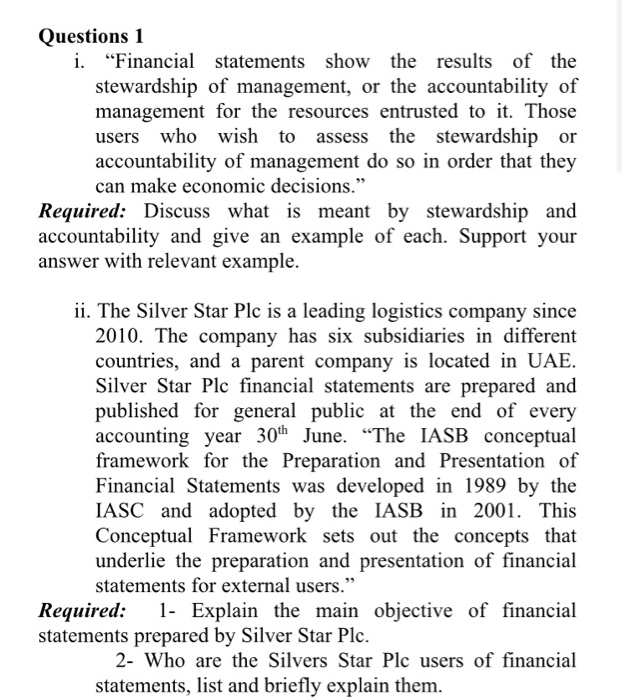

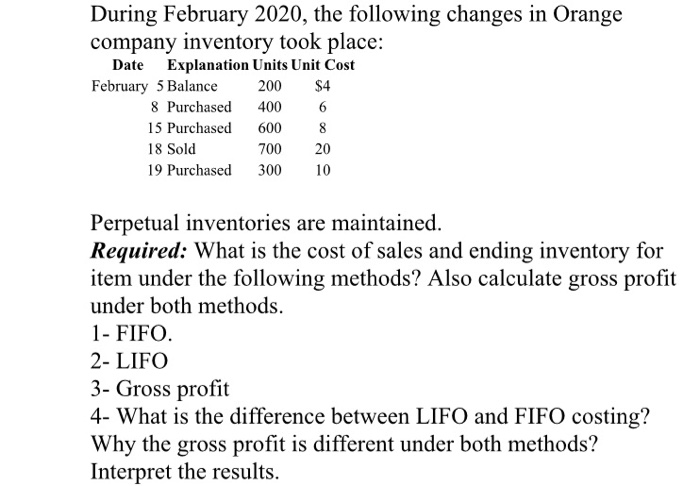

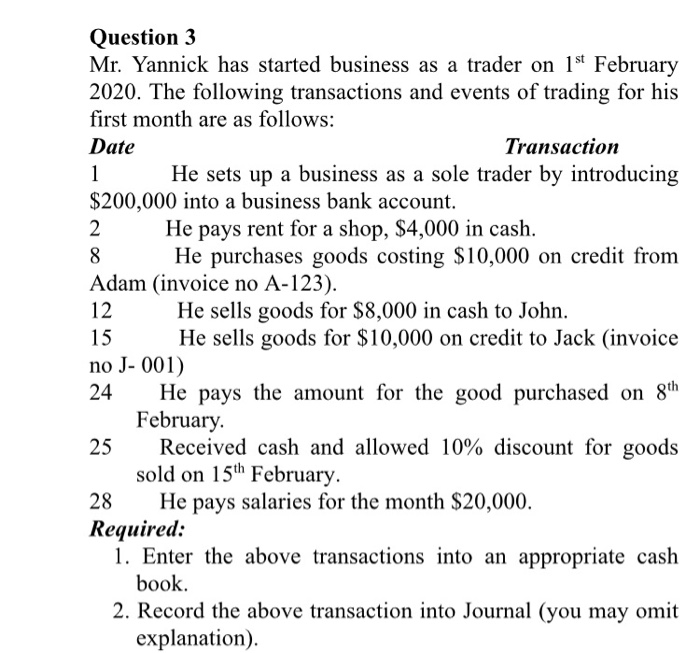

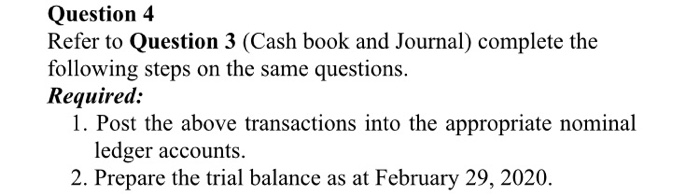

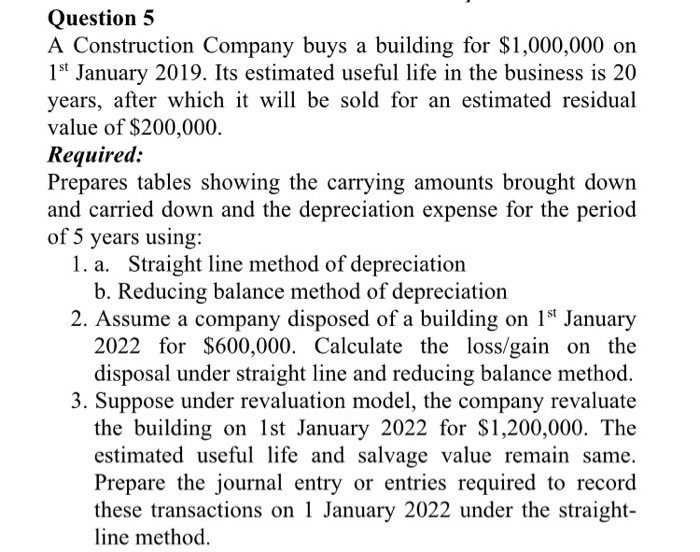

Questions 1 i. "Financial statements show the results of the stewardship of management, or the accountability of management for the resources entrusted to it. Those users who wish to assess the stewardship or accountability of management do so in order that they can make economic decisions." Required: Discuss what is meant by stewardship and accountability and give an example of each. Support your answer with relevant example. ii. The Silver Star Plc is a leading logistics company since 2010. The company has six subsidiaries in different countries, and a parent company is located in UAE. Silver Star Plc financial statements are prepared and published for general public at the end of every accounting year 30th June. The IASB conceptual framework for the Preparation and Presentation of Financial Statements was developed in 1989 by the IASC and adopted by the IASB in 2001. This Conceptual Framework sets out the concepts that underlie the preparation and presentation of financial statements for external users." Required: 1- Explain the main objective of financial statements prepared by Silver Star Plc. 2- Who are the Silvers Star Plc users of financial statements, list and briefly explain them. During February 2020, the following changes in Orange company inventory took place: Date Explanation Units Unit Cost February 5 Balance 200 $4 8 Purchased 400 15 Purchased 600 18 Sold 700 19 Purchased 300 Perpetual inventories are maintained. Required: What is the cost of sales and ending inventory for item under the following methods? Also calculate gross profit under both methods. 1- FIFO. 2- LIFO 3- Gross profit 4- What is the difference between LIFO and FIFO costing? Why the gross profit is different under both methods? Interpret the results. sunt Question 3 Mr. Yannick has started business as a trader on 1st February 2020. The following transactions and events of trading for his first month are as follows: Date Transaction 1 He sets up a business as a sole trader by introducing $200,000 into a business bank account. 2 He pays rent for a shop, $4,000 in cash. 8 He purchases goods costing $10,000 on credit from Adam (invoice no A-123). 12 He sells goods for $8,000 in cash to John. He sells goods for $10,000 on credit to Jack (invoice no J- 001) 24 He pays the amount for the good purchased on 8th February 25 Received cash and allowed 10% discount for goods sold on 15th February 28 He pays salaries for the month $20,000. Required: 1. Enter the above transactions into an appropriate cash book. 2. Record the above transaction into Journal (you may omit explanation). Question 4 Refer to Question 3 (Cash book and Journal) complete the following steps on the same questions. Required: 1. Post the above transactions into the appropriate nominal ledger accounts. 2. Prepare the trial balance as at February 29, 2020. Question 5 A Construction Company buys a building for $1,000,000 on 1st January 2019. Its estimated useful life in the business is 20 years, after which it will be sold for an estimated residual value of $200,000. Required: Prepares tables showing the carrying amounts brought down and carried down and the depreciation expense for the period of 5 years using: 1. a. Straight line method of depreciation b. Reducing balance method of depreciation 2. Assume a company disposed of a building on 1st January 2022 for $600,000. Calculate the loss/gain on the disposal under straight line and reducing balance method. 3. Suppose under revaluation model, the company revaluate the building on 1st January 2022 for $1,200,000. The estimated useful life and salvage value remain same. Prepare the journal entry or entries required to record these transactions on 1 January 2022 under the straight- line method