Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTIONS: 1. What amount should be reported as inventory? 2. What amount should be reported as accounts payable? 3.What amount should be reported as sales?

QUESTIONS: 1. What amount should be reported as inventory? 2. What amount should be reported as accounts payable? 3.What amount should be reported as sales?

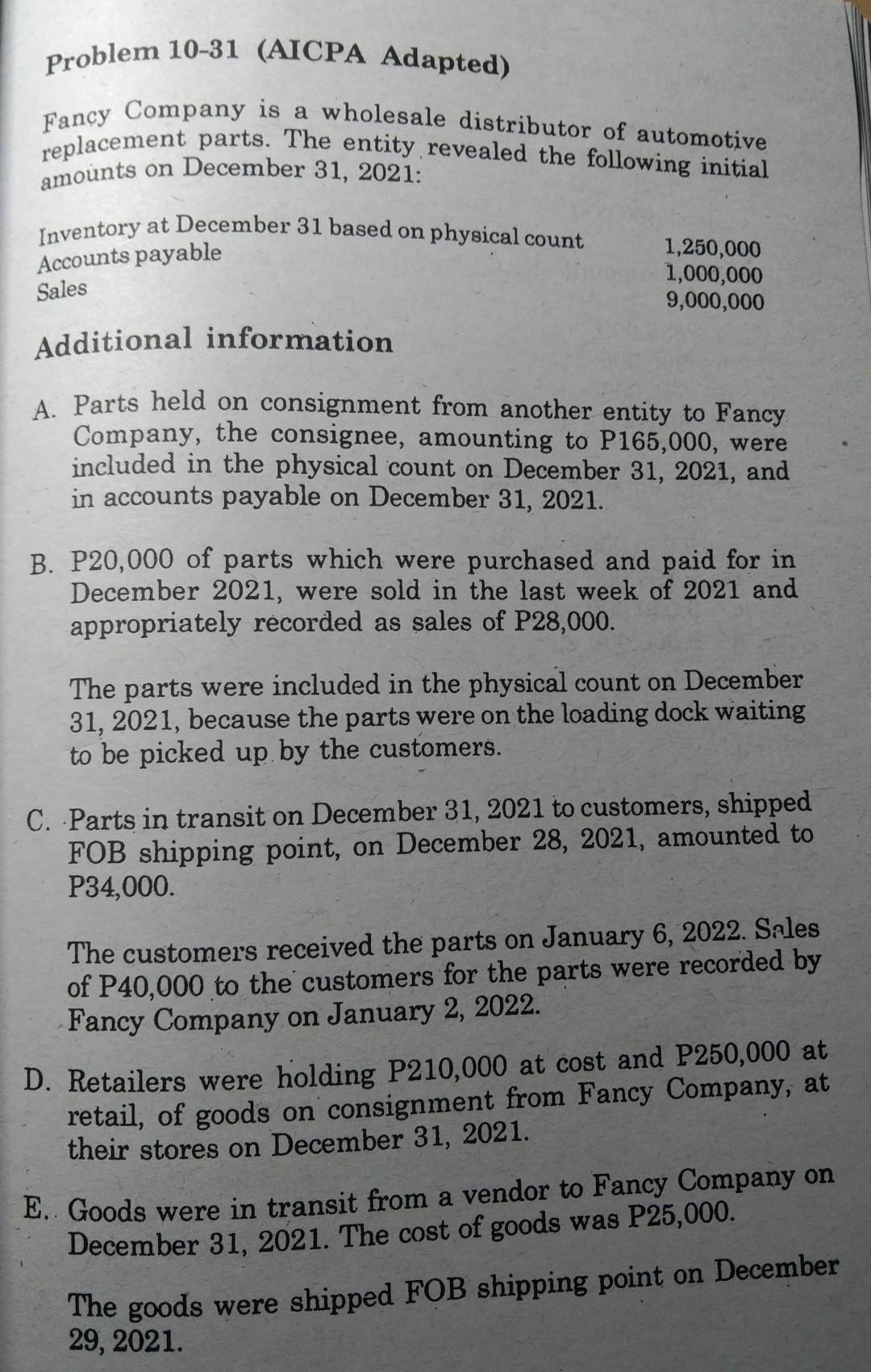

Problem 10-31 (AICPA Adapted) Fancy Company is a wholesale distributor of automotive replacement parts. The entity revealed the following initial amounts on December 31, 2021: Inventory at December 31 based on physical count Accounts payable Sales 1,250,000 1,000,000 9,000,000 Additional information A. Parts held on consignment from another entity to Fancy Company, the consignee, amounting to P165,000, were included in the physical count on December 31, 2021, and in accounts payable on December 31, 2021. B. P20,000 of parts which were purchased and paid for in December 2021, were sold in the last week of 2021 and appropriately recorded as sales of P28,000. The parts were included in the physical count on December 31, 2021, because the parts were on the loading dock waiting to be picked up by the customers. C. Parts in transit on December 31, 2021 to customers, shipped FOB shipping point, on December 28, 2021, amounted to P34,000. The customers received the parts on January 6, 2022. Sales of P40,000 to the customers for the parts were recorded by Fancy Company on January 2, 2022. D. Retailers were holding P210,000 at cost and P250,000 at retail, of goods on consignment from Fancy Company, at their stores on December 31, 2021. E. Goods were in transit from a vendor to Fancy Company on December 31, 2021. The cost of goods was P25,000. The goods were shipped FOB shipping point on December 29, 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started