Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1-3 1. Describe the transaction smith should execute to hedge against charges in interest rates on the purchase of three-month treasury bills in March.

Questions 1-3

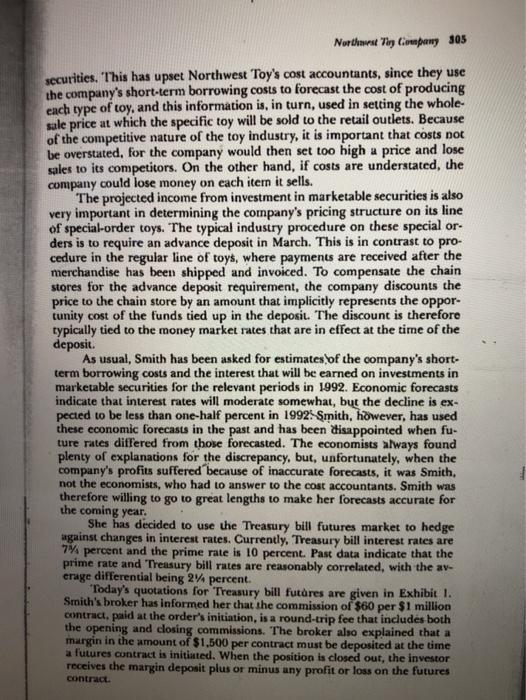

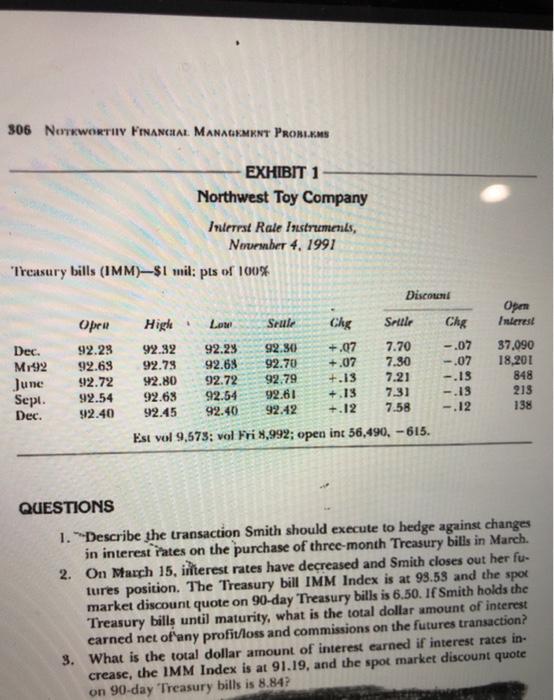

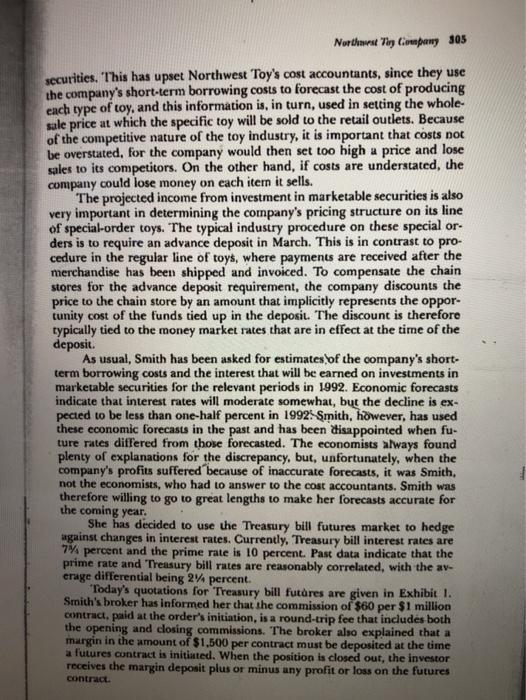

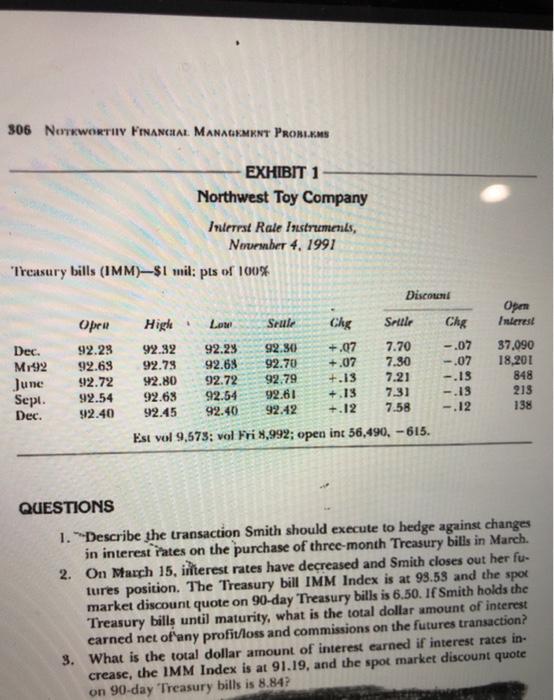

Northus Mon Company 305 securities. This has upset Northwest Toy's cost accountants, since they use the company's short-term borrowing costs to forecast the cost of producing each type of toy, and this information is, in turn, used in setting the whole sale price at which the specific toy will be sold to the retail outlets. Because of the competitive nature of the toy industry, it is important that costs not be overstated, for the company would then set too high a price and lose sales to its competitors. On the other hand, if costs are understated, the company could lose money on each itern it sells. The projected income from investment in marketable securities is also very important in determining the company's pricing structure on its line of special-order toys. The typical industry procedure on these special or- ders is to require an advance deposit in March. This is in contrast to pro- cedure in the regular line of toys, where payments are received after the merchandise has been shipped and invoiced. To compensate the chain stores for the advance deposit requirement, the company discounts the price to the chain store by an amount that implicitly represents the oppor- tunity cost of the funds tied up in the deposit. The discount is therefore typically tied to the money market rates that are in effect at the time of the deposit As usual, Smith has been asked for estimates of the company's short- term borrowing costs and the interest that will be earned on investments in marketable securities for the relevant periods in 1992. Economic forecasts indicate that interest rates will moderate somewhat, but the decline is ex- pected to be less than one-half percent in 1992 Smith, however, has used these economic forecasts in the past and has been disappointed when fu- ture rates differed from those forecasted. The economists always found plenty of explanations for the discrepancy, but, unfortunately, when the company's profits suffered because of inaccurate forecasts, it was Smith, not the economists, who had to answer to the cost accountants. Smith was therefore willing to go to great lengths to make her forecasts accurate for the coming year. She has decided to use the Treasury bill futures market to hedge gainst changes in interest rates. Currently, Treasury bill interest rates are 7% percent and the prime rate is 10 percent. Past data indicate that the prime rate and Treasury bill rates are reasonably correlated, with the av- erage differential being 2. percent. Today's quotations for Treasury bill futures are given in Exhibit I. Smith's broker has informed her that the commission of $60 per $1 million contract, paid at the order's initiation, is a round-trip fee that includes both the opening and closing commissions. The broker also explained that a margin in the amount of $1.500 per contract must be deposited at the time a futures contract is initiated. When the position is closed out, the investor receives the margin deposit plus or minus any profit or loss on the futures contract 306 NOTEWORTHY FINANCIAL MANAGEMENT PROBLEMS EXHIBIT 1 Northwest Toy Company Interest Rate Instruments, November 4, 1991 Treasury bills (IMM)-$1 mil: pls of 100% Discount Open Interest Highe. Lot Srule Chy Seullr Chg Dec. M192 June Sept. Dec. 92.28 92.69 92.72 92.54 92.40 ..07 -.07 -.19 92.32 92.28 92.80 +.07 7.70 92.78 92.68 92.70 +.07 7.30 92.80 92.72 92.79 +13 7.21 92.68 92.54 92.61 +.13 7.31 92.45 92.40 92.42 +.12 7.58 Esi vol 9,573; vol Fri 8,992; open int 56,490, -615. 37.090 18,201 848 213 138 -.13 -.12 QUESTIONS 1. Describe the transaction Smith should execute to hedge against changes in interest rates on the purchase of three-month Treasury bills in March. 2. On March 15, interest rates have decreased and Smith closes out her fu- tures position. The Treasury bill IMM Index is at 93.58 and the spor market discount quote on 90-day Treasury bills is 6.50. If Smith holds the Treasury bills until maturity, what is the total dollar amount of interest earned net of any profit/loss and commissions on the futures transaction? 3. What is the total dollar amount of interest earned if interest rates in crease, the IMM Index is at 91.19, and the spot market discount quote on 90-day Treasury bills is 8.84? Northus Mon Company 305 securities. This has upset Northwest Toy's cost accountants, since they use the company's short-term borrowing costs to forecast the cost of producing each type of toy, and this information is, in turn, used in setting the whole sale price at which the specific toy will be sold to the retail outlets. Because of the competitive nature of the toy industry, it is important that costs not be overstated, for the company would then set too high a price and lose sales to its competitors. On the other hand, if costs are understated, the company could lose money on each itern it sells. The projected income from investment in marketable securities is also very important in determining the company's pricing structure on its line of special-order toys. The typical industry procedure on these special or- ders is to require an advance deposit in March. This is in contrast to pro- cedure in the regular line of toys, where payments are received after the merchandise has been shipped and invoiced. To compensate the chain stores for the advance deposit requirement, the company discounts the price to the chain store by an amount that implicitly represents the oppor- tunity cost of the funds tied up in the deposit. The discount is therefore typically tied to the money market rates that are in effect at the time of the deposit As usual, Smith has been asked for estimates of the company's short- term borrowing costs and the interest that will be earned on investments in marketable securities for the relevant periods in 1992. Economic forecasts indicate that interest rates will moderate somewhat, but the decline is ex- pected to be less than one-half percent in 1992 Smith, however, has used these economic forecasts in the past and has been disappointed when fu- ture rates differed from those forecasted. The economists always found plenty of explanations for the discrepancy, but, unfortunately, when the company's profits suffered because of inaccurate forecasts, it was Smith, not the economists, who had to answer to the cost accountants. Smith was therefore willing to go to great lengths to make her forecasts accurate for the coming year. She has decided to use the Treasury bill futures market to hedge gainst changes in interest rates. Currently, Treasury bill interest rates are 7% percent and the prime rate is 10 percent. Past data indicate that the prime rate and Treasury bill rates are reasonably correlated, with the av- erage differential being 2. percent. Today's quotations for Treasury bill futures are given in Exhibit I. Smith's broker has informed her that the commission of $60 per $1 million contract, paid at the order's initiation, is a round-trip fee that includes both the opening and closing commissions. The broker also explained that a margin in the amount of $1.500 per contract must be deposited at the time a futures contract is initiated. When the position is closed out, the investor receives the margin deposit plus or minus any profit or loss on the futures contract 306 NOTEWORTHY FINANCIAL MANAGEMENT PROBLEMS EXHIBIT 1 Northwest Toy Company Interest Rate Instruments, November 4, 1991 Treasury bills (IMM)-$1 mil: pls of 100% Discount Open Interest Highe. Lot Srule Chy Seullr Chg Dec. M192 June Sept. Dec. 92.28 92.69 92.72 92.54 92.40 ..07 -.07 -.19 92.32 92.28 92.80 +.07 7.70 92.78 92.68 92.70 +.07 7.30 92.80 92.72 92.79 +13 7.21 92.68 92.54 92.61 +.13 7.31 92.45 92.40 92.42 +.12 7.58 Esi vol 9,573; vol Fri 8,992; open int 56,490, -615. 37.090 18,201 848 213 138 -.13 -.12 QUESTIONS 1. Describe the transaction Smith should execute to hedge against changes in interest rates on the purchase of three-month Treasury bills in March. 2. On March 15, interest rates have decreased and Smith closes out her fu- tures position. The Treasury bill IMM Index is at 93.58 and the spor market discount quote on 90-day Treasury bills is 6.50. If Smith holds the Treasury bills until maturity, what is the total dollar amount of interest earned net of any profit/loss and commissions on the futures transaction? 3. What is the total dollar amount of interest earned if interest rates in crease, the IMM Index is at 91.19, and the spot market discount quote on 90-day Treasury bills is 8.84 1. Describe the transaction smith should execute to hedge against charges in interest rates on the purchase of three-month treasury bills in March.

2. On March 15, Interest rates have decreased and Smith closes out her futures position. The treasury IMM index is at 93.53 and the spot market discount quote on 90-day treasury bills is 6.50. If smith holds the Treasury Bills until maturity, what is the total dollar amount of interest earned net of any profit/loss and commissions on the futures transaction?

3. What is rhe total dollar amount of interest earned if interest rates increase, the IMM index is at 91.19, and the spot market discount quote on 90-day treasury bills is 8.84?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started