Question

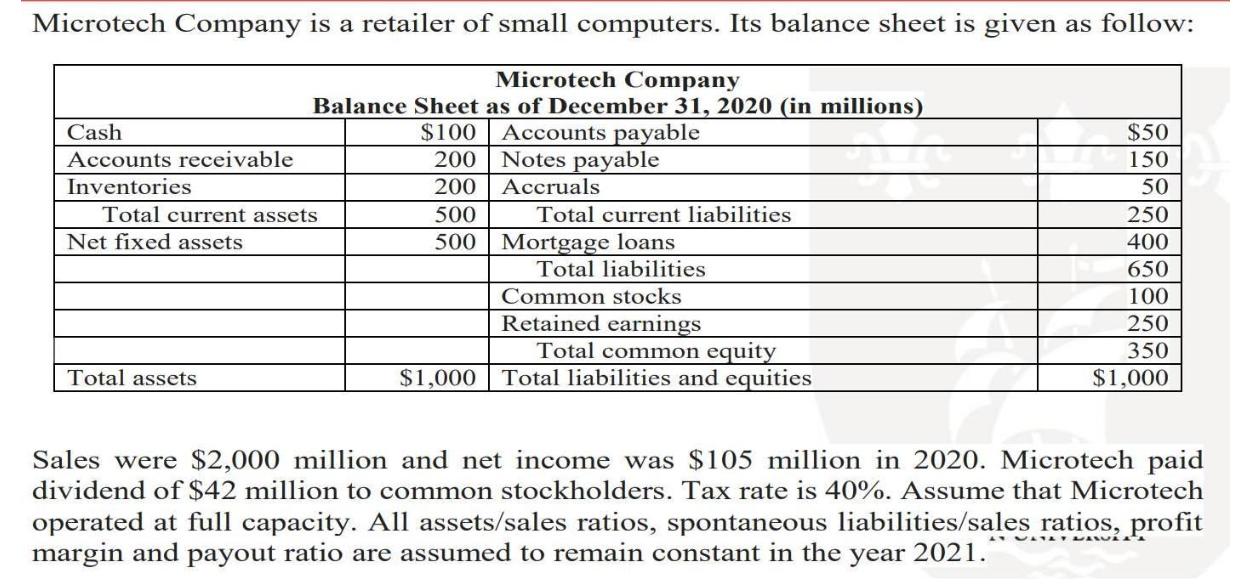

Questions: 1. If sales are projected to increase by 10% during 2021, use the additional fund need method (AFN) to determine Microtechs external fund requirement.

Questions:

1. If sales are projected to increase by 10% during 2021, use the additional fund need method (AFN) to determine Microtech’s external fund requirement.

2. Find the self-supporting growth rate of Microtech Inc.?

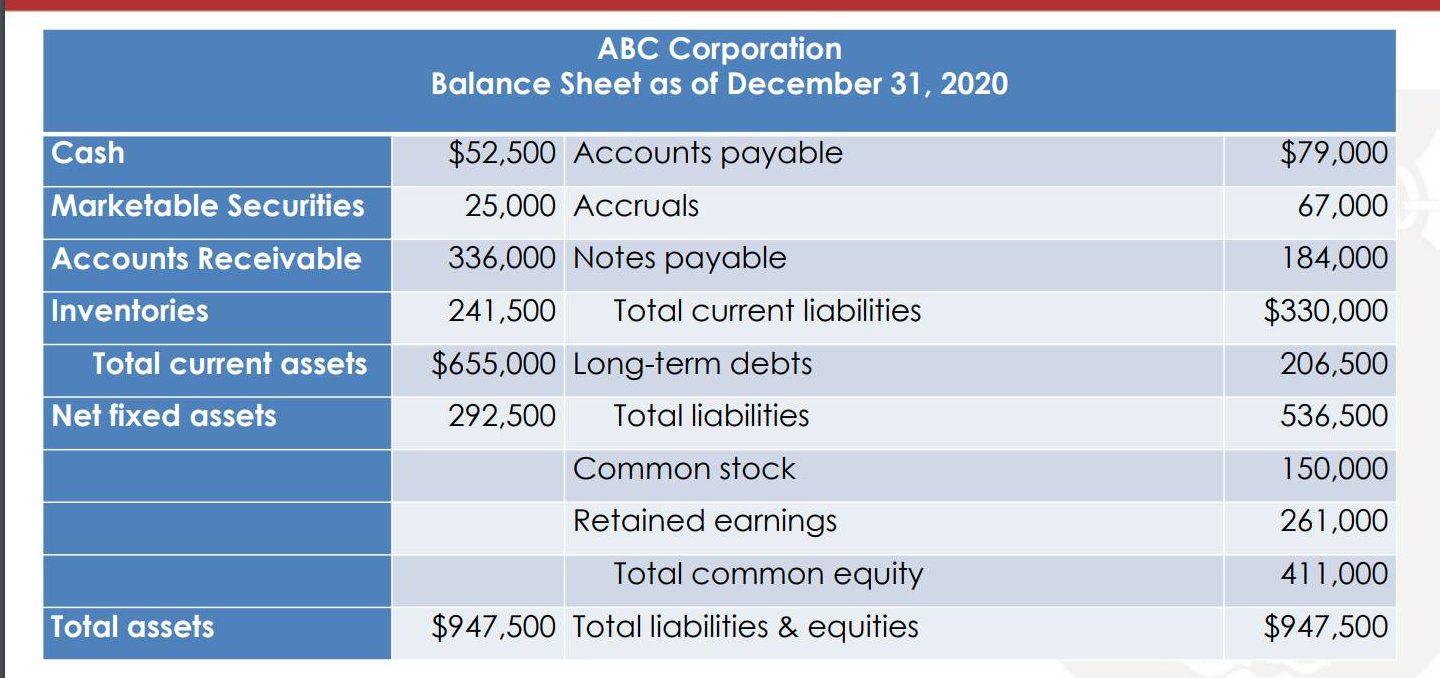

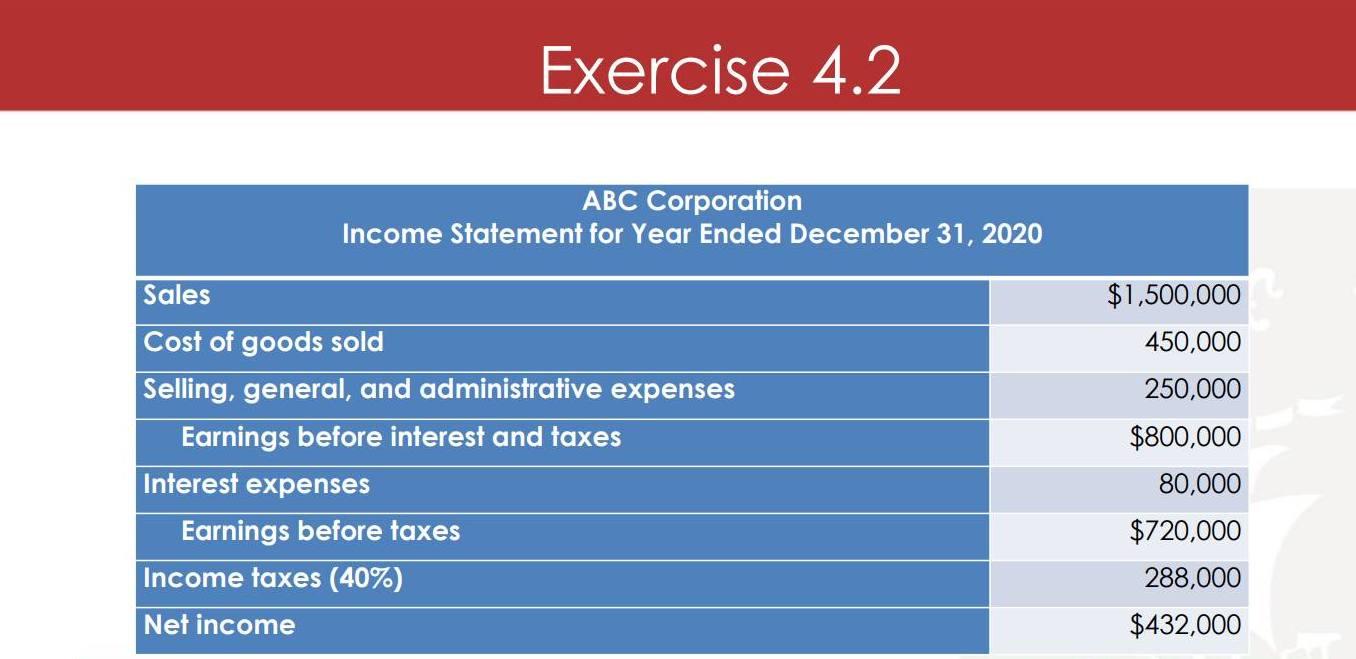

Exercise 4.2

• ABC Corporation operated at full capacity in 2020. It is expected that ABC will grow in the future, thus, it may need to raise funds from external sources. The followings show the financial statement and information regarding the expected future growth of the corporation. Use the following information to forecast the income statements and balance sheets in 2021. Find the amount of ABC’s additional funds needed using the forecast financial statement method.

- Marketing manager forecasted a sales growth of 12% in 2021.

- Cost of goods sold as well as selling, general, and administrative expenses in 2021 are forecasted to increase by the same percentage as sales.

- To manage its cash holding and marketable securities investment in 2021, the management has planned to reduce the holding of cash by 10% from $52,500 in 2020. The amount of reduction in cash holding will instead invest in marketable securities. Assume cash and marketable securities do not earn any interest income.

- Accounts receivable, inventories, net fixed assets, and spontaneous liabilities are forecasted to increase by 10% from their respective values in 2020.

- Interest rate charge of all debt is equal to 10%.

- Any additional funds if needed will be financed only by issuing notes payable.

- In 2021, the board members will retain only 10% of their net income available to common stockholders and pays out the remaining as common stock dividends.

Microtech Company is a retailer of small computers. Its balance sheet is given as follow: Microtech Company Balance Sheet as of December 31, 2020 (in millions) Accounts payable $100 200 Notes payable 200 Accruals Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets 500 500 Total current liabilities Mortgage loans Total liabilities Common stocks Retained earnings Total common equity $1,000 Total liabilities and equities $50 150 50 250 400 650 100 250 350 $1,000 Sales were $2,000 million and net income was $105 million in 2020. Microtech paid dividend of $42 million to common stockholders. Tax rate is 40%. Assume that Microtech operated at full capacity. All assets/sales ratios, spontaneous liabilities/sales ratios, profit margin and payout ratio are assumed to remain constant in the year 2021.

Step by Step Solution

3.63 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Question 1 To determine Microtechs external fund requirement using the AFN methodwe can use the following formula AFN A LE where A projected increase in assets LE projected increase in liabilities and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started