Answered step by step

Verified Expert Solution

Question

1 Approved Answer

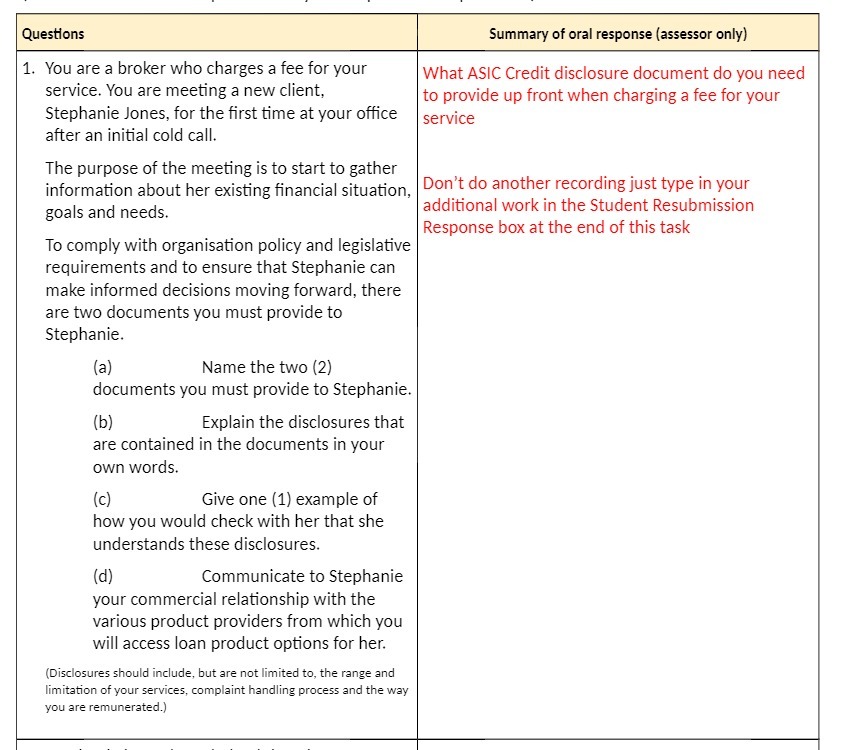

Questions 1. You are a broker who charges a fee for your service. You are meeting a new client, Summary of oral response (assessor

Questions 1. You are a broker who charges a fee for your service. You are meeting a new client, Summary of oral response (assessor only) What ASIC Credit disclosure document do you need to provide up front when charging a fee for your Stephanie Jones, for the first time at your office service after an initial cold call. The purpose of the meeting is to start to gather information about her existing financial situation, goals and needs. To comply with organisation policy and legislative requirements and to ensure that Stephanie can make informed decisions moving forward, there are two documents you must provide to Stephanie. (a) Name the two (2) documents you must provide to Stephanie. (b) Explain the disclosures that are contained in the documents in your own words. Don't do another recording just type in your additional work in the Student Resubmission Response box at the end of this task (c) Give one (1) example of how you would check with her that she understands these disclosures. (d) Communicate to Stephanie your commercial relationship with the various product providers from which you will access loan product options for her. (Disclosures should include, but are not limited to, the range and limitation of your services, complaint handling process and the way you are remunerated.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started