Question

Questions: 1. How much is the taxable income if the taxpayer is a domestic corporation? 2. How much is the taxable income if the taxpayer

Questions:

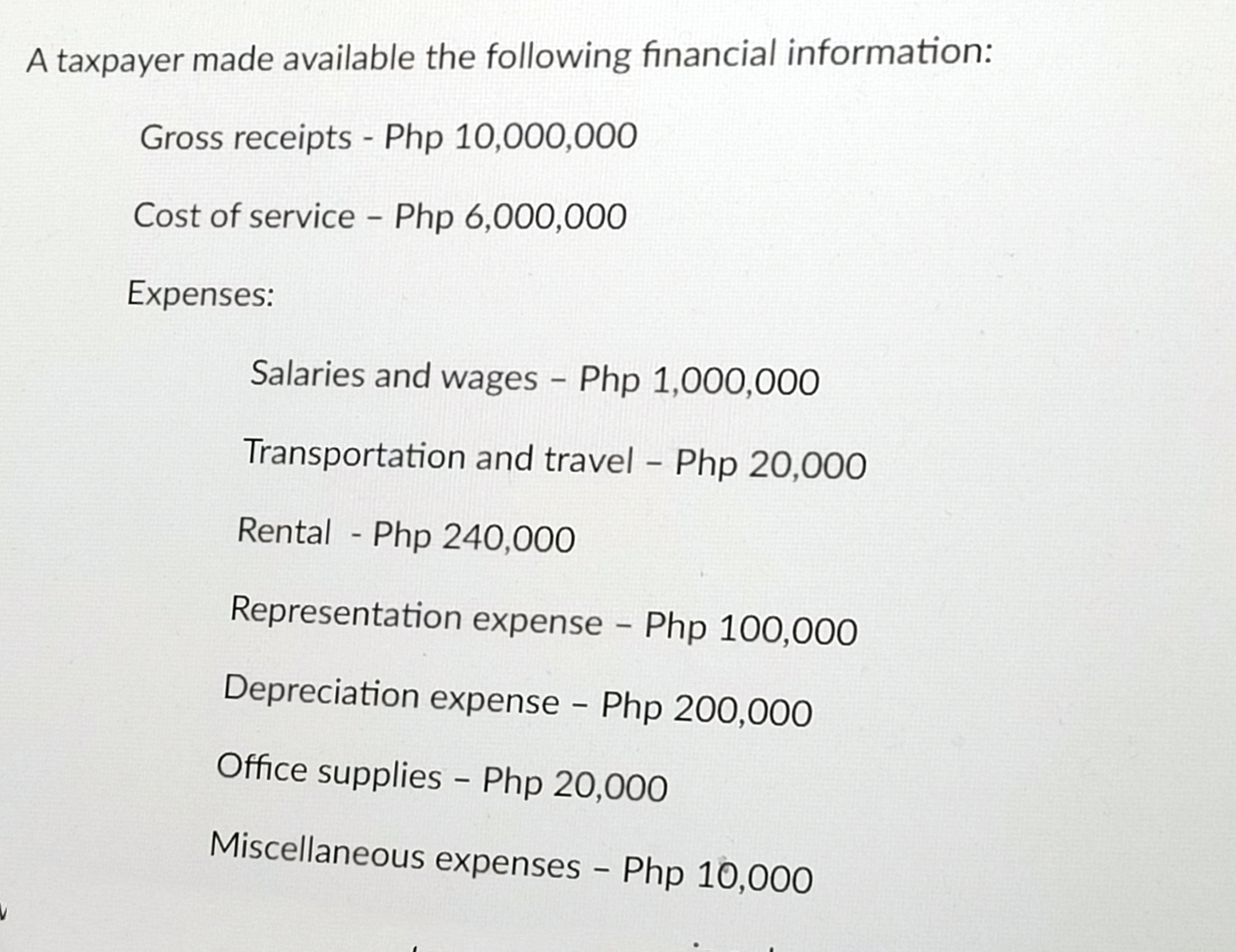

1. How much is the taxable income if the taxpayer is a domestic corporation?

2. How much is the taxable income if the taxpayer is an individual and opted for OSD?

3. How much is the taxable income if the taxpayer is a general professional partnership?

4. How much is the taxable income if the taxpayer is an ordinary partnership and opted OSD?

5. How much is the taxable income if the taxpayer is a individual?

6. How much is the ALLOWABLE DEDUCTION if the taxpayer is a domestic corp.?

7. How much is the taxable income if the taxpayer is a ordinary partnership?

8. How much is the TOTAL ALLOWABLE DEDUCTION if the taxpayer is a resident citizen?

9. How much is the taxable income if the taxpayer is a domestic corporation and opted for OSD?

A taxpayer made available the following financial information: Gross receipts - Php 10,000,000 Cost of service - Php 6,000,000 Expenses: Salaries and wages - Php 1,000,000 Transportation and travel - Php 20,000 Rental - Php 240,000 Representation expense - Php 100,000 Depreciation expense - Php 200,000 Office supplies - Php 20,000 Miscellaneous expenses - Php 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started