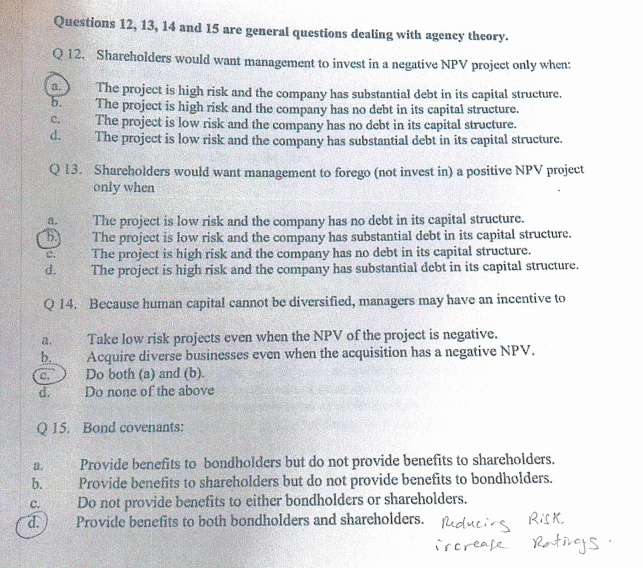

Questions 12, 13, 14 and 15 are general questions dealing with ageney theory Q12. Shareholders would want management to invest in a negative NPV project only when: The project is high risk and the company has substantial debt in its capital structure The project is high risk and the company has no debt in its capital structure. a c The project is low risk and the company has no debt in its capital structure. d. The project is low risk and the company has substantial debt in its capital structure. O 13. Shareholders would want management to forego (not invest in) a positive NPV project only when a. The project is low risk and the company has no debt in its capital structure. The project is low risk and the company has substantial debt in its capital structure. cThe project is high risk and the company has no debt in its capital structure. d. The project is high risk and the company has substantial debt in its capital structure. Because human capital cannot be diversified, managers may have an incentive to Q 14. a. Take low risk projects even when the NPV of the project is negative. b Acquire diverse businesses even when the acquisition has a negative NPV. d.Do none of the above CDo both (a) and (b). Q15. Bond covenants: a. Provide benefits to bondholders but do not provide benefits to shareholders. b. Provide benefits to shareholders but do not provide benefits to bondholders. c Do not provide benefits to either bondholders or shareholders. Provide benefits to both bondholders and shareholders. uducirs Questions 12, 13, 14 and 15 are general questions dealing with ageney theory Q12. Shareholders would want management to invest in a negative NPV project only when: The project is high risk and the company has substantial debt in its capital structure The project is high risk and the company has no debt in its capital structure. a c The project is low risk and the company has no debt in its capital structure. d. The project is low risk and the company has substantial debt in its capital structure. O 13. Shareholders would want management to forego (not invest in) a positive NPV project only when a. The project is low risk and the company has no debt in its capital structure. The project is low risk and the company has substantial debt in its capital structure. cThe project is high risk and the company has no debt in its capital structure. d. The project is high risk and the company has substantial debt in its capital structure. Because human capital cannot be diversified, managers may have an incentive to Q 14. a. Take low risk projects even when the NPV of the project is negative. b Acquire diverse businesses even when the acquisition has a negative NPV. d.Do none of the above CDo both (a) and (b). Q15. Bond covenants: a. Provide benefits to bondholders but do not provide benefits to shareholders. b. Provide benefits to shareholders but do not provide benefits to bondholders. c Do not provide benefits to either bondholders or shareholders. Provide benefits to both bondholders and shareholders. uducirs