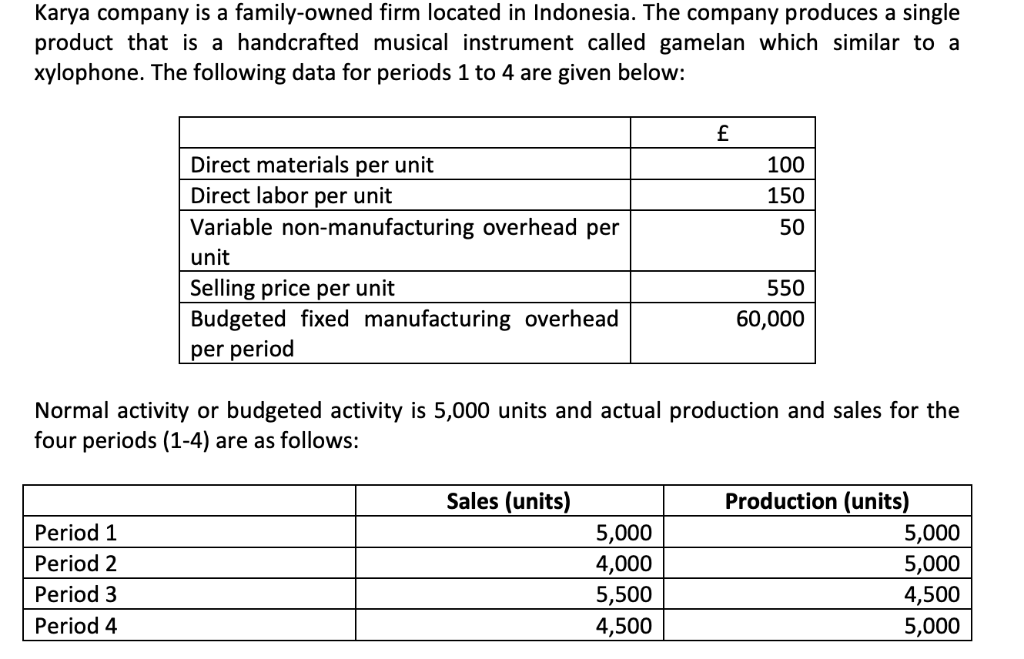

Question

Questions: 1) Determine the product (inventoriable) cost per unit under: a) Absorption costing [1 mark] b) Variable costing. [1 mark] 2) Prepare the statement of

Questions: 1) Determine the product (inventoriable) cost per unit under: a) Absorption costing [1 mark] b) Variable costing. [1 mark]

2) Prepare the statement of profit and loss for periods 1-4 under absorption costing by using the gross margin approach. [12 marks]

3) Prepare the statement of profit and loss for periods 1-4 under variable costing by using the contribution margin approach. [12 marks]

4) Reconcile the absorption and variable costing operating profit figures for each period and explain the differences in the operating profits resulting from the use of the two costing methods. [5 marks]

5) Define the absorption costing system and variable costing system. Discuss the arguments for and against the inclusion of fixed manufacturing overhead in stock valuation for internal profit measurement purposes. [3 marks]

6) Under what circumstances will the operating profit under the variable costing be identical to that under absorption costing? Relate your answer to the results for the previous calculation of operating profit of Karya company for questions 2) and 3). [1 mark]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started