Questions 1-10 are all part of P6-1

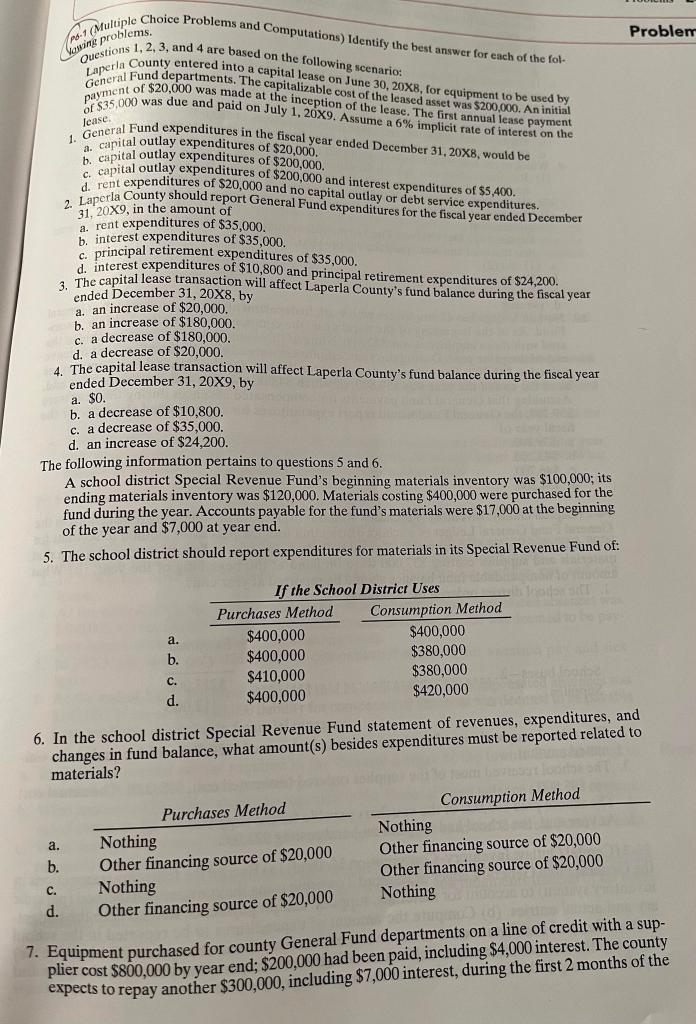

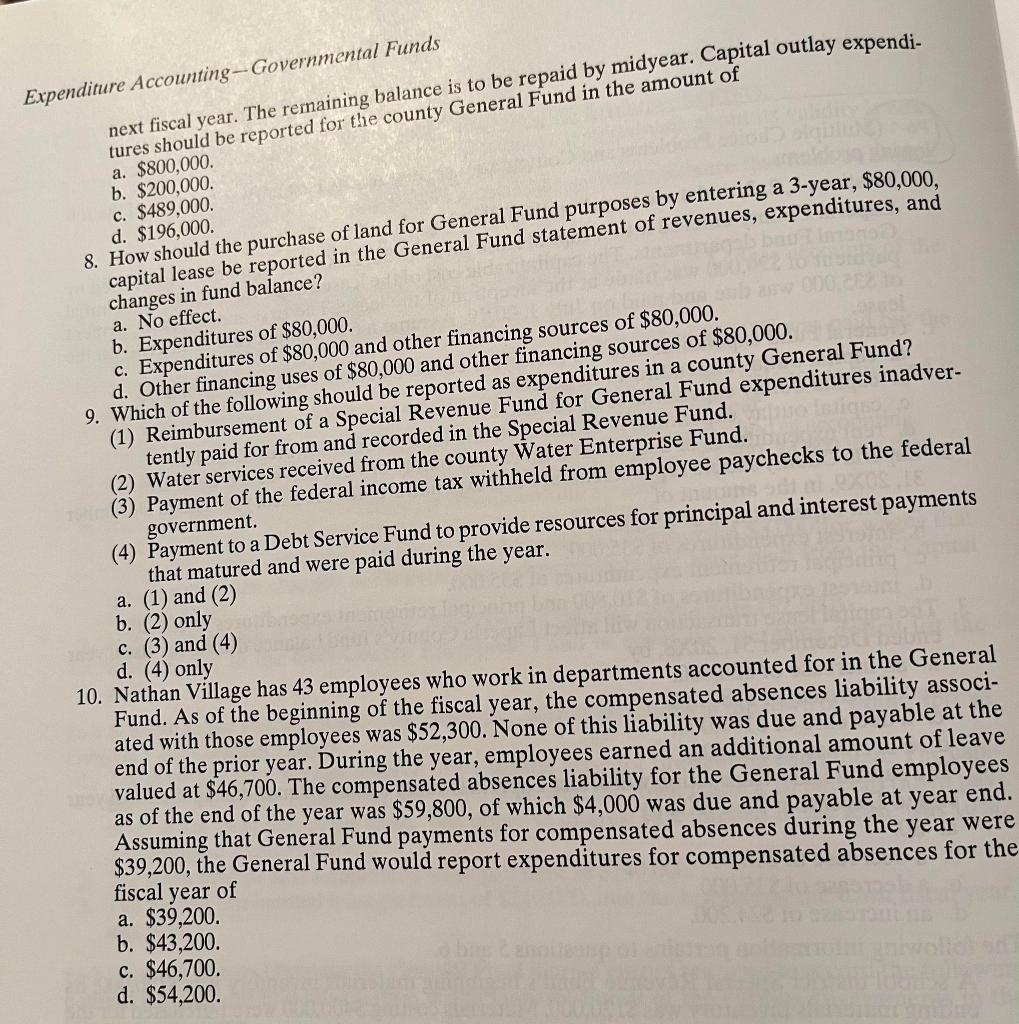

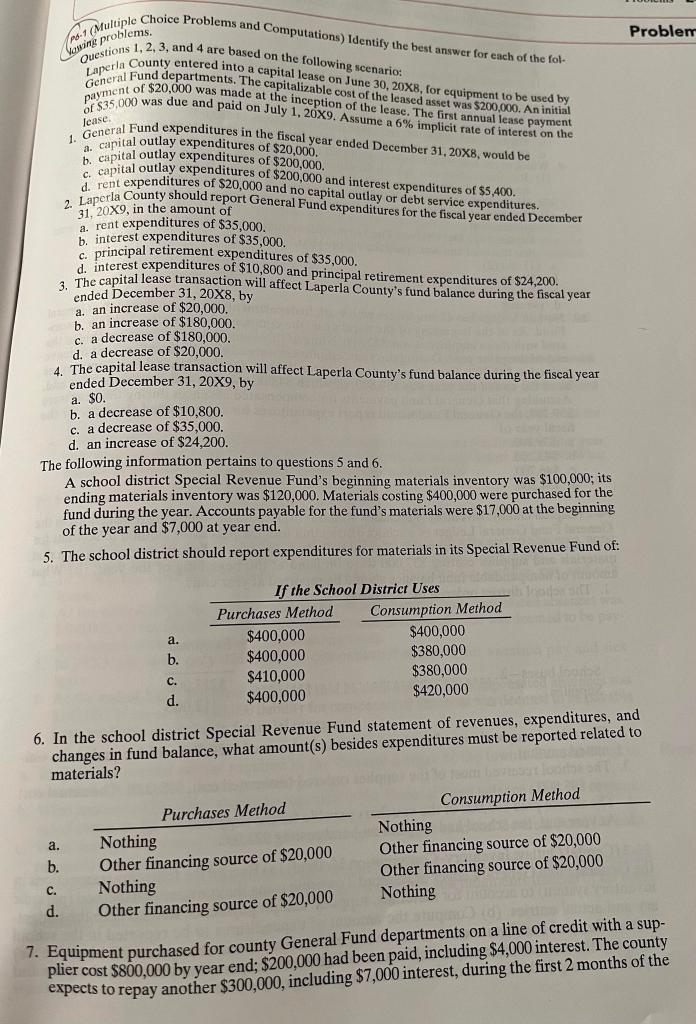

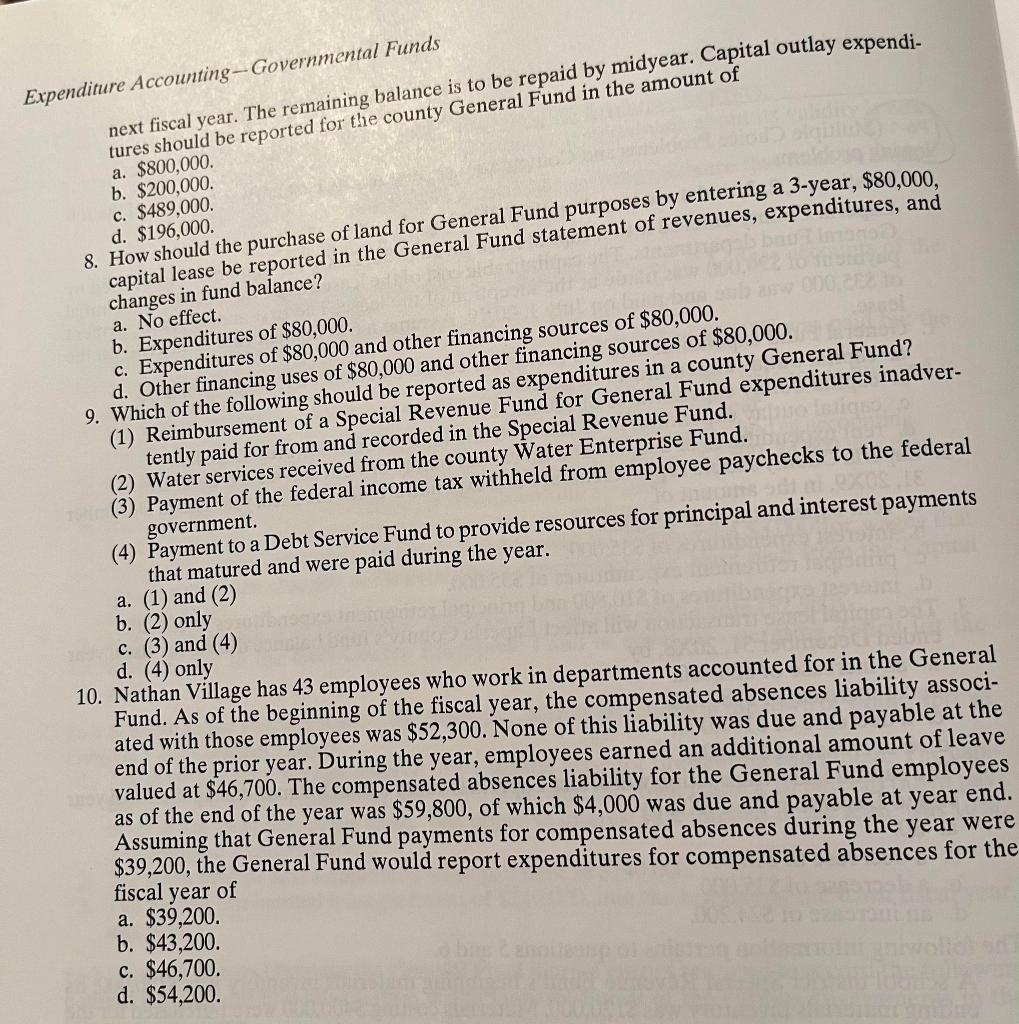

(Muliplems. questions 1, 2,3, and 4 are based on the following scenario: Laperal County entered into a capital lease on June 30,208, for equipment to be used by payment of $20,000 was made at the inception of of the leased asset was $200,000. An initial laase. 1. General Fund expenditures in the fiscal year ended December 31,208, would be a. capital outlay expenditures of $20,000. b. capital outlay expenditures of $200,000. c. capital outlay expenditures of $200,000 and interest expenditures of $5,400. d. rent expenty should report Gene no capital outlay or debt service expenditures. 2. Lapcrla County 31,20 , in the amount of a. rent expenditures of $35,000. b. interest expenditures of $35,000. c. principal retirement expenditures of $35,000. d. interest expenditures of $10,800 and principal retirement expenditures of $24,200. 3. The capital lease transaction will affect Laperla County's fund balance during the fiscal year ended December 31,208, by a. an increase of $20,000. b. an increase of $180,000. c. a decrease of $180,000. d. a decrease of $20,000. 4. The capital lease transaction will affect Laperla County's fund balance during the fiscal year ended December 31,209, by a. $0. b. a decrease of $10,800. c. a decrease of $35,000. d. an increase of $24,200. The following information pertains to questions 5 and 6 . A school district Special Revenue Fund's beginning materials inventory was $100,000; its ending materials inventory was $120,000. Materials costing $400,000 were purchased for the fund during the year. Accounts payable for the fund's materials were $17,000 at the beginning of the year and $7,000 at year end. 5. The school district should report expenditures for materials in its Special Revenue Fund of: 6. In the school district Special Revenue Fund statement of revenues, expenditures, and changes in fund balance, what amount(s) besides expenditures must be reported related to materials? 7. Equipment purchased for county General Fund departments on a line of credit witn a supplier cost $800,000 by year end; $200,000 had been paid, including $4,000 interest. The county expects to repay another $300,000, including $7,000 interest, during the first 2 months of the next fiscal year. The remaining balance is to be repaid by midyear. Capital outlay expendi- xpenditure Accounting - Governmental Funds tures should be reported for the county General Fund in the amount of a. $800,000. 8. $196,000. 8. How should the purchase of land for General Fund purposes by entering a 3-year, $80,000, depent expenditures, and b. $200,000. capital lease be reported in the General Fund statement of revenues, expenditures, and c. $489,000. changes in fund balance? c. Expenditures of $80,000 and other financing sources of $80,000. a. No effect. d. Other financing uses of $80,000 and other financing sources of $80,000. b. Expenditures of $80,000. 9. Which of the following should be reported as expendor General Fund expenditures inadver- (1) Reimbursement of a Special Revenue Fe Special Revenue Fund. tently paid for from and recorded in the county Water Enterprise Fund. (2) Water services received from the county Wat from employee paychecks to the federal (3) Payment of the federal income tax resources for principal and interest payments government. that matured and were paid during the year. a. (1) and (2) b. (2) only c. (3) and (4) 10. Nathan Village has 43 employees who work in departments accounted for in the General d. (4) only Fund. As of the beginning of the fiscal year, the compensated absences liability associated with those employees was $52,300. None of this liability was due and payable at the end of the prior year. During the year, employees earned an additional amount of leave valued at $46,700. The compensated absences liability for the General Fund employees as of the end of the year was $59,800, of which $4,000 was due and payable at year end Assuming that General Fund payments for compensated absences during the year wer $39,200, the General Fund would report expenditures for compensated absences for th fiscal year of a. $39,200. b. $43,200. c. $46,700. d. $54,200