Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions: 1. Why would a company like Chevron invest so much capital in a project with so many risks? 2. How had Chevron tried to

Questions:

Questions:

1. Why would a company like Chevron invest so much capital in a project with so many risks?

2. How had Chevron tried to mitigate the political risks of the project?

3. Had the risks associated with Tengiz changed or evolved over time?

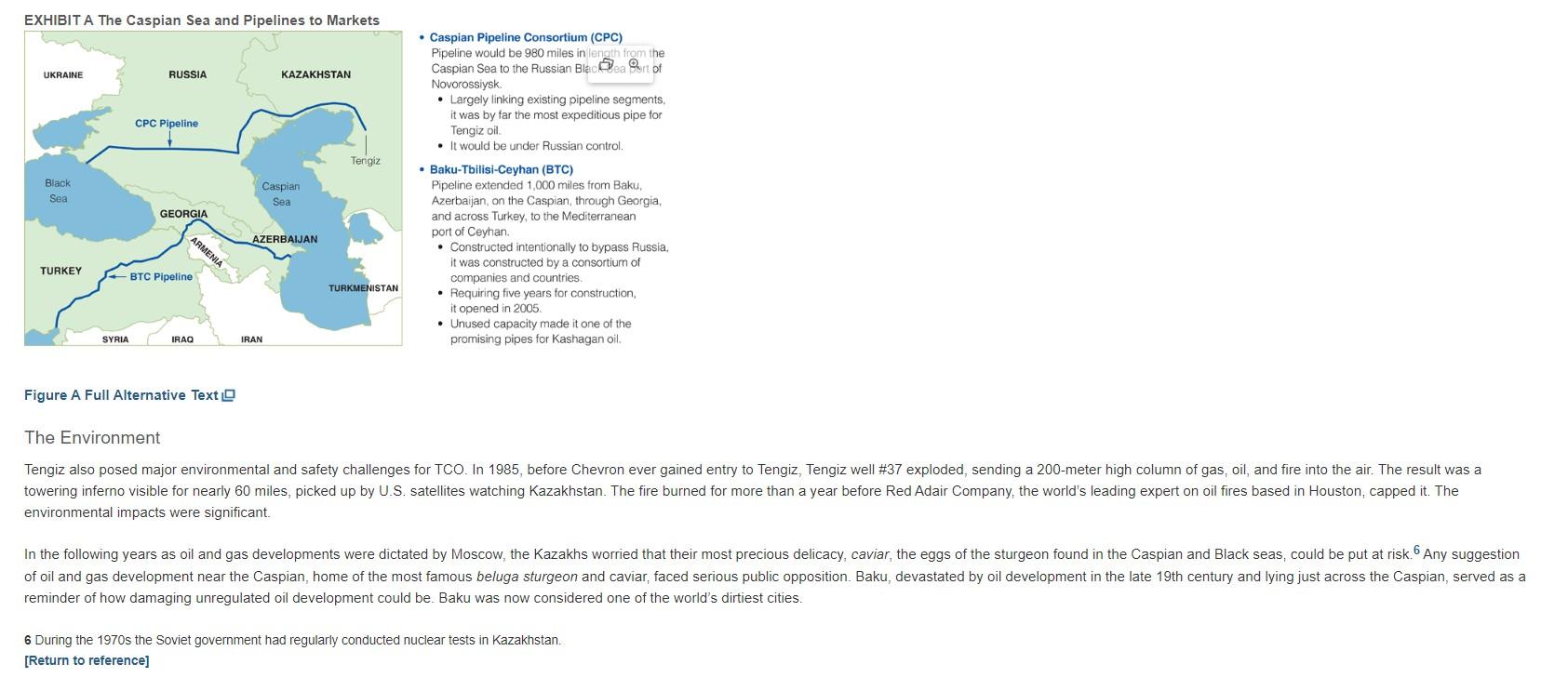

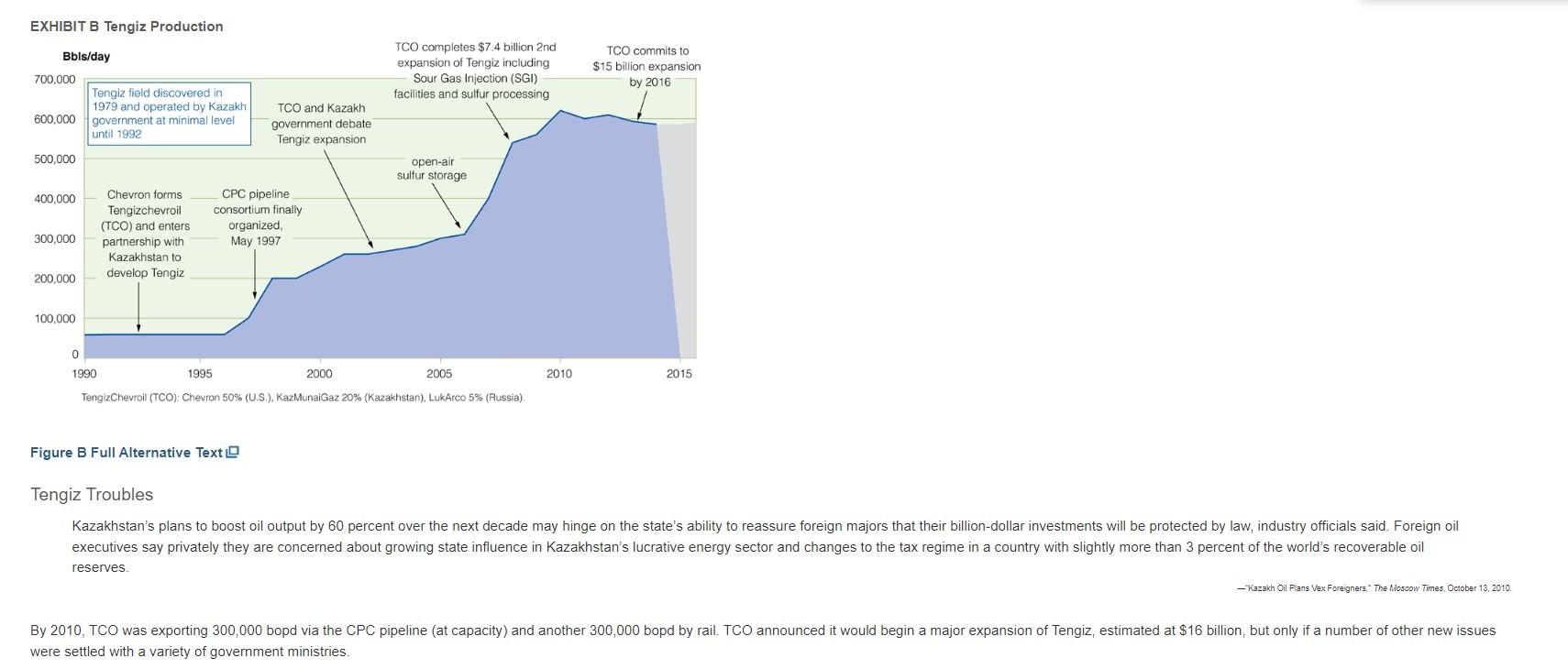

The problem is that money has to be invested. What difference is it to me if it is Americans, Omanis, Russians? The main thing is that oil comes out. later, the field had still not reached its potential. TCO's owner/investors worried about continuing political risks and the prospects of investing another $26 billion. Tengiz month, Chevron and the former Soviet republic announced a preliminary agreement to develop the Tengiz and Korolev fields, estimated to be even bigger than Alaska's Prudhoe Bay. elsewhere. The field saw some preliminary drilling and production in the mid-1980s, but needed an investor-operator with technology, experience, and capital. and support was costly. Recruiting, training, and retention of the highly skilled workforce needed proved to be a major challenge. Chevron Union. But the ink was barely dry when the Soviet Union broke apart. With Kazakhstan's declared independence in December 1991, negotiations began again. naming Chevron as the operator. 5 The company was structured as a joint venture between Chevron and Kazakhstan. Chevron pledged $20 billion over the next 40 years. 5% [Return to reference] roads, schools, and hospitals, limiting social spending to 3% of total investment. Pipe Dreams Trouble is, after more than two years of work and a $1 billion investment, Chevron has yet to make much money on Tengizchevroil, its 50/50 joint venture with the government of Kazakhstan. - "Chevron Struggling in Tengiz," by Kennesh Howe, San Francisco Chronicle, September 25, 1995. market. Chevron wanted to get the oil west to the Black Sea; from there it could then be moved by tanker to the Mediterranean and markets beyond. kilometers to the Black Sea. Operations began in 2003. A second pipeline, the Baku-Tbilisi-Ceyhan pipeline (BTC), began operation a few years later, as shown in Exhibit A . FXHIRIT A The Casnian Sea and Pinelines to Markete - Caspian Pipeline Consortium (CPC) Pipeline would be 980 miles in ength from the Caspian Sea to the Russian Blac Novorossiysk. - Largely linking existing pipeline segments. it was by far the most expeditious pipe for Tengiz oil - It would be under Russian control. - Baku-Tbilisi-Ceyhan (BTC) Pipeline extended 1,000 miles from Baku Azerbaijan, on the Caspian, through Georgia and across Turkey, to the Mediterranean port of Ceyhan. - Constructed intentionally to bypass Russia it was constructed by a consortium of companies and countries - Requiring five years for construction, it opened in 2005 - Unused capacity made it one of the promising pipes for Kashagan oil. Figure A Full Alternative Text The Environment environmental impacts were significant. reminder of how damaging unregulated oil development could be. Baku was now considered one of the world's dirtiest cities. 6 During the 1970 s the Soviet government had regularly conducted nuclear tests in Kazakhstan. [Return to reference] Chevron spent more than $40 million on a sulfur pellet processing facility in 2001 to expand marketability, but with mixed success. projects began. The production of oil and gas in the Caspian is very complex, very difficult. Ten years ago, fifteen years ago when contracts were written, people didn't understand the complexities. -Richard Matzke, Chevron Texaco Vice Chairman of the Board, 2007. to reinject natural gas back into the reservoir. Growing Tension growth, the reinvestment would dramatically reduce the consortium's taxable profits and payments to the government-and the government needed the money. provided for future investments. the country with the most to gain from an expected surge in demand for its exports, Kazakhstan should be cultivating foreign investors. Instead, it is in danger of putting them off. 7 7 "Field of Dreams," The Economist, January 9, 2003. [Return to reference] and fines on the consortium. in operation, the last of which alone cost $7.4 billion. Production hit more than 700,000 bopd in 2009 , as illustrated in Exhibit B . Tengiz Troubles reserves. were settled with a variety of government ministries. were settled with a variety of government ministries. permanent exemption under its operating agreement. argued that the production agreement had no such restrictions. the result of an emergency situation. are customarily much more difficult to obtain. $90 billion to Kazakhstan. roughly $45 per barrel, expansion was riskyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started