Question

Questions: 1. Use ratio analysis (ROA, ROE, profit margin, gross profit margin, inventory turnover, debtors turnover) and comment on any significant changes from 2017 to

Questions:

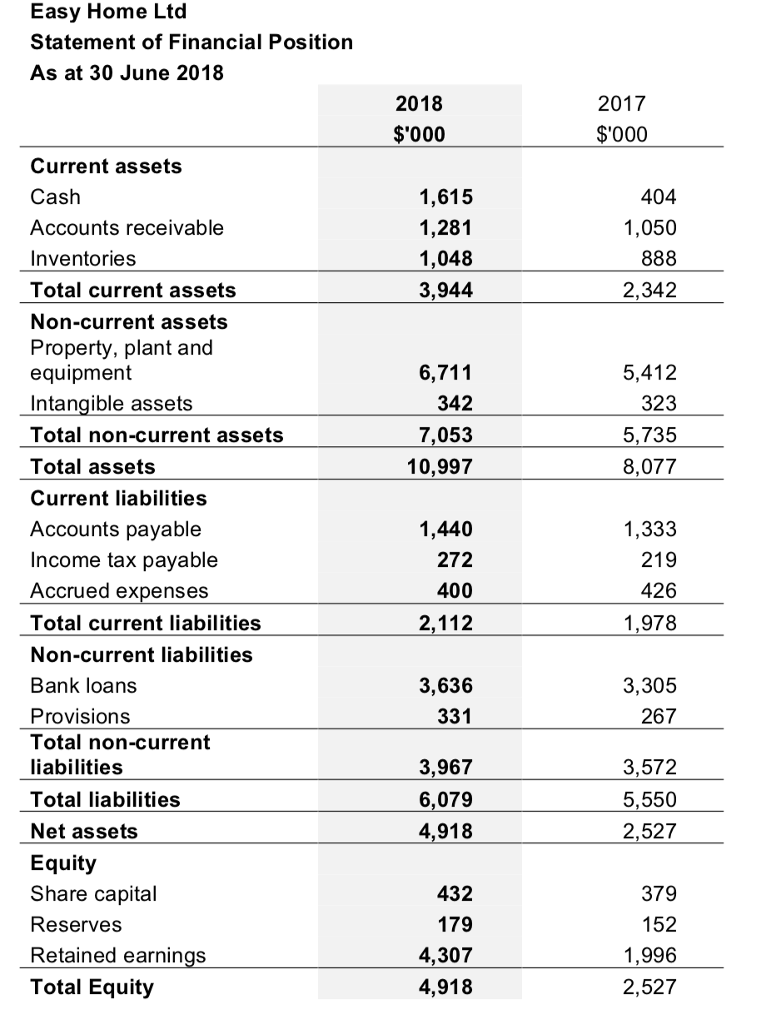

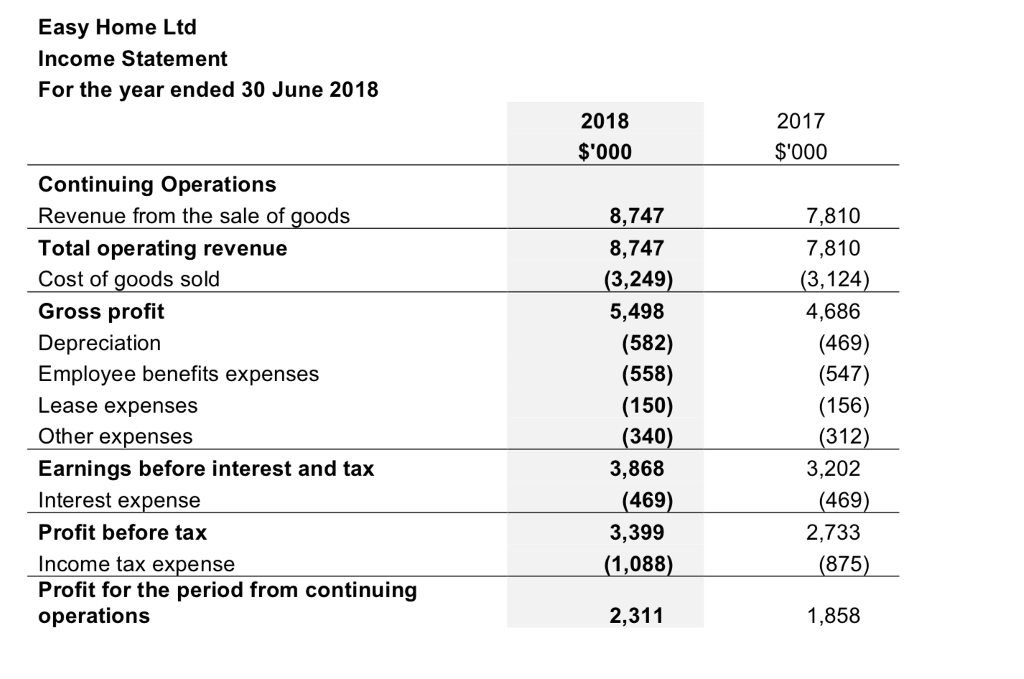

1. Use ratio analysis (ROA, ROE, profit margin, gross profit margin, inventory turnover, debtors turnover) and comment on any significant changes from 2017 to 2018. Additionally provide reasons for this change.

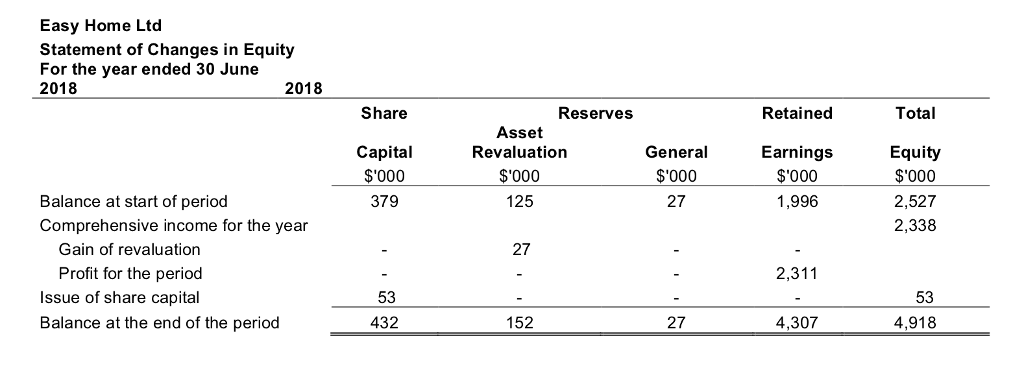

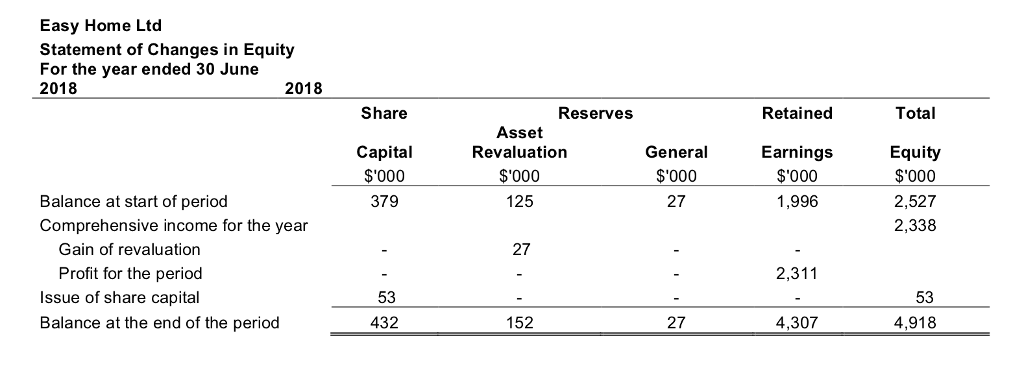

2. What impact will the upward re evaluation of PPE ($27,000) have on the ratio anaysis and on finacial statements

3. What imapct will occur when the depreaction calcualtion method is changed to (straitline) have on the finacial statemens

Note 12: Change in accounting policy

During the current financial year, the company changed its accounting policy with respect to the valuation of property, plant and equipment. The company now applies the fair value method in order to value such assets. Prior to this change in policy, the company measured these assets at historical value (less accumulated depreciation).

The company believes this new method is preferred, as it is more accurate in reflecting the current market value of the particular assets held in this category of property, plant and equipment. The impact of this voluntary change in accounting policy on the statement of financial position is an upward revaluation of property, plant and equipment assets of $27,000. Consequently, this has increased non-current assets, total assets, and net assets by this amount. A corresponding increase has been made to equity via the companys asset revaluation reserve.

Note 20: Debt restrictions

The bank loans of $3,636,000 are subject to the following conditions: The company will not exceed a debt to equity ratio of 45% The company will maintain an interest coverage ratio (calculated as earnings before

interest and taxes/interest expense) of no less than 2.5:1

If breaches of these conditions occur, the lender may demand payment of all outstanding debts due immediately. Should payment not be made within 7 business days, the lender may commence legal action to recover the debt including exercising their right to take physical possession of secured assets. The loans are currently secured against the companys property, plant and equipment.

Note 26: Change in Depreciation Calculation

As of this current financial year, Easy Home Ltd has changed the way it depreciates its new equipment that is used in the factories to produce its products. This equipment was purchased this year to replace old machinery. The depreciation method has now changed to a straight-line deprecation method, to better reflect the natural depreciation of the equipment used. The 4 pieces of equipment used in the factories, and their depreciation schedule, is as follows:

Conveyor Belt Pulley System: o PurchasePrice:$180,000 o UsefulLife:10years o ResidualValue:$20,000

CPU Machinery System: o PurchasePrice:$125,000 o UsefulLife:8Years o ResidualValue:$15,000

Device Assembly Machinery: o PurchasePrice:$210,000 o UsefulLife:12Years o ResidualValue:$40,000

Packaging Machinery: o PurchasePrice:$75,000

o UsefulLife:15years o ResidualValue:$15,000

Easy Home Ltd Statement of Financial Position As at 30 June 2018 2018 $'000 2017 $'000 Current assets Cash Accounts receivable Inventories Total current assets Non-current assets Property, plant and equipment Intangible assets Total non-current assets Total assets Current liabilities Accounts payable Income tax payable Accrued expenses Total current liabilities Non-current liabilities Bank loans Provisions Total non-current liabilities Total liabilities Net assets Equity Share capital Reserves Retained earnings Total Equity 404 1,050 1,615 1,281 1,048 3,944 2,342 6,711 342 7,053 10,997 5,412 323 5,735 8,077 1,440 272 400 2,112 1,333 426 1,978 3,636 331 3,305 267 3,967 6,079 4,918 3,572 5,550 2,527 432 179 4,307 4,918 379 152 1,996 2,527

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started