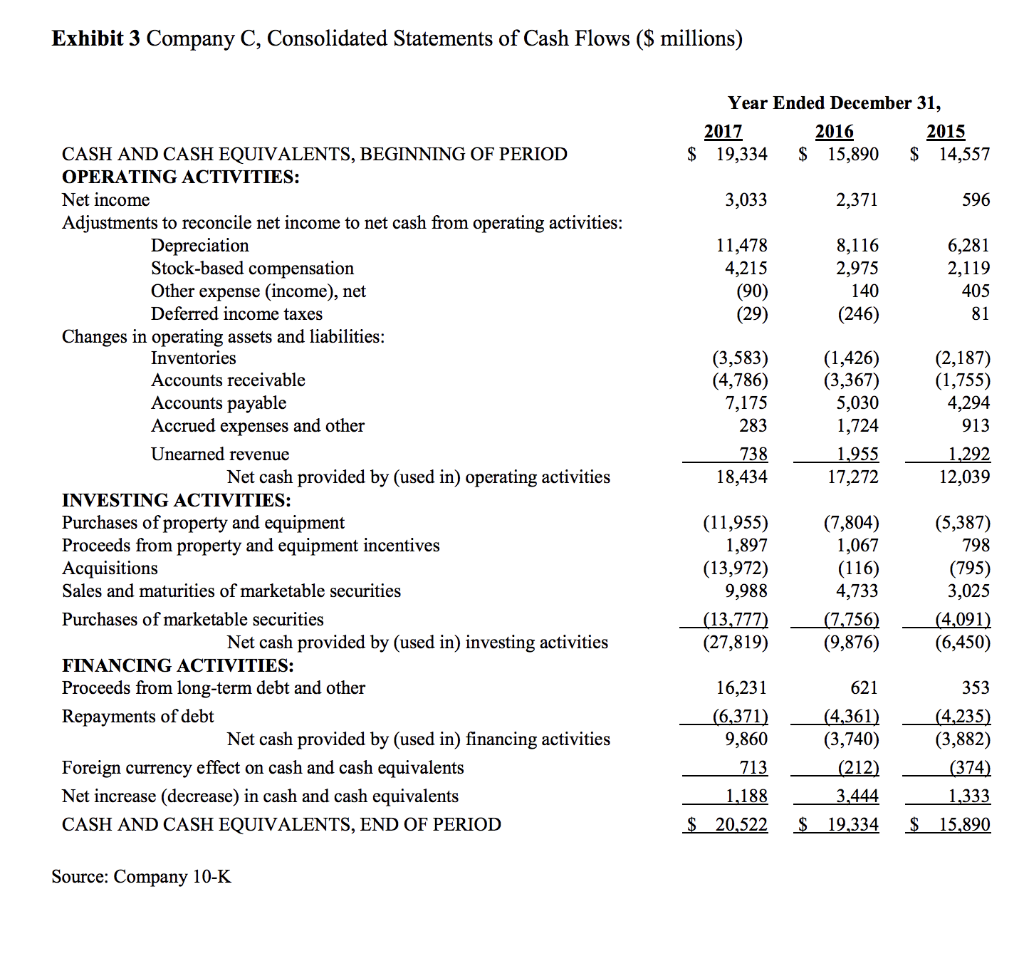

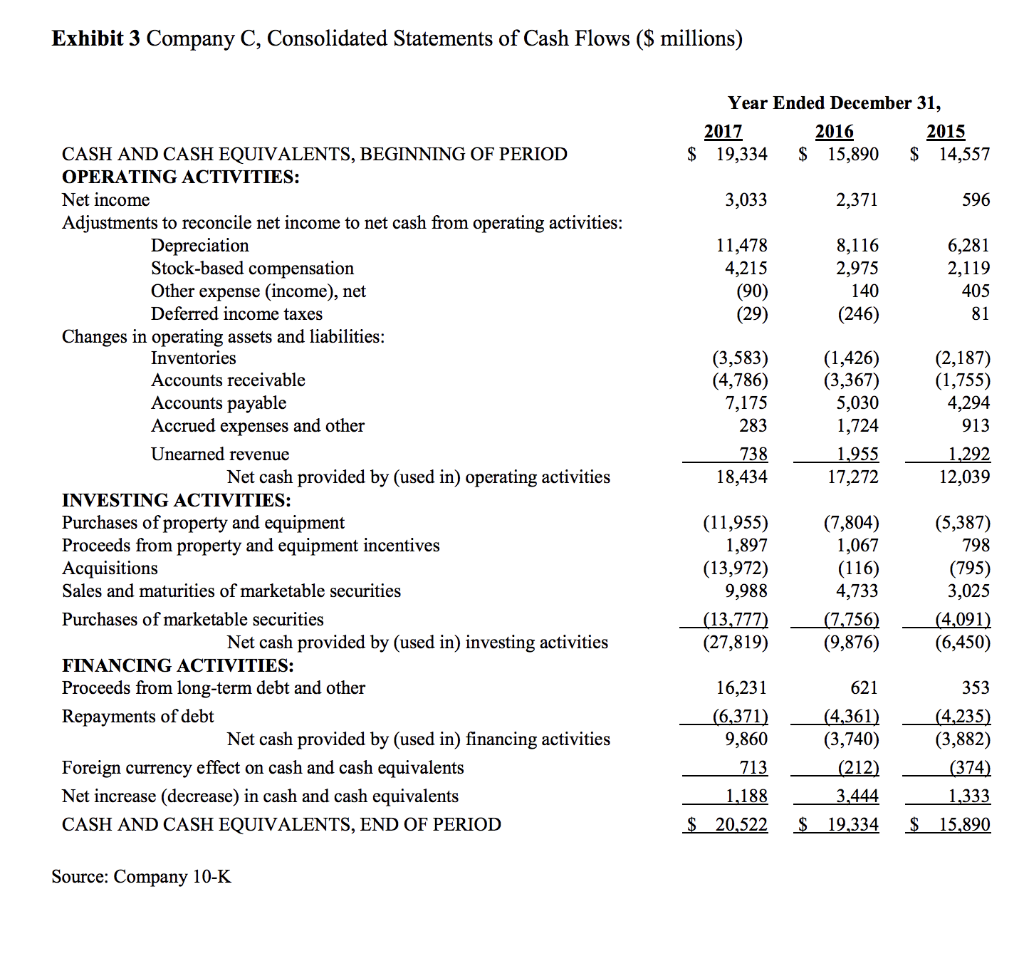

Questions 1. Examine the contents of the three cash flow statements carefully and analyze the situation for each of the three companies. When answering the following questions, please provide a qualitative assessment of major accrual and cash flow components (there is no need for specific numbers). For example, to answer the question Increase in working capital? indicate if the capital increased, decreased, or did not materially change, and then explain which component of working capital contributed most significantly to the change for each of the years. a. List major sources of cash b. List major uses of cash c. Is cash from operations greater than net income? d. List the major reasons for the difference between cash from operations and net income e. Is cash from operations greater than capital expenditures? f. Is cash from operations less than capital expenditures? And how did the company finance their capital expenditures? g. What is the trend in net income? h. What is the trend in cash from operations? i. What is the trend in capital expenditures? j. What is the trend in working capital? 2. Based on your analysis above, what is your overall assessment of the cash flow situation for each company? Please rate each company on a scale of 1 to 5, where 1 indicates that the corporation will declare bankruptcy next year, 3 represents a reasonable cash flow situation with only a few problems noted, and 5 represents an outstanding cash flow situation. Exhibit 3 Company C, Consolidated Statements of Cash Flows ($ millions) Year Ended December 31, 2017 2016 2015 19,334 $ 15,890 $ 14,557 $ 3,033 2,371 596 8,116 2,975 11,478 4,215 (90) (29) 6,281 2,119 405 81 140 (246) (3,583) (4,786) 7,175 283 CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash from operating activities: Depreciation Stock-based compensation Other expense (income), net Deferred income taxes Changes in operating assets and liabilities: Inventories Accounts receivable Accounts payable Accrued expenses and other Unearned revenue Net cash provided by (used in operating activities INVESTING ACTIVITIES: Purchases of property and equipment Proceeds from property and equipment incentives Acquisitions Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (used in) investing activities FINANCING ACTIVITIES: Proceeds from long-term debt and other Repayments of debt Net cash provided by (used in) financing activities Foreign currency effect on cash and cash equivalents Net increase (decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS, END OF PERIOD (1,426) (3,367) 5,030 1,724 1,955 17,272 (2,187) (1,755) 4,294 913 1,292 12,039 738 18,434 (11,955) 1,897 (13,972) 9,988 (13,777) (27,819) (7,804) 1,067 (116) 4,733 (7,756) (9,876) (5,387) 798 (795) 3,025 (4,091) (6,450) 16,231 (6,371) 9,860 713 1,188 20,522 621 (4,361) (3,740) (212) 3,444 19,334 353 (4,235) (3,882) (374) 1,333 15,890 $ $ $ Source: Company 10-K